2016 Most Dangerous Emerging Risks

Crumbling Infrastructure: Day Of Reckoning

For decades, government watchdog groups and engineering associations warned that the nation’s infrastructure was grossly underfunded and on the brink of collapse, but those warnings, for the most part, went unheeded by authorities.

Now a day of reckoning is upon us. The dereliction of North American infrastructure is a catastrophe in slow motion.

For four months, natural gas spewed from a leaking well in southern California — the largest recorded natural gas leak in history. The amount of methane released was the equivalent of running half a million cars for a year. Residents of the area were sickened and more than 10,000 of them needed to be relocated.

For more than a year, the residents of Flint, Mich., suffered lead exposure when the city changed its water source. Water from the Flint River interacted with aging water pipes, resulting in thousands of children being exposed to heavy metals for extended periods. The city is in a federal state of emergency.

Michael Sillat, president and CEO, WKFC, managing general underwriter, Ryan Specialty group

Dozens more health and environmental debacles are certain to take place.

“U.S. infrastructure is in a dire state of disrepair,” said Michael Sillat, president and CEO of WKFC, a managing general underwriter in the Ryan Specialty group handling excess and surplus lines.

“The roads, bridges, schools, airports and power grids of the U.S. will take something like $3.5 trillion to bring them up to an acceptable, safe and manageable standard.”

Despite events like the huge Northeast blackout in 2003 that affected seven states and the Province of Ontario, and the collapse of the Interstate 35 Bridge in Minneapolis, he noted that “funding for public infrastructure is deficient.”

Operational Risk Challenges

The continuing problem in Flint underscores the challenge of operational risk and risk management. Municipalities all over the country are facing water main ruptures and sewage overflows daily. The costs of repairs and cleanup have to be calculated against any perceived savings in operational or maintenance expenses.

“The onus is on the insureds, especially on government entities for shoring up the infrastructure in the country.” —Michael Sillat, president and CEO, WKFC, managing general underwriter in the Ryan Specialty group

“We write governmental entities that are water and wastewater authorities and municipalities that treat and provide their own water and collect or treat their own sewage,” said Kathy Adamson, lead underwriter for government entities at CivicRisk, a division of WKFC.

“Prior loss history and infrastructure condition/maintenance is a major factor in determining our attachment and premium.”

Addressing infrastructure shortcomings lies at the feet of owners.

“The onus is on the insureds,” said Sillat, “especially on government entities for shoring up the infrastructure in the country.”

Grace Hartman, director at Aon Infrastructure Solutions, noted that the “contraction in [public] spending … does not mean that existing bridges don’t need maintenance and that new ones don’t need to be built.”

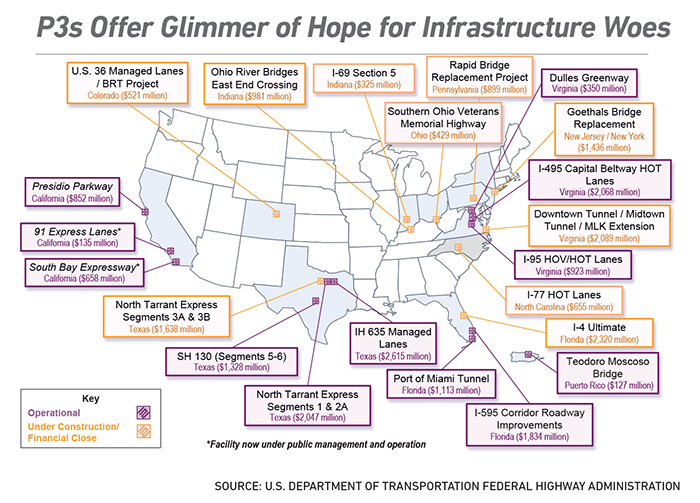

“The question is how to get that done if public entities are not going to pay up-front. There are alternative project delivery methods, notably public-private partnerships (P3s).”

