Industry Pulse

Bombings, Shootings, Vehicular Homicide. Yet People Believe the World is Less Risky.

In the last year alone, violence broke out in hundreds of cities across the world, from Las Vegas to Myanmar, Sutherland Springs to Mogadishu. Hurricanes and wildfires tore through neighborhoods in August, September and October, leaving residential and corporate destruction in their wake.

Yet survey results show that many American business owners and executives don’t believe that the world is getting more risky.

“We saw that both consumers and businesses are feeling more optimistic about their risk outlook,” said Pat Gee, a senior vice president with Travelers.

“This may mean that there is decreasing concern about economic uncertainty due to a gradually-improving economy over the past several years.”

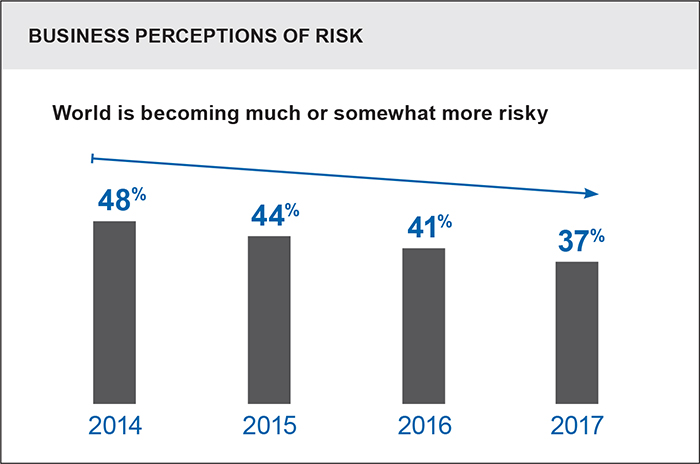

Every year, Travelers surveys business owners and executives on their overall perception of risk in the world. This year, 37 percent of respondents said the world is getting riskier, down from last year’s 41 percent.

In 2014, when Travelers first began the annual survey, 48 percent believed the world was getting riskier.

But while perceptions of an increasingly risky world declined each year, business owners and execs still have concerns for the future.

Medical cost inflation tops that list, with 61 percent of respondents answering they worry some or a great deal that it affects their business.

This, said Gee, isn’t a surprising result; it is consistent with what business owners and executives have said since Travelers first conducted the survey.

Cyber threats followed next at 56 percent, then legal liability, retaining a talented workforce and complying with government laws.

When it comes to talent, business leaders in midsized and larger companies are most concerned with finding qualified workers and keeping them in a competitive labor market. The risk of having an aging workforce coupled with an influx of new and younger workers led many to cite this as the riskiest emerging trend, more likely to be a future business risk than an opportunity.

Thirty-eight percent of respondents said that the changing future workforce posed a great risk to their business in the next five years.

Others named emerging trends including e-business, social media and increased connectivity. Business owners believe increased use of digital platforms and the ability to connect with anyone at any time will contribute the most opportunity in the next five years.

But increased use of digital platforms opens businesses to cyber threats, too.

“Cyber risks continue to be a worry for businesses overall. Yet according to our Risk Index, only 22 percent of businesses have a cyber-breach response plan,” said Gee.

“Cyber criminals are getting smarter and more creative about how to steal information from companies,” he added.

“Business leaders need to consider not only what they can do to avoid these incidents, but also the available safety nets for the company should a cyber event occur.”

Thirty-eight percent of respondents said that the changing future workforce posed a great risk to their business in the next five years.

The best practice, Gee added, would be to require regular password updates for employees. These passwords should be complex in nature.

“Employees with unsophisticated passwords leave their computers and accounts — and therefore, the company — vulnerable to attack.”

Other risks measured by Travelers include distracted driving, workplace harassment, emerging technologies, extreme weather and employee safety. The study also broke down business owners’ and executives’ perceived risks by industry, from health care to banking, real estate to manufacturing.

Cyber remained a reoccurring top risk in all industries.

Consumer Concerns

In addition to surveying executives, Travelers asked consumers about their perception of world risks.

Much like businesses, some consumers feel that the world is getting less risky. Fifty-two percent of consumer respondents said the world is getting riskier, compared to last year’s 56 percent.

But consumers, too, had their own list of concerns.

Finances ranked highest. Sixty-four percent of respondents said not having enough money to pay expenses, live without debt or be able to retire was their biggest concern.

Cyber threats, identity theft, personal safety concerns and travel risks also were among the top five named by consumers.

Of note, the survey found a disparity in how millennials and non-millennials view the practice of distracted driving.

Forty percent of millennials worry about getting into an automobile accident due to their own cell phone distractions, while 27 percent of non-millennials worry about their own cell phone use while driving.

“No matter the perception, the epidemic of distracted driving affects us all,” said Gee.

“We’re encouraging all businesses to consider implementing a distracted driving policy, but especially businesses with employees that drive as part of their job duties.”

Travelers launched an educational initiative called “Every Second Matters” to combat distracted driving.

“To be effective, business leaders should make it clear to employees that safety comes first, and they should not make or answer any work-related communications while driving,” added Gee.

The survey report, “2017 Travelers Risk Index,” is available to view online. The full report dives deeper into the concerns raised by both consumers and business executives. &