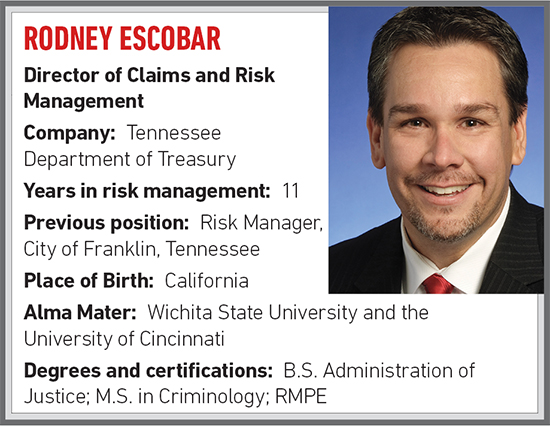

Here’s What a Former Police-Officer-Turned-Risk-Manager Has to Say About the Profession

R&I: How did you come to work in risk management?

I was a police lieutenant with the City of Franklin, Tenn. The City of Franklin leadership recruited me to lead the risk management program for the city government. When the city’s HR director asked me if I wanted to be the city risk manager, my response was, “What’s a risk manager?”

R&I: What is the risk management community doing right?

The risk management community across the U.S. continues to seek ways to introduce technology within their risk programs that have the capability of improving operational processes that lead to reducing financial losses for their organizations. It is imperative for risk managers to understand, explain and know how to apply the information provided from a robust software platform. This data assists risk managers with developing a strategic plan of action, which leads to establishing or continuously building political capital for the risk management programs.

Promoting ideas and operational change cannot be achieved without valid and accurate data, which technology provides us as a tool to expand and move our risk programs forward. I have learned that technology helps risk managers gain buy-in from their leadership, which is vital for the continuation of successful risk programs. However, if a risk manager is incapable of using tech as a tool, today’s successful risk management program will not be a successful program in the future.

R&I: What could the risk management community be doing a better job of?

I believe the risk management community needs to hold their vendors more accountable via contract as it pertains to managing cyber risks. Risk professionals should ensure their vendors procure cyber liability coverage, as well as provide proof of exercising their business continuity and disaster recovery plans and having redundancies in place for the data and workflows that are crucial to their organizations’ daily operations.

R&I: What emerging commercial risk most concerns you?

I am still concerned with the frequency and severity of cyber incidents and breaches. Ransomware, email attacks and malware attacks. I believe most people think about cyber incidents and breaches occurring with malicious software platforms, vulnerabilities with internet security software, not having strict security mechanisms like multi-factor authentication in place, email phishing, cloud data storage that does not have a secure registration process, and old servers not updated still connected to current systems. But sometimes the most obvious incidents involving personal identifiable information (PII) occur when organizations fail to recognize that some of the most common breaches involve employees improperly handling hard copies of PII.

R&I: What’s been the biggest change in the industry since you’ve been in it?

For risk management, the biggest change is the new faces, with people retiring or leaving the industry to pursue other things. Also in the risk industry, vendors, private businesses and governments are trying to attract and retain risk professionals, which appears to be a difficult challenge.

For the insurance industry, the current property markets and the hardening of these markets (due to companies leaving the world market) financially has been the biggest change for me so far. The hardening of the property markets has had a negative impact on budgets across the U.S. for large self-insurers.

I believe we will start seeing risk management professionals that administer large self-insured programs begin to explore and eventually move to a captive insurance program. I am certain that captives will be the future for financing risk exposures for some private and public organizations. But this will have to start with changing the mindset of risk managers and how they finance their risk. With that said, when a new mindset toward utilization of captives occurs as an industry norm, it will eventually change the insurance industry as we know.

R&I: Is the contingent commission controversy overblown?

No, I think there is a valid concern, as contingent commissions could have the appearance of creating an incentive for an intermediary broker to work with specific reinsures because the compensation of return may not be in the best interest of the private or public entity.

R&I: Who is your mentor and why?

I have had three mentors who helped me establish my roots as a professional risk manager. These individuals are Laura Jungmichel with Public Risk Insurors, and Michael Fann and George Dalton with Public Entity Partners here in Tennessee. Their knowledge of risk management within the public sector was the foundation I needed to reach my professional goals, and today I still seek advice and ask questions of them when I run into scenarios I haven’t seen before.

R&I: What have you accomplished that you are proudest of?

Professionally, I am proud of working every day with my team to seek continuous improvements with our State self-insured programs. One of our greatest achievements was changing the culture of the State of Tennessee’s workers’ compensation program, which has resulted in significant financial savings for Tennessee taxpayers. The State has reduced total incurred paid losses from approximately $27 million to $16.5 million since fiscal year 2013.

R&I: If the world has a modern hero, who is it and why?

James Shaw Jr., who disarmed the Antioch Waffle House shooter here in Nashville in 2018. He demonstrated distinguished courage and I admire the bravery and selfless act of saving lives during a horrific tragedy. And now, Mr. Shaw has started the James Shaw Foundation that seeks to address mental and social health issues. Mr. Shaw is someone who works toward change.

R&I: What is your favorite book or movie?

Gotta love “Tombstone” with Kurt Russell.

R&I: What is the most unusual/interesting place you have ever visited?

Bubblegum Alley is one of the most unusual places I have visited, located in San Luis Obispo, California.

R&I: What is the riskiest activity you ever engaged in?

As a law enforcement officer, over the years, there were so many incidents and calls to service that placed me at risk, from traffic stops, domestic violence calls, undercover narcotic operations and high-risk search warrants, which I would say all were the most riskiest activities that I have ever engaged in — but I would do it all over again if I could. &