Mega Claims in Workers’ Compensation: The NCCI Weighs In

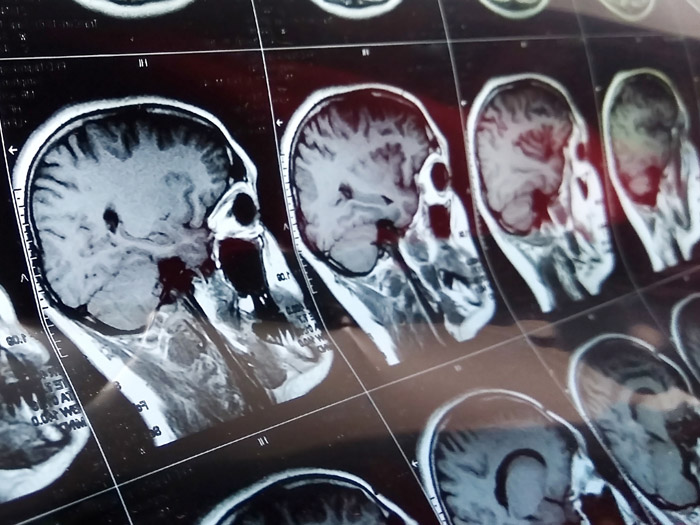

As might be expected, head injuries make up a high percentage of mega claims.

The National Council on Compensation Insurance (NCCI) released a new report on August 25 about mega claims in the workers’ compensation system and growth trends associated with the highly uncertain category, revealing that such claims are at a 12-year high.

The report, Countrywide Mega Claims, incorporates claims data from participating state rating bureaus at thresholds of $3 million, $5 million and $10 million in total incurred losses at 2018 cost levels for the 2001 through 2017 accident years at annual evaluations.

The study was held in response to stakeholder suggestions to NCCI that mega claims may be increasing in frequency and severity due to “medical advances, improving mortality patterns particularly for those with serious injuries, [and] increasing prevalence and cost of home health care.”

A 12-Year High

Ryan Voll, a manager and associate actuary for NCCI, that the definition of a mega claim is a “general term meant to convey that we are studying significantly large claims” but that “the selected thresholds balanced, analyzing some of the largest workers’ compensation claims while also considering the number of claims that would be available at each dollar threshold.”

In all, NCCI found that “approximately 4,500 claims from accident year 2001 through 2017 were reported as of December 31, 2018, with incurred loss in excess of $3 million at 2018 cost levels, which is approximately one out of every 2,500 reported indemnity claims. Of those, 57% were between $3 million and $5 million, 33% between $5 million and $10 million and 10% in excess of $10 million.”

These numbers constitute a significant increase in mega claim incidence, especially in 2016 and 2017 during which the 12-year high was established.

However, NCCI exercises caution in raising the alarm for two primary reasons: First, insurers may be able to identify these claims earlier in the process. Voll explained “an analysis of carrier-specific analytical tools was beyond the scope of the current research, although these tools may help provide an earlier identification of potentially high-cost claims—allowing them to be triaged earlier in the claim handling process.”

Additionally, estimates of ultimate counts of mega claims can be actuarially volatile for relatively immature, meaning recent, years.

The report explained: “For example, if the mega claim count development was to develop at a rate more typical of the past and development on the 2017 year was consistent with that of the average of the latest three years, ultimate 2017 mega claims would be significantly higher and at an all-time high. Conversely, if mega claim count development continues to accelerate, ultimate 2017 mega claims counts would be lower.”

Characteristics of a Mega Claim

The report ties the recent increase in mega claims to the Great Recession, noting that as construction employment plummeted in 2008, so did mega claims. By 2013, the sector began to recover, and mega claims increased in turn.

The construction industry occupies an exorbitant place in the incidence of mega claims, comprising 37% of claims between $3 million and $5 million, 42% of claims between $5 million and $10 million, and 46% of claims above $10 million. This exists in contrast with the fact that, for most states, construction claims account for less than 20% of overall claim volume.

Assessed by the part of the body injured, NCCI chose to delineate the data by the following categories: neck and spine, head and brain, multiple body parts, and all other.

The proportion of each of these categories to the total mega claim count differed for each cost threshold. However, head and brain injuries appeared especially devastating, as one might expect.

Overall, head and brain injuries accounted for 30% of mega claims in excess of $10 million, though such claims comprise less than 5% of all workers’ compensation claims in most states.

Considering the other categories, NCCI noted that the proportion of the “all other” body part category has grown in the last decade.

Cause of injury categories for the purposes of this analysis included: fall/slip, motor vehicle accident, struck by and all other causes. Fall and slip injuries were the leading cause, with 35% of mega claims attributed to these common accidents.

This has remained relatively steady over time.

For the nature of injury, NCCI categorized by concussion/contusion, fracture/crushing/dislocation, multiple injuries and all other injuries. The “all other” category claimed over 50% of mega claims in the first two cost thresholds and remained the most common compared to the other categories in the excess of $10 million threshold.

According to the report, the largest categories within the “all other” injury grouping are amputation/severance, burn/electrical shock, cumulative injury and strain/sprain.

Workers’ Comp Taking on the Brunt of Claims

The workers’ compensation system bears nearly all of the costs associated with mega claims, with only approximately 10% also involving employers’ liability. This was particularly true for New York. A bare sliver of the mega claim pie belongs to employers’ liability only.

Patterns in the recognition of mega claims differ significantly, hence NCCI’s caution that analytical tools could come to bear on eventual mega claim counts. The report emphasizes that many catastrophic claims are recognized as such almost immediately, but others can take years to develop and pierce the $3 million threshold.

NCCI explains in the study that less than half of all claims $3 million or more reach that incurred loss threshold by 18 months, from policy inception, and less than 90% reach that threshold by 126 months, also from policy inception.

They attribute this to medical development that can happen later in the life of a claim, such as a failed surgery.

The report takes a special look at harbinger states California and New York, as well.

In California, mega claim development appears to take a slower pace than other states, which NCCI linked to California’s Senate Bill No. 863, a medical reform bill that reduced claim duration. In New York, mega claims have dropped in the last decade, a change which could be due to the state’s aggressive efforts to reduce opioid use, along with its introduction of medical treatment guidelines.

NCCI continues to study mega claims as part of its Insights web publication. Additional NCCI analysis on mega claims from 2019 can be found here. &