Use of P3s in the U.S. varies with state law. “So called ‘mini-mega’ projects, in the $750 million to $1 billion range have been identified as the correct economy of scale and cost of capital for P3s so far,” Hartman added.

For all the signs of progress, it is unlikely that full infrastructure restoration can be accomplished before another major failure.

Risk professionals in the public and private sectors are asking about worst-case scenarios — bridge collapses that cut off major highway arteries; dam failures that flood vast areas and prevent manufacturing and trade. There are not yet a lot of answers to those big questions.

“We see some agencies in the U.S. that do not even know what their assets are,” said Terry Bills, global transportation industry manager for Environmental Systems Research Institute (Esri). “If I were an insurer, I would have concerns about asset management and would be very engaged in the process.”

In starting to assess the effects of a major infrastructure failure or natural disaster, Adrian Pellen, also a director at Aon Infrastructure Solutions, said the costs “have to look beyond frequency and severity of losses to include litigation costs and issues. Property insurance is not intended to pick up things that are already in disarray, but liability can still play a big role.”

The Insurance Response

Aging infrastructure puts a spectrum of industries and even the economy as a whole at risk, said Lou Gritzo, vice president and manager of research at FM Global.

“The key issue is protecting industry from water, a risk that continues to change with rising sea level. Now, there are exposures that were previously unrealized. That directly affects coastal development and urbanization.”

There have been efforts by the industry to adapt business-interruption policies to accommodate indirect disaster and infrastructure risks. Results have been mixed. Underwriting is complex, and uptake among owners has been spotty.

Where there are clear and present dangers, such as indicated on new flood maps, homes and businesses are being moved, but refineries and chemical plants can’t be.

“The most important protections in any case are those that are fit for purpose,” said Gritzo. “Anything that can be moved or elevated should be.”

Risk managers must make a plan based on current exposures, and then address the greatest vulnerabilities, he said.

Bills of Esri said that public agencies are focusing on traffic levels as they decide what to repair and what to abandon.

“What to keep and what to let go is a very different political issue now,” said Bills. “Infrastructure used to be nonpartisan. But the gridlock at the federal level has forced states to be creative in their own directions.

“One option is P3s, which are growing fast in some places,” he said.

According to the U.S. Army Corps of Engineers, there were about 3,000-plus P3 projects in the works as of September 2015, with a value of about $268 billion.

Part of the problem, said George Spakouris, director of infrastructure advisory at KPMG, is that “governments have not been building things in a long time. The booms were in the ’50s and ’60s. That expertise is not within cities and states anymore. Even utilities don’t seem to know how to plan and build anymore.”

That brings the problem full circle, Spakouris noted. “There are many old assets out there where failure could cause great damage,” well beyond the immediate loss of the structure. &

2016’s Most Dangerous Emerging Risks

The Fractured Future Infrastructure in disrepair, power grids at risk, rampant misinformation and genetic tinkering — is our world coming apart at the seams?

The Fractured Future Infrastructure in disrepair, power grids at risk, rampant misinformation and genetic tinkering — is our world coming apart at the seams?

Cyber Grid Attack: A Cascading Impact The aggregated impact of a cyber attack on the U.S. power grid causes huge economic losses and upheaval.

Cyber Grid Attack: A Cascading Impact The aggregated impact of a cyber attack on the U.S. power grid causes huge economic losses and upheaval.

Fragmented Voice of Authority: Experts Can Speak but Who’s Listening? Myopic decision-making fostered by self-selected information sources results in societal and economic harm.

Fragmented Voice of Authority: Experts Can Speak but Who’s Listening? Myopic decision-making fostered by self-selected information sources results in societal and economic harm.

Gene Editing: The Devil’s in the DNA Biotechnology breakthroughs can provide great benefits to society, but the risks can’t be ignored.

Gene Editing: The Devil’s in the DNA Biotechnology breakthroughs can provide great benefits to society, but the risks can’t be ignored.