Insurance Industry

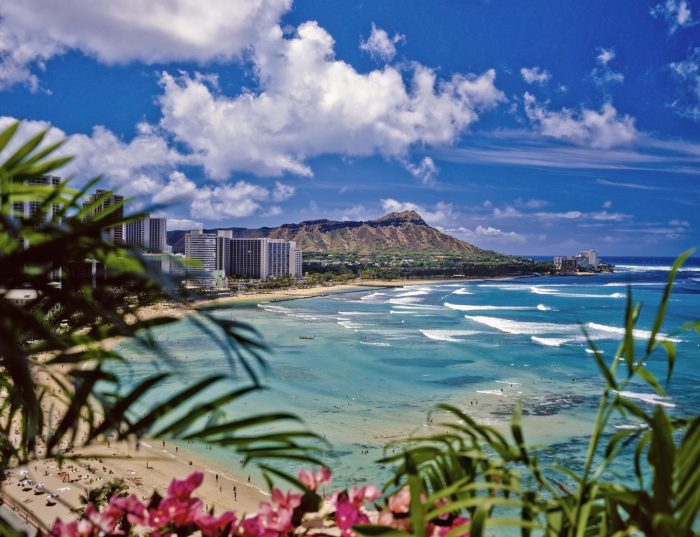

Hawaii Calls

The CPCU Society expects to see some 7,000 CPCU conferees in Honolulu at its September meeting, which acts as a graduation ceremony for new designees.

In addition to the CPCU (Chartered Property Casualty Underwriter) designation, the Malvern, Pa.-based The Institutes also provides training and materials for designations such as the ARM (Associate in Risk Management) and the AU (Associate in Commercial Underwriting).

According to Brian Savko, president of the CPCU Society — a community of CPCU-credentialed insurance professionals — that’s an enormous jump from the 750 or so designees who attended last year’s celebration in Indianapolis.

That’s no knock on Indianapolis, which has its own charms. But Hawaii is, after all, Hawaii.

An added incentive for those professionals who complete the eight courses comprising the designation — including a course on ethics — is that most of their companies not only pay for them to take the course, but will also fly them along with a spouse or friend to Honolulu.

As a result, the number of CPCU students that choose to complete their course study in time for the Hawaii event “just flood in,” said Savko.

The Institutes moves the event around from year to year. Future sites include San Diego and Orlando, both warm weather locations that can be fun to visit.

Hawaii Gets the Most Attendees

Hawaii, though, is the location every seven or eight years that gets the most attendees, hands down.

Savko, a State Farm executive, said if you are considering getting the designation, you might want to get it done in time to take full advantage the next time the event is in Hawaii.

When they are not considering how big the waves might get on the beach at Waikiki, underwriters, claims professionals and others pursuing the CPCU designation have a host of real-world issues to consider that will be impacting the insurance industry.

Chief among them, according to a recent survey by The Institutes, are the challenges presented in cyber security.

The other top challenges that Institutes members believe will have an impact are the sharing economy, in particular ride-sharing; predictive analytics; terror threats; and the rising use of drones.

As for threats facing their own companies, recruiting and retaining talent, with a response rate of 39.8 percent of those surveyed, was far and away the biggest in-company worry.

According to the CPCU Society’s Savko, that’s one more reason to celebrate the fact that more than 7,000 CPCUs will be honored in Hawaii.

“Certainly it’s well needed now due to all of the departures we are seeing in the industry,” he said. &