Cyber Insurance Growth Slows But Opportunities Remain: Swiss Re

The cyber insurance market’s double-digit expansion phase may be cooling off, but the growth story is far from over, according to Swiss Re.

The cyber insurance market experienced an impressive 32% annual growth rate from 2017 to 2022, with global premiums doubling twice in that period. However, recent data from 2023 and 2024 suggests a new market reality of lower growth and declining cyber insurance rates. Despite this, forecasts of 20% annual growth continue to circulate, Swiss Re stated.

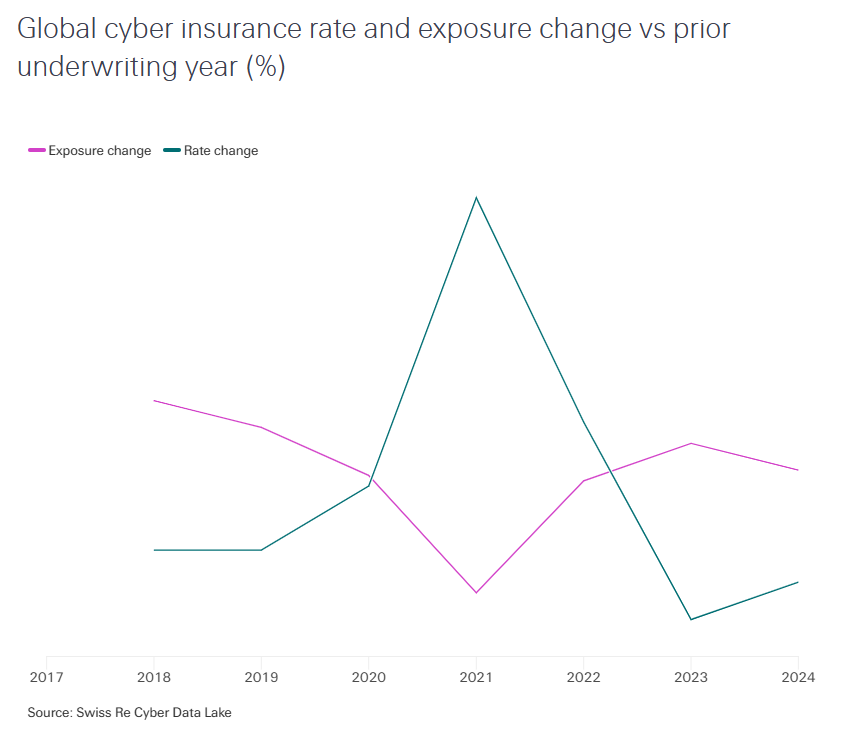

The market’s growth up to 2019 was largely driven by new exposure in North America and Europe, with more corporations purchasing cyber insurance, according to Swiss Re’s analysis. However, the growth driver shifted significantly from 2020 to 2022 due to a surge in ransomware leading to significant losses. The cyber market responded with increased rates to reflect that heightened exposure.

The cyber insurance market’s recent growth, therefore, can be broken down into two main components: organic exposure growth (clients purchasing new policies and existing clients purchasing higher limits) and rate growth (higher premiums for the same limits).

The cyber insurance industry reacted decisively and quickly to the ransomware surge, with many insurance carriers rigorously re-underwriting their cyber portfolios, according to Swiss Re. Carriers raised the minimum cyber security requirements to obtain insurance, reduced their deployed policy limits and increased cyber insurance rates to reflect the new level of risk.

In 2022, the cyber insurance market hit a tipping point. Strong rates and improved profitability prospects of cyber portfolios increased the appetite of incumbent market participants and attracted new entrants into the cyber insurance market, Swiss Re observed. However, increased competition reversed the rate and exposure cycle in 2023, with rate reductions counter-balancing much of the organic growth.

Despite these changes, the cyber market is far from saturated. Swiss Re estimates a market premium of $16.6 billion (+8% over 2024) for 2025, with a significant cyber protection gap remaining. There is considerable geographical potential for growth, with North America currently dominating with a 70% premium share, followed by Europe (19%) and APAC (8%).

There are also distinct differences in cyber insurance penetration across customer segments. While approximately 80% of Large Corporates (businesses with annual revenue above $10 billion) have purchased cyber insurance, only around 10% of SMEs (with annual revenue below $100 million) have done so, according to Swiss Re. This suggests a significant growth opportunity in the SME segment, which requires investment and adapted approaches.

View the full report here. &