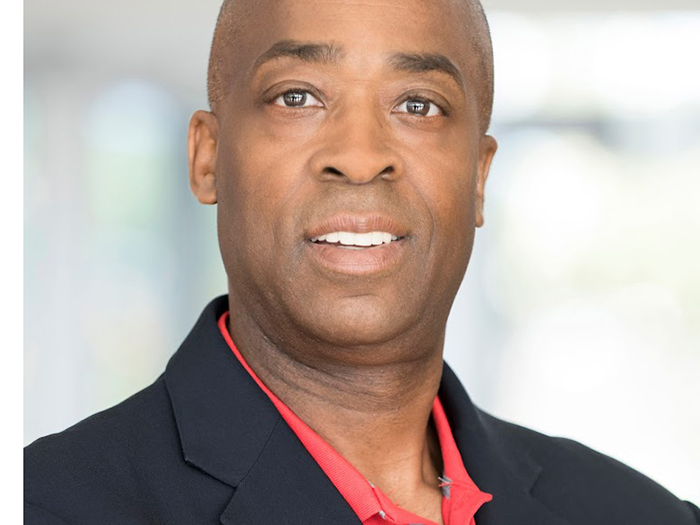

EPIC’s Jeff Breskin Shares What It Takes to Be the Best in Workers’ Comp Brokering

Jeff Breskin, a 2021 Workers’ Compensation Power Broker, industry vet and vice president of workers’ comp claims for EPIC Insurance Brokers in Southern California, has seen many sides of the business, and as he rounds the corner on his third decade in the insurance trade, he’s ready to put down the gloves and start educating.

“Like most people in the insurance business, I got into it by mistake,” Breskin explained.

“I graduated with a business degree from Cal State Northridge and thought I wanted to work for a sports franchise — that was my passion.”

Instead, Breskin found himself in insurance at the start of January 1987, when he interviewed for Liberty Mutual.

“They had a great training foundation. They sent me to Chicago in the dead of winter, and I was there for eight weeks of phenomenal training. Carriers don’t really do that now, and I wish I would see more of it with the younger examiners coming into play. Having that nucleus of knowledge of different lines of insurance before sitting at a frontline desk is great,” he said.

Finding a Niche to Excel In

Breskin settled on workers’ compensation as his specialization right away, enjoying the puzzles that the line presents as a claims examiner.

“I think the bigger the claim, the more I excelled,” Breskin said.

“I became a claims supervisor working with the home office in Boston, and it grew from there. I believe I was the first examiner in the state of California who handled a work-related AIDS claim in 1987. That was a three-finger amputation, and the person received a [contaminated] blood transfusion.”

Another brick in the wall of Breskin’s success came when Zenith Insurance established its mandated Special Investigative Unit (SIU) in California. He learned Spanish as a child, and when Zenith’s program was taking shape as a bilingual unit in 1990, Breskin was tapped to lead it.

“My passion became dealing with doctors and attorneys and injured workers. [Because] I spoke Spanish growing up as a small child, I had the ability to speak to more injured workers in Southern California and that led me to the fast track of my career.”

Going Undercover

Breskin and the other members of the SIU engaged in counterintelligence to catch bad actors attempting to take advantage of the system.

“We went undercover, went into medical mills and went through the dumpsters, got their infrastructure and how their marketing worked. People who were being laid off during that time — there were massive layoffs in California during that time — instead of filing for unemployment, they would be taken by vans and taken to doctors to sign up for workers’ comp.”

Always a Broker at Heart

As the early ’90s recession rounded the corner in 1992 as a jobless recovery, Breskin made his next move, transitioning to the intricacies of brokerage.

“I thought that would springboard me to another level in my career, and so I went to work for Aon,” said Breskin.

“I was there for eight years and loved what I did. I handled accounts like Dole, Disney, Mattel and Hilton Corporation. I had the opportunity to travel all over the country and became well-versed in workers’ comp laws and jurisdictions, as well as mitigation.”

After a few more moves, Breskin found himself again seeking change.

“The way that brokerage firms look at accounts is as a time allocation, but I’m one of these people who believes in being a trusted advisor and being an extension of a client’s risk management team,” Breskin said.

“I’m a firm believer that you work 24/7/365, and that my paycheck is not from the organization that I work for, but from the clients’ names on the paycheck. I wanted to go out and learn more of the sales side.”

Breskin signed on the dotted line with Wells Fargo to head up a team of about 30 producers, then moved to Hays Companies to build the Southern California organization, and then to New York-based Crystal & Co. He was named a Power Broker in 2017 and 2018 while at Crystal, but after the company was bought out by Alliant in 2018, he transitioned with a team to EPIC Insurance Brokers.

Loving the Comp Space Even More

More recent events have proven to Breskin that workers’ comp is still just as dynamic as it was in 1987.

“When COVID was running rampant in March of 2020, that’s where my career catapulted and changed once again,” he said.

“We didn’t know where this was going to go from a workers’ comp standpoint — compliance with all of the CDC guidelines and what clients and essential employers had to do with safety and health. It challenged me at a very high level, working around the clock.”

That challenge led Breskin to prove that what he sold his clients was delivered in spades.

“The carriers didn’t know what to expect. We’re in a very soft market here in California, the base rates are very competitive, and at the end of the day, what is the proposition value that me or my agency brings? Price is price, you can be two to five percent at either end. You have to create that value add,” he said.

“A lot of clients have been with me for 15 to 20 years — they’re family to me. They know they can call me anytime. Workers’ comp, you never know when you’re potentially going to have a catastrophic loss.”

Outside Pandemic, Other Comp Risks to Watch

Breskin emphasized that despite COVID’s threat slowly abating in the United States, there is still plenty on the horizon to keep brokers and the risk managers they serve on their toes.

“In California, part of the issue we’re starting to see is employment practice liability exposure. I call that the bridge of the Bermuda Triangle,” Breskin explained.

“There’s a strategy to labor law and workers’ comp. It’s processes and programs. From an EPLI standpoint, you have discrimination, sexual harassment, ADA — these are the things I take to my clients and prospects. When somebody goes off on a disability, what do you do? Do you put them on FMLA, do you COBRA them after the 12 weeks run out? A lot of HR folks don’t understand, and to make sure you’re crossing the t’s and dotting the i’s, that’s my job, too.”

In addition to client HR personnel, Breskin emphasized that brokers are responsible for holding carriers accountable for what they say and do, and he takes teachable moments seriously.

“I dissect claims like you wouldn’t believe,” said Breskin.

“I used to go into quarterly claim reviews and pound my fists and all of that, but I don’t do that anymore, because I was there at one time. My approach over the last 15 to 20 years is to make it an educational experience for the examiners. I’m here to bring a different side of the claim to light for them.” &