The Profession

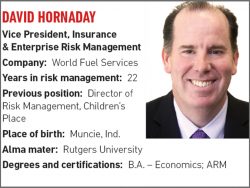

David Hornaday

Working as a signalman for Consolidated Rail Corp. I did that for about a year and a half before I got my first risk management job as a claims agent for ConRail. That was a self-insured company, so they administered their own claims.

R&I: How did you come to work in risk management?

ConRail got acquired by two different railroads and was split up, so I had the opportunity to either go with one of the railroads or look outside for another position, and I wanted to do more than just work with claims. I wanted to be exposed to the corporate risk management side of things. So I found a job as a risk manager for Suburban Propane in Whippany, N.J.

R&I: What is the risk management community doing right?

We’re working closely with brokers and underwriters and communicating internally to bring the insurance expertise to companies that need it.

R&I: What could the risk management community be doing a better job of?

Risk managers should be aware of non-traditional risks and focusing on ERM, versus just the traditional insurance procurement function. That’s where the future of our profession is going.

R&I:: What was the best location and year for the RIMS conference and why?

This is a little self-serving, but I thought Vancouver in 2011 was great because I had never been there but always wanted to go.

R&I: What’s been the biggest change in the risk management and insurance industry since you’ve been in it?

Risk managers have to be more fluent and competent in the financial world. Just procuring insurance isn’t enough anymore. You have to have a basic level of financial knowledge to communicate with not only internal treasury and CFOs, but also with underwriters and insurers.

R&I: What emerging commercial risk most concerns you?

Social engineering. The onslaught of fraudsters is relentless. Companies have to be vigilant. But the coverage surrounding that sort of risk is also emerging, so risk managers will have to pay close attention to that and keep up with that evolving coverage.

R&I: What insurance carrier do you have the highest opinion of?

We had a major loss recently and there was a handful of insurers who paid on that claim which I thought were exceedingly professional: ACE (now Chubb), Ironshore and XL (now XL Catlin).

R&I: How much business do you do direct versus going through a broker?

We use a broker for everything.

R&I: Is the contingent commission controversy overblown?

It probably was a little bit overblown, but I think it’s good that things are more transparent now.

R&I: Are you optimistic about the U.S. economy or pessimistic and why?

I’m probably a little more pessimistic than optimistic. I just don’t see signs of strength out there. There are still companies with tons of cash outside the U.S. which can’t really bring it back in a way that makes sense. U.S. oil production is way down since the price of oil is so low. Of course, the lower gas prices help the average consumer and lowers overhead costs for businesses, so it’s a little bit of a mixed bag.

R&I: Who is your mentor and why?

My mentor in this business is Joe Racansky. He was the director of risk management and my boss at CyTec Industries, and I learned as much from him as anybody in my career.

R&I: What have you accomplished that you are proudest of?

Successfully resolving claims stemming from the Lac-Megantic train derailment in 2013.

R&I: How many e-mails do you get in a day?

I’d say about 100.

R&I: How many do you answer?

All the important ones.

R&I:: What’s the best restaurant you’ve ever eaten at?

Prime 112 in South Beach, Miami. It was the freshest tuna I’ve ever had, and it was with the team from Aon, so it was great food and great company.

R&I: What is your favorite drink?

Gin and tonic.

R&I: What is your favorite book or movie?

My favorite movie is “Bull Durham.” It’s a baseball movie.

R&I: Who’s your favorite baseball team?

The Cincinnati Reds.

R&I: What is the most unusual/interesting place you have ever visited?

Key West, Fla., is pretty interesting. My wife and I have been there a few times and you always see something different.

R&I: If the world has a modern hero, who is it and why?

I was moved by the Chris Kyle story. I thought his life and story were inspiring.

R&I: What do your friends and family think you do?

I think they think I just buy insurance, when it’s really more comprehensive than that. They don’t know about meeting with underwriters and contract review and working on M&A deals.