Broker Liability

Duty to Advise

An increasing number of courts are taking a fresh look at whether insurance brokers should be held liable for their insurance purchasing recommendations.

One case weaving through the Florida courts now is Tiara Condominium Association Inc. vs. Marsh USA Inc., in which the condo association alleges that the Marsh broker failed to procure an adequate insurance policy on its building, which subsequently suffered extensive wind damage from two hurricanes in September 2004.

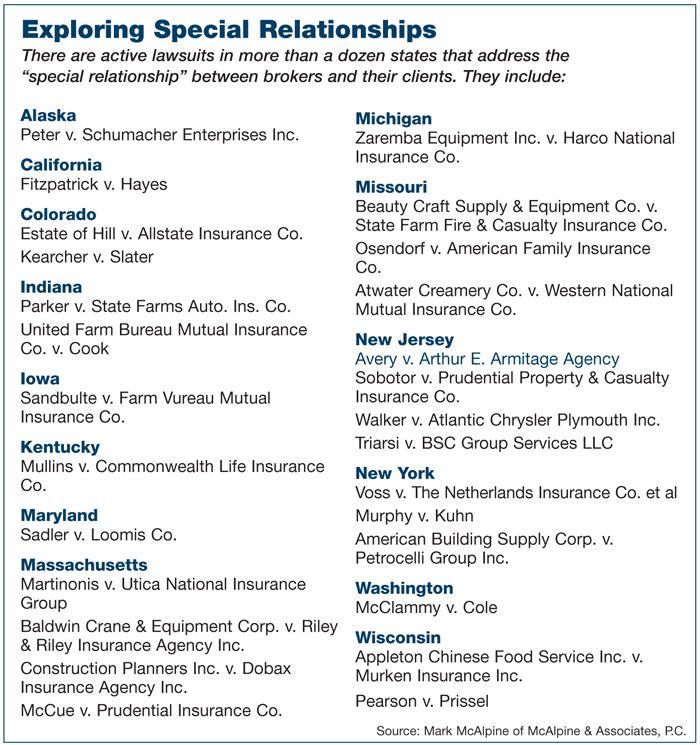

The case, which revolves around whether the broker had a “special relationship” with the client, is provoking interest around the country.

Marsh had secured windstorm coverage through Citizens Property Insurance Corp., which issued a policy that contained a loss limit in an amount close to $50 million, according to the lawsuit. After the condo building sustained significant damage caused by hurricanes Frances and Jeanne, Tiara claims Marsh assured the association that it would be entitled to nearly $100 million for both occurrences, and the association proceeded to repair the building.

However, when Tiara sought payment from Citizens, the carrier claimed that the loss limit was $50 million in the aggregate, not per occurrence, according to the lawsuit. The carrier settled with Tiara for roughly $89 million — less than the more than $100 million spent by condo association.

Tiara’s attorney Mark L. McAlpine, founding principal of McAlpine & Associates, P.C. in Auburn Hills, Mich., said it will be up to the jury to decide whether Marsh did, indeed, have a special relationship with the condo association, which affects its liability in the case.

A broker is determined to have a special relationship that imposes enhanced duties to the insured, he said, if:

• They hold themselves out to have special expertise;

• The broker is an integral part of the claimant’s decision-making process;

• The broker receives additional compensation for risk advising services; or

• The broker is in a position to affect such decisions and the insured is known to be relying on the broker’s advice in making an insurance purchase decision.

A Marsh spokeswoman said Marsh did not have a “special relationship” with the condo association, and noted that the association’s “purchasing decisions were made by the association’s special insurance committee which included a former senior insurance executive, a lawyer and a CPA.”

“The law in virtually all states is that an insurance broker has a duty to obtain the insurance requested by the client or inform the client that it could not be obtained. Some courts have created an exception to this rule when the plaintiff alleges the existence of a ‘special relationship’ between the broker and the client,” she said.

“However, those courts have also made clear that the ‘special relationship’ exception should be applied only in very limited circumstances. For example, New York’s highest court recently stated that ‘[we] reiterate that special relationships in the brokerage context are the exception, not the norm.’”

Typical Skills and Experience

Bryson Popham, a partner in the Annapolis, Md. law firm, Popham & Andryszak, P.A. who represents agents and brokers, said that they are generally held to a legal standard of care based upon typical skills and experience, and that they should be accountable for the advice they give.

There’s always the exception, Popham said, but on typical issues such as whether a client has the right coverage, an agent or broker should advise a client based on the client’s needs.

