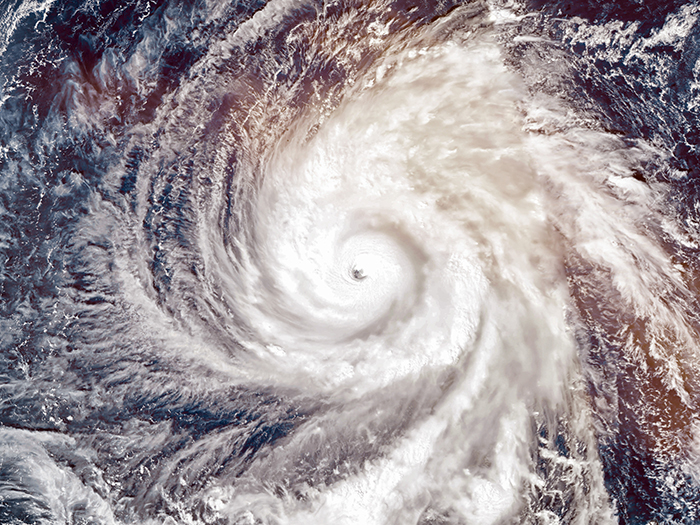

Hurricane Ian’s Aftermath and the Insurance Implications

Now that the storm is over, the United States is starting to tally the losses from Hurricane Ian’s assault on Florida and the Carolinas.

First and foremost are those whose lives the storm took. As of this writing, more than one hundred people lost their lives to the Category 4 storm, which made landfall in Florida and the Carolinas in late September.

But Ian isn’t the only hurricane to put a strain on the U.S. this year. The storm hit less than two weeks after Hurricane Fiona devastated Puerto Rico. Parts of the island accumulated more than 30 inches of rain, per National Hurricane Center data, leading to flooding, power outages and a lack of clean water in some areas.

Today, some are still without power.

All told, the physical and economic losses from this year’s hurricane season will be enormous.

“Hurricane Ian is a historical event and very complex. A Category 4 event with a maximum 150 mph wind speed and a 50-kilometer radius, massive record storm surge and inland flood all point to Ian most likely being one of the costliest events in Florida,” said Mohsen Rahnama, chief risk modeling officer at RMS.

Damage by the Numbers

- Initial analysis from satellite company ICEYE found that flooding caused by Hurricane Ian affected at least 83,879 properties.

- Total economic losses could be $75 billion, ABC News reported — and that’s the “best-case scenario.”

- Stephen Bennett, chairman of the American Meteorological Society’s committee on financial weather and climate risk management and co-founder and chief climate officer of Demex, said many are waiting to see if losses reach $100 billion.

- If recent years are any indication, many of Ian’s losses will likely be uninsured. In the 10-year period between 2012 and 2021, 67% of hurricane losses in the U.S. have been uninsured, per data from Guy Carpenter.

- Bennett estimated that insured losses reached $50-60 billion.

The Future of Property and Flood Insurance in Florida

Given the potentially high costs of rebuilding and vast number of un- or underinsured properties, Hurricane Ian could lead to a high volume of litigious claims and may cause some insurers to move out of the market.

Before the event, many insurers in Florida were already having trouble balancing their books and some were facing insolvency. Bennett said he’s seen about a dozen insurers face insolvency as a result of an increase in natural catastrophes in the area.

“I think the insurance marketplace in Florida is particularly threatened here. It was in an unstable position before [Ian] even made landfall,” he said. “It’s the recurring significant losses year after year after year, on top of the market instability.”

Rahnama summed it up, saying “I believe this event will change the Florida insurance market landscape.”

From a commercial insurance standpoint, the large number of natural catastrophes in recent years is causing some property insurers to pull back their capacity, leading to protection gaps even for events that would not be considered Nat CATs.

“We’ve had multiple years of catastrophe losses,” said Matt Coleman, chief risk officer at Demex. “We’re seeing similar protection gaps for even perils that are more frequent and less severe that would not be dubbed catastrophes.”

Rebuilding costs are likely to be exacerbated as inflation, supply chain delays and labor shortages continue to put strain on builders.

“The current inflation situation pre-Hurricane Ian and any shortage of materials and qualified contractors in Florida will amplify the repair cost. I believe the repair will be in multiple stages, starting with a quick functional repair followed by the major repair — which requires a permit and qualified contractors,” Rahnama said.

Though the costs of rebuilding will be high for those with insurance, properties without are likely to face an even bigger financial burden. Many homes in the state lack flood insurance through the National Flood Insurance Program (NFIP).

“Hurricane Ian exposed the danger of Florida homes not being insured for flood risk. There are 7.3 million single-family homes in the state, but only 1.6 million have flood insurance from the NFIP,” said Jerry Theodorou, director of the finance, insurance and trade program at R Street Institute.

“Ian demonstrated that exposure to loss from flooding is not limited to coastal properties. Inland flooding from violent, torrential downpours can be as catastrophic as coastal flooding and surge. Ian may be the wake-up call to stimulate more take-up of flood insurance.”

A large number of uninsured losses will likely end up in litigation as insureds fight for the financial resources they need to rebuild.

“As shown in the recent events — particularly Hurricane Irma in 2017, where many cases ended up in the litigation process — we saw increases in claims cost. For Ian, we expect that some of the claims’ closers will take more than a year due to potential litigation,” Rahnama said.

“The split of losses between wind and storm surge will be contentious, [just as it will be] to understand what portion of loss will go to primary, reinsurance layers and retro — and then to understand what will be covered by NFIP and what is in the gap and uninsured.” &