‘It’s What We Do’: E&S Steps Up to Address Hardening Markets and COVID Hinderances

Companies have found it increasingly difficult to find sufficient and affordable coverage in many lines of business as a result of the COVID-19 crisis and other factors.

As social inflation, nuclear jury verdicts and claims costs continue to spiral, traditional insurers have responded by tightening terms and conditions and ramping up rates, with some also pulling coverage, limits and capacity altogether, particularly in specialist professional liability lines.

On top of that, the low interest rate environment has put additional strain on already-tight margins, while continued economic uncertainty, large-scale weather events and erosion of prior year loss reserves have taken a toll.

With no option but to look elsewhere, insureds are increasingly turning to the excess and surplus (E&S) market for coverage.

Capitalizing on their granular level of expertise and ability to respond quickly in structuring bespoke programs, as well as offering competitive rates and capacity, E&S providers have stepped up to fill the void left by the traditional market.

“Any time you see an upheaval, that’s when surplus lines companies benefit from their freedom of rate and form and agility, and react to the prevailing market conditions,” said David Blades, associate director at A.M. Best.

Darrell Pippin, head of E&S property, North America, Swiss Re Corporate Solutions

“The subsequent pullback from the standard markets went to the next level in the pandemic, which benefitted surplus lines companies.”

“The E&S market is highly specialized and with that comes increased efficiency,” added Greg May, senior vice president, excess casualty for Allied World.

“E&S underwriters understand high-hazard risks and are able to quickly review submissions to select those that best fit their appetite. For risks that are difficult to place, the E&S market can respond quickly and usually find a layered solution that a wholesale broker is able to utilize. The wholesale brokers in the space know which markets to approach for different classes of business and are able to place coverage efficiently,” May added.

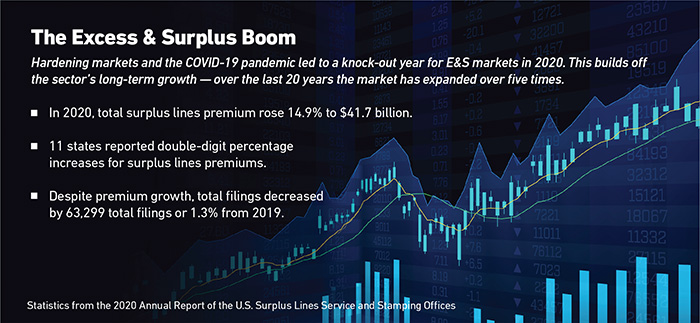

That attractiveness is borne out in the numbers, with total surplus lines premium rising 14.9% in 2020 to $41.7 billion, according to the U.S. Surplus Lines Service and Stamping Offices. During the same period, 11 of the 15 states with stamping offices reported double-digit premium increases.

This mirrors the E&S sector’s long-term growth, expanding by five times over the last 20 years — a trend that has accelerated in the hardening market over the past 18 months.

The segment also had a combined ratio of 96.1% in 2020, A.M. Best’s surplus lines composite has shown, which compares favorably with the overall insurance industry figure of 98.7%.

But can this trend be sustained? And which lines will be most profitable moving forward?

A Hardening Market

The hardening market shows no signs of abating through 2021 and beyond.

Driven by double-digit increases in property catastrophe, excess management and cyber liability in the second half of 2020, that trend has carried on through the first half of this year.

Other areas of recent success have been in personal and commercial auto and workers’ compensation.

“We have been in a firming rate environment, and I believe this will be a trend that we will see through at least 2021,” said James Drinkwater, president, brokerage division at AmWINS.

“My expectation is that rates will increase in specific classes, and we will see tighter terms and conditions, but as results improve, standard carriers will be drawn back into classes they exited.”

“The specialization within the E&S segment is key for high-hazard risks that are difficult to place. The improved data and scale of the larger wholesale brokers are making them more relevant and necessary in the chain than ever. As the rate environment continues to improve, it lends itself to a stronger and more sustainable E&S market which is built for the long term,” Allied World’s May added.

