Claims Handling Tools

Innovation Meets Workers’ Comp Workflows

Ask anyone in our industry and they will tell you that, in the past, we have not kept pace with the speed of technological change that has occurred in many other industries. Thankfully, times are changing.

Over the past 5 to 10 years, many things in our industry have changed dramatically. Evidence-based guidelines have become an integral part of our WC language and practice. The number of vendors available for the necessary specialty services has multiplied several times over. Subsequent consolidation in our industry has created opportunities for some and challenges for others. But as always, risk managers and their payer partners want to maintain control over medical treatment, equipment & supplies along with the opportunity to choose as many and whichever vendors they desire in order to ensure quality.

How Technology Impacts Workflow

There are new innovative tools now available that will enable risk managers and their payer partners to achieve these goals. The intersection of evidence-based guidelines and new workflow technology is making it easier to drive consistency in clinical decision-making and streamlining the workflows to capture more care in the specialty networks chosen by each payer delivering more control and more choice.

How can you assure a quick and consistent approach to approving appropriate medical treatment requests without formal utilization review?

These new clinical decision tools perform automated utilization review and are designed to provide a clinical decision on a treatment request in 30 seconds or less. These software programs can contain multiple embedded and stacked treatment guidelines (including your own jurisdictional guidelines or medical management strategies) and with just a small amount of data entry, this advanced guideline analysis tool enables a “hands off” process that results in a quick evidence-based medical decision. The minimum amount of input coupled with exceedingly low transaction costs (sometimes as low as a couple of dollars) ensures that adjusters can compare results against guidelines on every single request for authorization to determine which ones to send for utilization review and which ones to immediately approve.

This consistency and efficiency ultimately result in better and faster decisions about medical care and lower overall costs.

But how are these decisions reached? How can we assure quality advice with such little input? From what we’ve seen it’s all about automating medical strategy. The more decision criteria that can be included in the decision making process the better. Using guidelines is a complex process. There are decisions to be made about injury duration, evidence strength, and guideline appropriateness.

“[There is] just so much for adjusters to keep track of and so much data to enter and track, there is danger of them becoming clerks instead of claim managers.” — Gian P. Giandomenico, AVP and insurance group leader, First Niagara Risk Management

Most adjusters simply do not have the time or the necessary expertise to apply this complexity to each request. Applying this complexity is an absolute necessity to ensure quality, but so is hiding the inner workings. Making complex decisions quick and easy is what it’s all about and what some of the tools strive to do.

So now that you have an evidence-backed decision, now what? How can you ensure that adjusters are able to easily and efficiently access the appropriate preferred vendors/case managers? A simple routing mechanism is just not enough. There are so many factors involved in directing care to the right parties, and again we need a simple interface to hide a complex decision process.

Vendor contracts must be embedded within rules engines. It takes software engineers to really understand this complexity since an incorrect choice can lead to significant financial and clinical deficiencies. The rules engines must be able to accomplish the following:

- All referral decisions are made automatically depending on the vendor chosen for a specific service (radiology, DME, etc.).

- Communications to vendors informing them of a forthcoming referral are automatically generated and transmitted without the need for adjuster involvement.

- Organizations must have the ability to allow adjusters to override decisions if appropriate.

- If an organization has multiple vendors for a particular service, some of the rules engines can allocate the referrals, i.e. 75 percent to one, 25 percent to another, “round robin,” or route by geography.

- Clinical guidance must be supported in the rules engines. The ability to determine which referral source to connect to based on clinical rules (such as unique diagnosis or inappropriate use of narcotics) is vital.

- Financial considerations are also vitally important to include. For example, the ability for tools to send high-cost procedures to peer review automatically drastically can cut inappropriate expensive care from slipping through the cracks.

This level of automation of these types of decisions can and will significantly speed the access to medical treatment for the injured worker and increase an employer or payer’s specialty-network penetration, reducing “leakage” and thereby reducing costs to negotiated contract amounts whenever a referral needs to be made.

What the Market Is Saying

There is already quite a bit of conversation about the role this new innovation can play in a claims organization.

Brad Johnson, EVP at Sedgwick, noted that Sedgwick wants their clinical and professional colleagues practicing at the top of their experience. He said that automation is one of the ways they plan to get there since software platforms with rules engines can ensure consistency in process and outcomes, improve productivity and most importantly, expedite medical care to the injured workers.

Sedgwick utilizes rules engines in many of their processes because they believe that the workflow technology enables colleagues to focus on the best way to manage each claim and to make the important decisions that impact the overall result.

“These new clinical decision tools will mean less unnecessary conversations before the claim gets to the appropriate place, less frustrated medical providers and the best customer experience and outcomes for the injured worker.”

Gian P. Giandomenico, AVP and insurance group leader at First Niagara Risk Management, does business primarily in New York State, where the workers’ compensation landscape is complex, ever changing, and highly compliance oriented. He described some of the challenges he and his claims team experience.

He explained that the NY pain management guidelines are about to be released adding yet another set of guidelines with which to comply. He notes that, in addition, there is “just so much for adjusters to keep track of and so much data to enter and track, there is danger of them becoming clerks instead of claim managers.”