“Agents and brokers are knowledgeable about insurance coverage, but they are not property appraisers,” he said. “They should not take on that responsibility unless they have a special ability to make that determination, and most do not.

“Sometimes they take on those additional responsibilities unwisely,” he said, “and then they may have liability issues that could be hazardous to their professional health.”

“Where a broker says that he will evaluate risk and tell you what insurance to buy, the broker is going to be held to a very high standard.”

—Robert D. Chesler, shareholder, Anderson Kill

Issues over broker liability are also being scrutinized in the Northeast, where hundreds of insureds have not collected on insurance claims following Superstorm Sandy flooding.

There are many pending lawsuits alleging that insurance brokers did not advise their insureds on the availability of flood insurance, said Robert D. Chesler, a shareholder based in the Newark, N.J. office of the Anderson Kill law firm.

The law differs from state to state regarding the duty of an insurance broker to advise a client.

“In New Jersey, we’ve seen insurance brokers trying to market themselves as professionals with more expertise and greater standards,” Chesler said. “Where a broker says that he will evaluate risk and tell you what insurance to buy, the broker is going to be held to a very high standard.

“It used to be that policyholders just bought general liability insurance, but now they also must consider employment, cyber, environmental, flood insurance — the types of insurance that are now available has mushroomed,” Chesler said.

“This has led to some brokers in some cases not being fully up to speed on having the necessary knowledge to deal with their clients,” he said.

In New York, a February ruling by the N.Y. Court of Appeals in Deborah Voss vs. The Netherlands Insurance Co. found that a broker can only be liable if it has a special relationship with the insured, he said.

“It’s a major development, as it’s the first time a New York court found that a special relationship may exist,” Chesler said.

Business owner Deborah Voss claimed, among other things, that her broker from CH Insurance Brokerage Services Co. Inc. assured her that $75,000 per incident in coverage for business interruption losses was adequate, even after she questioned the limit, according to the lawsuit.

Moreover, the broker promised to reassess her coverages as her business grew, but failed to do so after she moved into another building that subsequently sustained water damage from a leaky roof on multiple occurrences, according to the lawsuit.

The court denied the insurance broker’s motion to dismiss the litigation and found that a special relationship could have existed — particularly since the broker promised to re-evaluate her policies as her business grew.

Specialized Advice

The concept of when an insurance broker has a duty to advise used to be “a much greater mountain to climb,” said Peter Biging, a partner at Goldberg Segalla LLP in New York City.

“I think these types of decisions are indicators of the judicial system increasingly identifying agents and brokers as experts providing highly specialized advice, instead of just being order-takers,” Biging said.

Such perceptions are due to the realities of “the competitive marketplace of today,” which demands that agents and brokers promise greater risk management services, either expressly or implicitly, he said.

“These types of decisions are indicators of the judicial system increasingly identifying agents and brokers as experts providing highly specialized advice, instead of just being order-takers.”

When that risk management duty is implied, it may be harder for clients to prove broker liability, he said. But if the agent’s or broker’s contract states they will act as the insured’s “exclusive risk manager” or “financial risk adviser,” courts will now likely require a higher level of care and responsibility on the part of the agent or broker.

In the Tiara case, McAlpine said, the condo association that made the insurance purchasing decisions “is actually run by volunteers who don’t have the expertise to make commercial insurance risk decisions and thus have no choice but to rely on the broker’s advice, which I believe, is an important consideration in determining whether or not its broker has a special relationship.”

He said Marsh was part of Tiara’s decision-making process as to the type and amount of hurricane coverage to obtain, and evaluated the condo association’s outdated replacement value appraisal, advising that a new appraisal was not necessary.

The trial is scheduled to begin in October, following a ruling in federal district court that the special relationship test should apply, McAlpine said.

“I think Florida is taking an enlightened path in recognizing that brokers in certain circumstances undertake enhanced duties to properly advise their clients as to their insurance risks,” he said.

If the special relationship exists, the broker may have a duty to properly advise them on the type and amount of insurance they need to buy, McAlpine said. Moreover, once the client has made its decision, the broker may have a further duty to warn the client if it has made a risky decision.

“Obviously, the broker’s duties may be tempered either way by the sophistication of its client,” he said.

“An experienced risk manager can be expected to know and understand its insurance risks, while a condo association making decisions through a voluntary board will likely be perceived by a jury to be particularly vulnerable and therefore reliant on the broker’s advice.”