Catastrophe Risk

Material Resiliency

The 2017 hurricane season is one for the record books. Rebuilding efforts are underway, with builders working to make insureds whole again as soon as possible … at least until the next storm comes along.

And therein lies the problem with recovery in disaster-prone regions. It evokes the oft-quoted definition of insanity: Doing the same thing over and over again and expecting a different result.

So what if we did it differently? What if instead of rebuilding to make structures “like new,” we rebuilt to make them better, more resilient, less prone to damage?

The reality is, we don’t really have a choice. Climate change is ushering in weather systems that are increasingly volatile. Wildfires are raging like never before. Sea-level rise is threatening our coasts, and there’s no way to dial any of it back.

Nevertheless, people will continue to build homes and businesses along the coast. Real estate developers will continue to nestle luxury homes into wooded foothills.

That means communities need to come to terms with the risk and plan for it intelligently.

“Natural disasters are going to happen,” said Michael Brown, vice president and property manager with Golden Bear Insurance. “But if we plan and build communities around the idea that something bad may happen someday, then that community can bounce back faster afterward.”

In any natural disaster, he added, “the property damage is extreme. But the biggest portion of the losses, both insured and uninsured, are the time element pieces. How long was the business closed? How long were homeowners unable to occupy their homes? Those are the pieces that drag on for months — years in some cases — and really drive the economic loss.”

That’s the motivation behind new materials, designs and strategies being implemented in the construction and repair of at-risk residential and commercial properties.

Powerful Flood Solutions

Newer building products move the needle significantly in terms of efficacy.

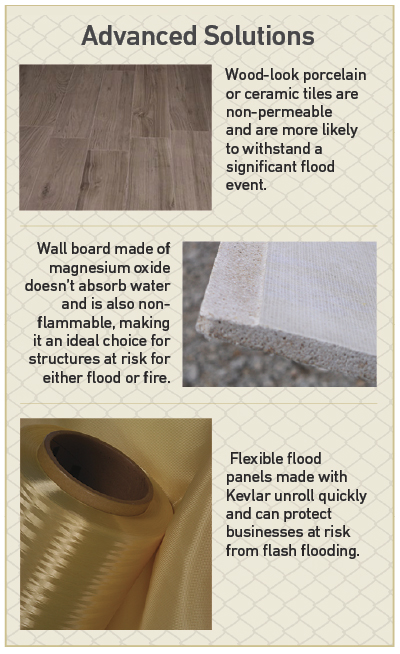

For new or restored structures in flood-prone regions, Georgia Pacific produces gypsum panels that incorporate fiberglass mats instead of paper facings and comply with the latest FEMA requirements for flood damage resistance and mold resistance. Wall boards made from magnesium oxide (MgO) don’t absorb water at all and have the added benefits of being environmentally friendly and non-flammable.

In the UK, advanced flood-resilient structures built with water-resilient concrete-block partitions are being fitted with not only MgO wallboards, but also wood-look porcelain or ceramic flooring that’s non-permeable and fire-resistant — without sacrificing aesthetics. Drains are installed in the flooring, along with sub-flooring gullies and submersible pumps that push the water back outside. Outlets and appliance motors are all situated above expected flood levels. Doors are equipped with sliding flood panels.

In the event of flooding that exceeds a depth of two feet, automatic opening window panels (flood inlets) are triggered by sensors to allow flood water to enter the property slowly, to reduce external pressure that could damage the structure.

Controlled inflow buys time for a homeowner to raise furniture up on blocks, or for a business owner to raise pallets of goods up to higher shelves or move equipment to a higher elevation.

Water intrusion is reduced dramatically, and even when it happens, there is little to no damage. Water is pushed into the floor drains, surfaces are allowed to dry, and then it’s back to business as usual in days rather than months — likely with no insurance claim filed.

Dramatic improvements are happening on this side of the pond as well. For entities that need permanent on-site flood solutions, barriers like flood gates and retractable flood walls are the most sophisticated they’ve ever been.