Giandomenico described the opioid issues within First Niagara’s claim population and the strain on the adjusters to stay on top of claims where the timing, frequency, or duration of the scripts is inappropriate. Although access to the best medical providers is critical to a successful claim outcome, in New York, direction of care is limited to those clients of Niagara’s with PPOs in place.

His interest in these enhanced clinical decision tools is related to his need to provide automated alerts to his claims and nursing staff regarding treatment outside of guidelines, inappropriate opioid utilization, and/or prescribing, and the opportunity when it presents itself to direct and immediately refer care to a PPO provider. “This kind of automation can help us keep the claim moving forward toward recovery and RTW. That is, after all, our ultimate goal.”

CIGA, the California Insurance Guaranty Association, has some unique challenges. They are the organization that pays the claims of insolvent property and casualty insurance carriers that are licensed to do business in California. This book of business is generally made up of claims that are over 5 years old and many have multiple involved body parts, conditions, and comorbidities. Most of their claim handling is outsourced to various TPAs, leaving them in the position of trying to implement their claims and medical management strategies from afar.

Terri J. Harrison, director of workers’ compensation for CIGA shared that they want consistency in their medical management processes, especially the mandatory UR process, an understanding of their spend in cost containment, and more data/intelligence in order to identify what is going on within their claims. Since they are interested in continuous improvement, they need to know how their various programs are working so they can determine if they should modify their medical management strategy. For example:

- They want to build criteria for referral to UR, CM, or ancillary services taking their own specific claim population into account.

- They need an understanding of their spend in medical management today so they can determine what to do in the future.

- They want to be able to ensure that all the claims staff handling CIGA claims follow the CIGA program requirements and protocols.

- They have an interest in this clinical decision automation as it will enable them to drive a consistent, CIGA-designed approach to medical management giving them control of the processes on all their claims and delivering data back that will enable them to continuously improve their programs.

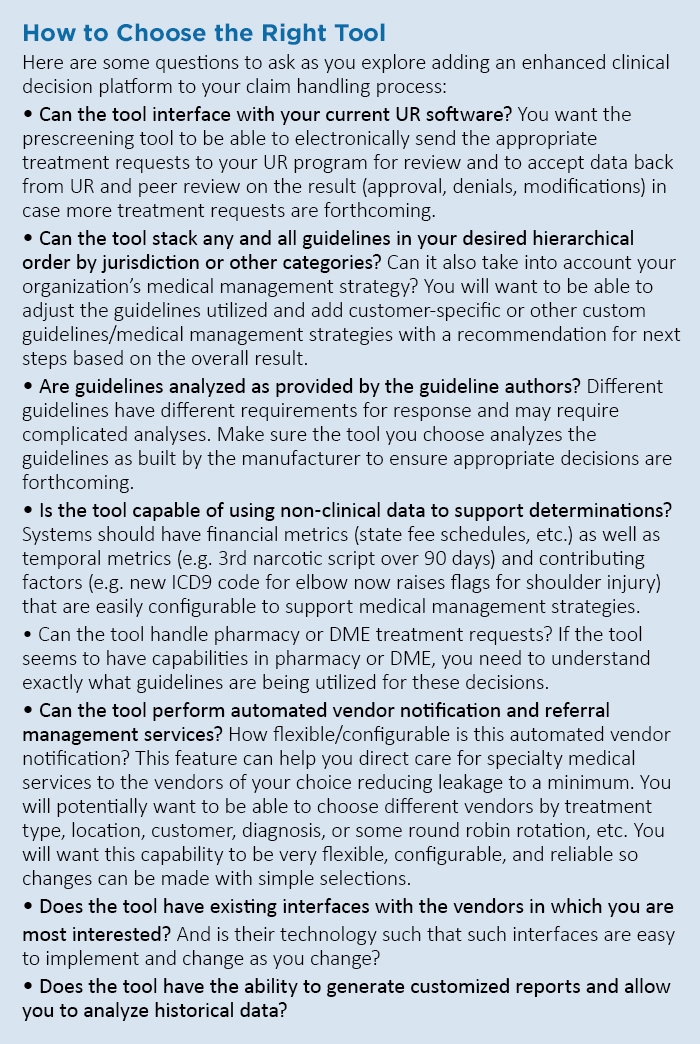

These tools are new so your usual due diligence about business structure, security and privacy as well as technology infrastructure should also apply. Ensuring that you have a chance to see the tools in action and not rely on marketing materials to describe features is vital (e.g. If you process California claims, have you seen the CA MTUS and ACOEM guidelines in action and not just heard that they are implemented?).

These tools are being deployed as Software as a Service (SaaS) and need the appropriate infrastructure to support such a mission critical service. Asking questions around business structure (i.e. Is the company SSAE 16 certified, do they have multiple data centers, what are their financial resources, etc.?) is necessary to reduce vendor risk in such a category.

We have waited so long for innovation in our industry. It is exciting to see innovation that will clearly bring significant benefits to all the stakeholders.