Risk Insider: Jack Hampton

Do You Know the Difference Between Business Intelligence and Business Analytics?

People who drink three cups of coffee a day live longer. This finding is based on a 2017 study of 500,000 people from 10 European countries.

In a recent period, the U.S. annual rate of inflation ranged from 2.5 to 4.0 percent. The data on annual rises in skin cancer in the same period was almost identical. Maybe inflation causes cancer.

Monmouth County, N.J., has 10 large shopping malls. A recent statistical assessment of its criminal activity showed the area to be one of the most-crime ridden places in New Jersey. Shoppers might be in danger.

Rob Wielgus, a Washington State University professor, published data showing a correlation between wolves and livestock. Killing wolves in one year may cause wolves to kill more livestock in the next year.

What do these statistics and their conclusions tell the risk manager? Drink coffee? Avoid cancer by moving to low inflation areas? Shop in New York? Do not annoy wolves.

Or perhaps they tell us something about risk when we try to make sense out of data and statistics.

Toys “R” Us was an iconic brand with a steady loyal customer base of parents and kids. It had access to tons of data on the desires and needs of customers but an inadequate understanding of how to respond to changing consumer preferences and market trends. It closed down in 2018.

Drinking coffee may help you live longer. Or it may reflect a habit of exercising and healthy eating by coffee-drinking Europeans. Linking inflation and skin cancer is nonsense. Monmouth County crime data mostly reflects shoplifting. The relationship between wolves and livestock may be complicated.

Misleading relationships in data and statistics, whether fallacies or lies, is old news. What is different is the growing risk when raw data is collected and used to make key business decisions.

In this context, we have growing amounts of data extracted from other data. Called “megadata,” an example occurs when thousands of people who post Facebook photos of family vacations are statistically correlated to the likelihood of them making other leisure purchases.

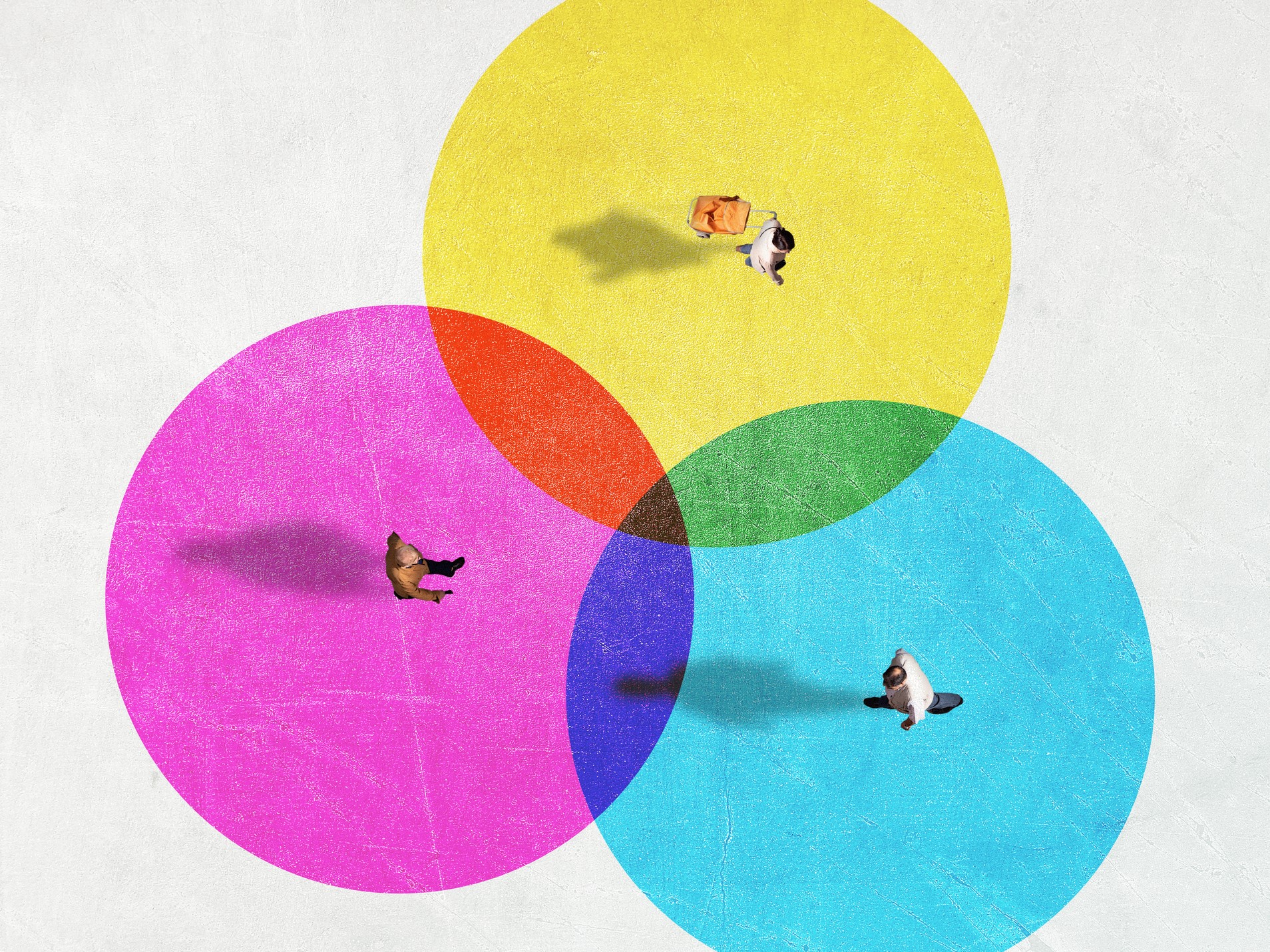

The danger arises when we fail to distinguish between business intelligence (BI) and business analytics (BA)

- Business Intelligence (BI). Analysis concerned with measuring past performance and identifying things that worked and things that did not.

- Business Analytics (BA). Analysis that extends BI so we convert data into actionable intelligence.

The risk management challenge is to create reliable and valid relationships from unreliable megadata. The question for risk managers, “Is your organization correctly distinguishing business intelligence (the past) and business analysis (the future)?”

In a nutshell, this is the problem. BI is often performed by bright young analysts without an understanding of the business of the organization. This can produce misleading conclusions.

Blockbuster and Netflix both had access to the same tools and data in 2004 when Blockbuster had 58,000 U.S. employees working in 4,500 stores. Netflix saw the future of streaming. Blockbuster did not and filed for bankruptcy in 2010.

Toys “R” Us was an iconic brand with a steady loyal customer base of parents and kids. It had access to tons of data on the desires and needs of customers but an inadequate understanding of how to respond to changing consumer preferences and market trends. It closed down in 2018.

Surely Blockbuster and Toys “R” Us had extensive business intelligence at work. Maybe the shortcoming was business analytics.

Along with studies of Borders, Sports Authority, Kodak, and Circuit City, we can see the growing danger of misjudgments as we bring in data from all sides. The situation is becoming more complex as a result of the risk of the Internet of Things (IoT).

Done right, data and statistical analysis give us insight into key relationships in the past and can drive business planning. Done wrong, it can be a disaster.

We might conclude with a caution that not everyone likes correct business analytics. Ask Professor Rob Wielgus. Ranchers and politicians wanted to kill wolves so his statistics were scorned. His enemies even commissioned other analysts to present contradictory results using his own metadata. Wielgus was pushed out of WSU a few months ago.

Who can say business analytics isn’t dangerous?