There has continued to be a high flow of submissions and demand for quality capacity, matched by new entrants to the market, said Darrell Pippin, head of E&S property, North America, at Swiss Re Corporate Solutions.

But he warned established providers against changing their strategy to compete.

“Markets that have been in the game for the past decade must stick to their game plans instead of trying to compete with the new markets and their different perspectives and strategies,” Pippin said.

“Each time there is disruption in the market, underwriting discipline is key to who survives.”

Many firms were forced to pivot their business models and reinvent themselves during the pandemic just to stay afloat, meaning their risks and coverage requirements changed.

While traditional insurers struggled to get to grips with many of these new exposures and needs, due to their flexibility, E&S providers have been able to step in to meet demand.

“This is exactly what the E&S market was designed to do — to respond quickly with rate and policy structure changes,” said Duffy Koller, head of excess and surplus lines, AmTrust E&S.

“Having learned from prior economic disruption how to handle such emergent risks, during the COVID-19 pandemic, providers have had the agility to solve the problem by making those changes and taking on more volume,” Koller continued.

Among the biggest areas of opportunity in E&S are long-term care, cannabis, property and excess commercial auto liablity.

Growth potential also exists in notoriously difficult-to-place risks, including transportation, health care and New York City construction.

Challenges Ahead

Despite the E&S market’s recent success, it has not been without its challenges.

One of the biggest issues has been implementing automation and underwriters harnessing technology to improve their efficiency, particularly in an industry steeped in tradition and historically slow to adopt new processes.

Like the traditional market, E&S has also been affected by the rise in social inflation and frequency and severity of claims, many stemming from the pandemic, particularly in the directors and officers and general and professional liability space.

As a result, capacity has been restricted on the professional liability side, with large and complex towers having to be filled at the different layers by multiple carriers; and rates have climbed, too.

“The current verdicts driven by auto, social economic implications and future climate changes are the leading factors facing the industry today,” said AXA XL’s head of E&S primary casualty, Ankur Chokshi.

“The long-tail lines are having to address the trends in claims litigation. In addition, we have seen a significant shift in environmental activities that are much more frequent and intense than before.”

Matt Dolan, president of North America Specialty at Ironshore and executive vice president of global risk solutions, Liberty Mutual

The fallout of the pandemic for small businesses has been a further hurdle, said Brady Kelley, executive director at the Wholesale and Specialty Insurance Association.

“Small business lines were most impacted by the pandemic as owners faced closure or significantly reduced operations,” Kelley said.

“And there are products like event cancellation coverage that will continue to be impacted.”

Another ongoing problem is cyber risk, given the prevalence of ransomware attacks and data breaches. Yet, E&S brokers and carriers have turned this into an opportunity to develop and provide new and innovative programs to insureds.

“The additional benefit of the E&S segment’s freedom of rate and form allows it to be an incubator for new or evolving product solutions in response to market dynamics or events,” said Steven Mills, president, E&S, The Hanover Insurance Group.

“These capabilities will continue to be an important contributor to the E&S segment’s growth and relevance within the overall industry.”

There will continue to be interest and investment in the E&S sector as growth gathers pace. Opportunistic new entrants will seek to exploit that by picking and choosing the most productive lines.

“Just like after 9/11, whenever we have a hard market, there tends to be an influx of new entrants,” said Joel Cavaness, president of Risk Placement Services.

“Some very successful carriers were started during these hard markets, and that trend will only continue.”

Moving forward, E&S providers best able to utilize new products, data and technology, achieve scale and deliver multiple lines of coverage in one place stand to benefit most from the growth enjoyed over the last year.

As new and more challenging risks continue to emerge, those that remain on the cutting edge and are prepared to write them will prosper.

“Risks are evolving in a rapid way,” said Matt Dolan, president of North America Specialty at Ironshore and executive vice president of global risk solutions at Liberty Mutual.

“We see new correlations, interdependencies and causations; risk no longer presents in conventional ways — there is a new nexus of risk — E&S markets can adjust and adapt to this dynamic.” &