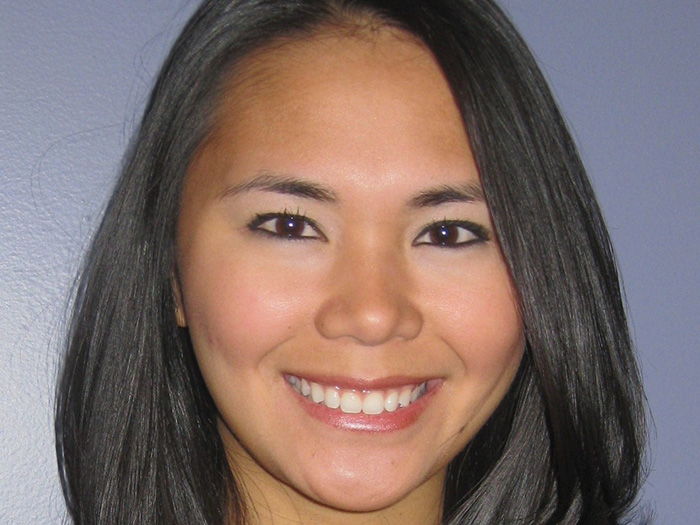

Rising Star Karen Frany Documents the Arc of Her Insurance Career and Her Respect for Her Employer

Come see the Stars! As part of our ongoing coverage of the best brokers in the commercial insurance space, Risk & Insurance®, with the sponsorship of Philadelphia Insurance, is expanding its coverage of the Rising Stars — those brokers who represent the next wave of insurance brokering talent.

Look for these expanded profiles on the Risk & Insurance website and in your social media feeds now and continuing into 2023.

Here’s our conversation with Karen Frany, managing director, executive liability practice, at Brown & Brown Risk Solutions, and a 2023 hospitality Power Broker winner.

Risk & Insurance: How did you first get into insurance and end up specializing in executive liability?

Karen Frany: My exposure to the insurance industry started while I attended Providence College and landed an internship at AIG for two summers before being offered my first post-graduate job there as an executive liability underwriter in New York City. My first year with AIG was 2008, and I quickly learned to navigate the corporate world during a global financial crisis.

In 2009, I continued my career at Berkley Professional Liability as an underwriter, where I provided professional liability insurance solutions, including directors and officers (D&O), employment practices and fiduciary for private and public entities across the U.S.

In 2012, I accepted an opportunity to become a broker at Brown & Brown Risk Solutions (formerly Beecher Carlson), where I feel like I have truly grown.

Brown & Brown Risk Solutions has been my work family for more than a decade now, and I am grateful for the opportunities to develop from a client advisor up to my current role as managing director within our executive liability practice. Currently, I am responsible for the design, development and execution of clients’ D&O liability, employment practices liability, fiduciary liability, professional liability, crime, special crime and cyber liability programs across various industries.

My account list is primarily focused on large publicly traded entities within a range of different industry sectors, including hospitality. As a broker, I also work closely with our claims group to assist our clients with insurance-related contract reviews and provide consultative risk management support related to executive liability.

I have also taken on the responsibility of training and developing our risk analysts, who are mainly entry-level teammates on track to become brokers. As I reflect, I can’t help but notice that I have truly come full circle from my first exposure to the industry.

R&I: What are the biggest risks currently facing your clients in the hospitality industry?

KF: Hospitality companies owe an extremely high duty of care to provide a safe environment for both their associates and their guests. Naturally, the hospitality industry faces risks that vary in scale, from isolated slip and falls to catastrophic disasters.

When focusing on the larger side of the scale, the industry is constantly gauging the possibility of another COVID-19 scenario, monitoring volatile weather events and assessing incomprehensible acts of violence, all of which create the potential for catastrophic loss of life and present huge threats to the hospitality industry. Extensive attention is also being afforded to network security and privacy, given the large amount of customer and employee information held by these companies through various technology platforms.

The use of artificial intelligence, for example, now adds another element of risk for companies. With a consistent flow of emerging risk exposures and constant changes in the various compliance rules and government regulations, directors and officers are keenly cognizant of the added weight with each decision they make to safeguard the company’s operational and financial wellbeing.

R&I: Can you give an example of how you have helped a client to overcome the challenges presented by the executive liability market, particularly in light of the COVID-19 pandemic and subsequent economic challenges?

KF: Hospitality was heavily impacted by the global pandemic, and there are still lingering challenges post-pandemic that my clients continue to tackle, in addition to addressing current regulatory and economic trends. As always, our brokerage team’s goal is to develop dynamic and progressive solutions for our clients. We want to showcase our client’s strengths, including (but not limited to) how our client has weathered and ultimately emerged from the most challenging 18-plus months in recent history.

It has been essential to keep in close communication with my clients throughout the year and kick-start our renewal strategy very early. Most recently, we were successful in preserving a client’s current program limits and continuing with the breadth of coverage while minimizing financial impact.

This particular insured was divesting a part of their company, which required us to build a separate runoff program to cover future D&O, employment practices and fiduciary claims from wrongful acts that occurred prior to the transaction. Given the complexity of the market, as well as understanding the business and economic challenges facing our client, our team diligently conducted a marketing campaign for all executive liability coverage lines to more than 30 insurers.

Through our marketing efforts, we negotiated a competitive runoff program and a double-digit decrease on their go-forward program. Further, we were able to broaden their insurance programs with new coverage enhancements, beyond exceeding our client’s expectations.

R&I: What proactive measures do you advise clients to put in place in order to tackle these kinds of issues before they become a major problem?

KF: I strive to show my clients that constant education and clear, honest communication are essential to any preparedness planning. Mastering simple tasks can be applied universally and makes dealing with larger issues, when presented, much easier.

I feel as if I can provide optimal solutions for my clients and analyze my clients’ financial and loss exposures by ensuring that, together, we both understand varying industry trends, current events and the overall temperature of the insurance market environment.

Collaboration is key, and my clients know I am a resource that will do everything in my power to inform them in order to make the best decisions for their company. When our goals are aligned, we are open to innovation, try new approaches and challenge the status quo, all in an effort to help my clients be better prepared for tomorrow.

R&I: What are the key benefits clients can derive from establishing a strong relationship with the insurer, and how does your former experience as an underwriter help in that regard?

KF: My hospitality clients understand the value of meeting with their insurer trading partners and spending quality time with each of them. Over the years, we have developed and fostered a level of trust and friendship across all insurance channels, which add a personalized depth to the partnership between Brown & Brown, my clients and the underwriting community.

I engage with my clients on all parts of the renewal process. With my background in underwriting, I make it a point to pay attention to details and learn my clients’ operations and unique risk profiles. This way, I am able to provide my clients with insight on the key factors underwriters focus on during their review, and we address them head-on.

I also take the time to understand my clients’ pain points, so our Brown team can develop and customize the program best suited for each of them. Pre-underwriting my client’s risk is a crucial step in my marketing process that uncovers anticipated underwriting concerns, enabling me to develop a strategy to positively differentiate my clients from their peers.

The key to achieving outstanding marketing results is exemplified in our team’s ability to communicate our client’s risk management and overall business initiatives in a way that produces all available underwriting credits. This allows our team to present a submission package capable of garnering the results identified in the program design process at the minimum possible price with the most comprehensive terms. &