Risk Insider: Phil Norton

The New World of Global D&O Insurance – Part 2

Note: This is the second of a two-part Risk Insider look at D&O.

As indicated in my previous Risk Insider post on Aug. 16, it’s been 10 years since the advent of the first local foreign D&O policies. Since then, many carriers have fine-tuned their process for underwriting and issuing local policies in foreign countries.

So, how should companies determine what countries have significant risk for them, and what are the key factors that should be examined in assessing the local exposure to D&O risk – whether from claims or from regulatory or tax concerns?

Not surprisingly, many multinationals have no interest in acquiring foreign local D&O coverage in countries where they believe their D&O exposure is negligible. After all, no exposure should translate into no premium allocation from the carrier, and thus no taxes or other compliance issues.

Therefore, when determining which countries are candidates for a foreign local D&O policy, it is critical to at least consider the following:

- Local exposures based on size, stock ownership, and brand.

- Types of local operations or business activities and status of the local management.

- Local regulations, including whether local non-admitted D&O coverage is permitted and recognized in country, and any potential taxes or penalties.

- Potential indemnification constraints for each country of concern.

- An assessment of local market conditions, purchasing patterns and claims activity.

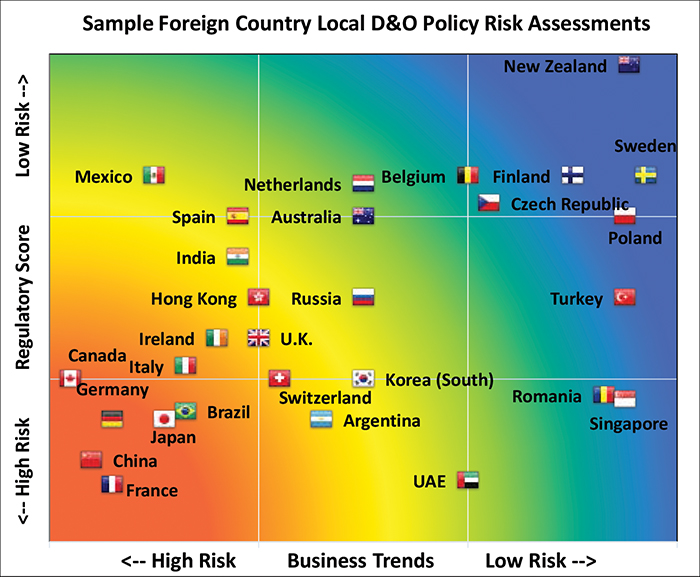

Ultimately, each multinational client company [in the U.S., for example] should prioritize its international D&O risks from both a claims and compliance perspective. By assessing “regulatory risks,” such as compulsory requirements, admitted paper, indemnification constraints, tax, regulatory, local market viability, enforcement and local D&O claims history, we have built a “Regulatory Score” for each country.

Not surprisingly, many multinationals have no interest in acquiring foreign local D&O coverage in countries where they believe their D&O exposure is negligible.

Against that very substantial analysis, we have also created a simple “Business Trends” score for each country by measuring how often multinationals do business in these countries, and the extent of such business in each country in terms of the size (revenues or assets) and complexity of their operations.

By substituting your own data on country by country exposures, a customized heat map can be drawn that will help you prioritize the countries which require the most attention from a D&O insurance perspective. A sample graphic for some of the more popular countries follows:

Implementing International D&O coverage through the use of locally issued D&O policies is both important and challenging. Brexit does not help. Although “Freedom of Services” (FOS) policies were never very popular, it was helpful in some cases to place a single U.K. policy to obtain coverage for all European Union countries. And while innovative responses to Brexit have already emerged, we continue to favor local policies in each of your countries of interest.

Finally, we recognize that implementing a strong International D&O strategy puts a large administrative burden on the corporate risk manager and corporate offices in general. A large amount of information is required, which may include the collection of application materials from local operations.

However, the trade-offs are worth the trouble in high-risk countries. Sound advice, patience and persistence are critical to a successful process.

See Part I here.