After suffering $4 billion in damage during Superstorm Sandy, New York’s Metropolitan Transit Authority invested heavily in flexible fabric flood panels that are made with Kevlar® and can be unrolled quickly and easily. Additional flood gates hinged to air grates are passively activated by the weight of incoming water entering the grates.

The transit authority is also testing a prototype “resilient tunnel plug” — essentially a giant air bag that can be deployed quickly to seal off sections of subway tunnel. The plug is designed to withstand not only flood but also biochemical attack.

Even temporary solutions are leaps and bounds beyond the days when sandbagging was typically the best option. New as-needed barrier methods include inflatable bladders that can be placed around a building’s perimeter and filled with water to keep floodwater and flood debris at bay.

“People have always said, ‘Well, I’m in a flood plain, it’s inevitable. It’s an act of God,’ ” said Carl Solly, vice president and chief engineer, FM Global. “In the last several years, we’ve really been trying to deliver the message that you can do something about your flood risk.”

Shake, Pummel and Burn

Flood is far from the only problem benefiting from smart engineering. FM Global is working with manufacturers to develop and certify roofing material designed to better withstand the localized hailstorms that often plague southeastern and midwestern states.

Current materials rated for severe hail can withstand hailstones up to 1 ¾ inches in diameter. The new product, rated for “very severe” hail can tolerate hailstones up to 2 ½ inches. The difference sounds small, but it’s far from it.

“It’s about three times the amount of impact energy when it hits the roof [compared to a 1 ¾ hailstone],” explained Solly. “That’s a big difference.”

As for “bouncing back” after a catastrophic fire, Solly said that’s a fairly tall order. But even there, technology is helping to reduce the severity of fires so that disruption is minimal.

FM Global researchers recently pioneered the concept of SMART sprinklers — shorthand for Simultaneous Monitoring and Assessment Response Technology — which can sense a fire earlier than traditional systems and activate targeted sprinkler heads when needed and shut off once the fire is out.

“You’ll catch it with less water, so from a water usage perspective, a water damage perspective and a smoke damage perspective, we think that has an opportunity to be a big difference-maker in the fire protection industry, particular with high-challenge fires,” said Solly.

“You’ve got a better chance of stopping what normally would be a really tough fire to catch.”

In addition, added Brown, smarter sprinkler systems, much like burglar alarms, could be programmed to notify the fire department instantly, even when a structure is unoccupied.

For earthquake risk, said Brown, resilient building efforts are less about new materials than they are about more strategic ways of using traditional materials.

“Here in California we wrap homes in stucco around the wood frame to help the whole building move as a unit. Stucco is concrete so it does crack. I end up with a building that’s got some cosmetic damage … but you don’t have to rebuild the building. It does its job in terms of absorbing a lot of the ground motion before it pushes the building beyond its design tolerances.”

Using stronger, larger steel brackets where the walls meet the roof or the floor or each other, said Brown, “keeps the north wall from moving in one direction while the west wall moves a different direction.”

Those kinds of stress points can push modest earthquake damage to catastrophic levels, he said.

One earthquake innovation still in the beta phase is a project out of the U.C. Berkeley Seismological lab, using the accelerometers in smartphones as virtual seismometers. Participating phones have an app that detects certain types of ground motion. As phones pick up earthquake wave patterns, they ping the server which checks nearby smartphones to see if they sensed the same pattern, all in microseconds. If an earthquake pattern can be confirmed, an alarm will be sent to every cellphone within a logical radius.

That might only buy people an extra two to five minutes before the event, said Brown, “but if you are the operators of Bay Area Rapid Transit commuter trains, that’s enough time to slow all the trains down to five miles an hour. If you are Google, that’s enough time to park a bunch of hard drives in your server farm so that they’re better able to resist shaking and not be damaged too badly.”

Raising Standards

Cost, of course, will impact the take-up of resilient materials and tools. If it’s three times more expensive to build a home out of the resilient materials, a lot of builders aren’t going to want to because the home will be tougher to sell.

FM Global’s Approvals division tests and certifies a variety of products aimed at mitigating disaster peril. That can help increase property owner confidence in these materials, particularly for commercial structures.

“When you’re betting millions of dollars and the future of your business — or at least the near-term future of your business — you really need to know that it’s going to work,” said Solly.

With just-in-time manufacturing, a company may have a few days’ worth of stock on hand rather than three months’ worth.

“So you can’t afford to be out of business for weeks, because your customers are going to go somewhere else for your product,” he said.

Building standards and codes can help drive adoption of resilient measures in both commercial and residential construction. But more work needs to be done to raise standards to meet the goal of resilience.

Effecting real resilience is something leaders across the spectrum should be talking about, including brokers and carriers, government and research agencies, building products manufacturers, and corporate executives.

If lives are saved in an earthquake, but a building is still damaged to the point where it needs to be torn down, said Brown “that building owner, that community, is going to have a much longer path to full recovery. We want the building codes strengthened to an immediate occupancy [goal] — we want people to be able to move right back into that building so there’s a much shorter window of disruption.

“It’s certainly better for me as the insurer,” he said, “but it’s even better for the guy that owns the building or runs his business out of it because now his employees still have a place to come to work and they can still get paid.”

Every single business able to minimize its downtime in this way helps the entire community be more resilient, he added. It creates that snowball effect in a good way. When businesses are able to stay open or reopen quickly, he said, workers don’t lose a meaningful amount of pay. Everybody’s in a better position to continue shopping and supporting the local economy.

“If you just shorten the line of people who are looking for some sort of federal aid, or state aid because they’ve had a massive financial disaster — maybe we can turn those into moderate to small financial disasters. That’s the key, I think, to communities being more resilient.”

Driving Demand

As the likelihood increases that property owners will experience a second loss or even third loss, some insurers are looking at ways to invest in resilience — a smarter long-term business plan than paying to rebuild again and again.

One new initiative is Lex Flood Ready, the product of a partnership between Lexington Insurance and The Flood Insurance Agency (TFIA). Flood Ready is a coverage enhancement for Lexington Private Market Flood clients that will not only indemnify property owners that suffer flood damage but will also provide the funds to rebuild them to a higher standard of resiliency when replacing floors and walls.

Resilience proponents advocate a variety of approaches to encourage take-up, including tax credits, resilience grants, insurance incentives and other partnerships, as well as encouraging lenders to engage borrowers by making the flood risk assessments part of the mortgage process.

A certification scheme similar to LEED could also help drive resilience efforts. The UK is currently beta-testing a certification program called Home Quality Mark, developed by the Building Research Establishment (BRE). Properties are rated on stringent criteria that considers not just disaster resilience, but energy performance and cost, durability and environmental impact.

“Getting people from diverse perspectives thinking about it and talking about it is going to be the avenue to finding the right answers.” — Michael Brown, VP and property manager, Golden Bear Insurance

That’s something builders would be able to use to add value to their properties, offsetting the cost of building in resilience and driving consumer demand for properties built to the highest standards.

With increased resilience will come questions for insurers, said Brown. “It will open up a can of worms.”

It will create something of an arms race among insurance companies, he said. “Who’s going to be the first one to figure out what’s the right way to insure that? What’s the right price? What are the right terms and conditions?” Admittedly, it’s a good problem to have.

Effecting real resilience is something leaders across the spectrum should be talking about, including brokers and carriers, government and research agencies, building products manufacturers, and corporate executives.

“Getting people from diverse perspectives thinking about it and talking about it is going to be the avenue to finding the right answers,” said Brown.

“That kind of mentality top to bottom in the industry is going to be necessary. It’s not the first time we’ve dealt with disruptive things and we will continue doing it. It’s what keeps the game interesting.” &