Business Interruption Lessons the Suez Canal Blockage Taught Us — and How Insurance Policies Need to Evolve as a Result

All it took was a big ship stuck in a narrow canal to unite the world behind one cause — for six days at least.

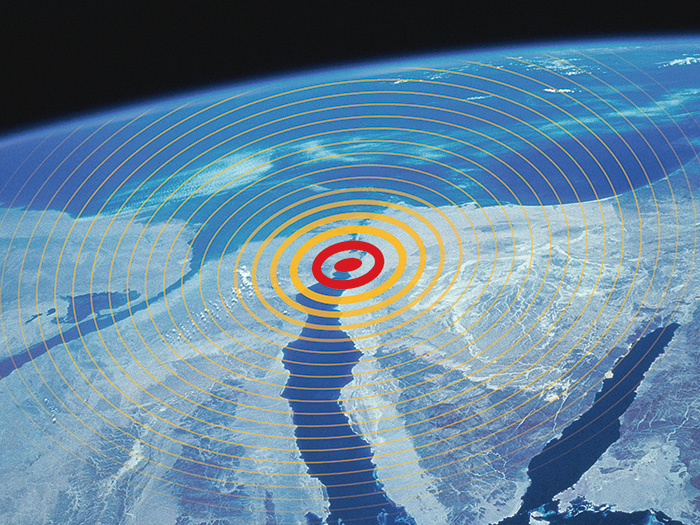

In March 2021, the massive container ship, the Ever Given, wedged itself in the Suez Canal, spurring memes and halting global trade.

Photos of a tiny excavator trying to dislodge the nearly 200-foot-wide, 1,300-foot-long ship went viral. Memes drew comparisons between the tugboats trying to move the ship and all of us trying to live through the pandemic. The world, which had grown weary after a year of battling the COVID-19 virus, was laughing together.

Less funny, however, was the economic loss caused by the blockage. About 12% of all global trade passes through the Suez Canal each day, World Finance reports, and when the Ever Given became stuck, it ground to a halt. Three hundred and sixty-seven vessels were trapped by the maritime traffic jam, and it took several days after the Ever Given was dislodged to send all the backed-up boats through the canal.

The blockage disrupted the path of more than $9 billion worth of goods per day. Per hour, the economic costs totaled almost $400 million, CNBC reported.

Ships that did not opt to wait in the Suez traffic jam detoured around the Southern tip of Africa, adding weeks to their journeys and driving up fuel costs. Elsewhere in commerce, businesses halted some shipments or operations due to cargo delays at a time when the COVID-19 pandemic was already stressing supply chains.

“The global supply chains had already been suffering,” said Ryan O’Connor, North American regional head for ocean cargo with Allianz Global Corporate and Specialty (AGCS). “It just happened at the worst possible time.”

Once it was freed, Egypt seized the Ever Given and demanded its owners pay $900 million in damages to the canal, costs of labor and equipment to free the ship, and lost revenue from vessels that ordinarily would have traveled through the Suez, according to the Washington Post.

All in all, the economic losses stemming from the blockage are likely to reach into the billions, and pain will be felt for months to come. As is usual in the face of massive financial strains, companies are turning to their insurers to see what losses are covered.

While protection and indemnity (P&I) policies will cover some of the third-party liability claims that arise from the blockage, insureds seeking coverage for cargo hold-ups may find themselves out of luck as P&I and business interruption policies are likely to exclude losses caused by delays.

This lack of coverage could spur lawsuits, and it has many wondering if new coverages are needed to protect against future blockages and subsequent shipment delays.

A Plethora of Potential Third-Party Claims

The largest share of claims from the blockage are likely to come in the form of third-party liability claims. Covering everything from damages to the canal to lost revenue claims from the Suez Canal Authority, P&I policies are coming under scrutiny in the wake of the event.

“It’s still very early to tell the full financial impact,” said Michael LaRocca, head of property and specialty for North America with Swiss Re Corporate Solutions.

Marcus Baker, global head of marine and cargo, Marsh

Though the Ever Given’s P&I policies will cover some of these losses, policies have their limits. At the time of the incident, the Wall Street Journal reported that the ship had more than $3 billion of insurance in place for liability claims — a sum that looks paltry when you factor in that Egypt alone is asking for nearly a billion dollars.

The ship owners could also face loss-of-hire claims from other ship owners whose vessels were trapped in the blockage, many of whom will file direct claims with their own insurers as well as third-party liability claims against the owners of the Ever Given.

“I think $900 million is a little bit ambitious in terms of the overall amount, and my worry would be the precedent that gets set if that does go through,” said Marcus Baker, global head of marine and cargo at Marsh. “I just don’t know where you draw the line in terms of the overall business interruption impact.”

In an attempt to limit their liability, the Ever Given’s owners filed a limitation of liability suit against the ship’s operator in the United Kingdom’s High Court, the Washington Post reported. The brief cited the complex ownership structure of container ships and the difficulty of determining who is at fault when something goes wrong at sea as reasons to limit the owners’ liability.

Ships and Cargo Owners May Not Have Coverage

Even if shipowners file both direct and third-party liability claims, there may not be coverage available for losses caused by the delay.

As we saw last year and into this year with the COVID-19 pandemic, most business interruption and loss of hire policies require physical damage to trigger a policy, meaning many ships will go without coverage because there was no physical loss.

“If you’re going to have a loss of hire or business interruption policy kick in, you’ve generally got to have some form of physical damage happen to the unit or product that you’re insuring,” Baker said.

“One could argue that the pace of shipping development and the size of the new generation of container ships has overtaken the physical capabilities of the Suez Canal as one of the world’s major shipping arteries.” —Marcus Baker, global head of marine and cargo, Marsh.

Cargo owners whose goods were delayed may also be out of luck when it comes to recouping losses from the canal blockage. Rather than relying on shipowners to obtain coverage for goods aboard freighters, cargo owners buy their own insurance to protect against risk of damage at sea.

These policies only kick in for physically damaged or lost goods, however, as many cargo owners forgo delay coverage due to high costs.

“Most cargo policies pay for physical loss or damage from an external cause, and they wouldn’t be paying the delay or the business interruption coverages that people might think,” O’Connor said.

A lack of coverage on their own policies will drive cargo owners and vessels trapped by the blockage to file third-party claims against the Ever Given’s owner, likely leading to years of litigation, though those in the industry are skeptical liability suits will be successful due to the lack of physical damage to vessels or cargo.

“It’s highly unlikely that a third party would be able to bring a successful claim against the owners of the ship for losses and from delays suffered,” LaRocca said.

Are Current Coverages Still Appropriate?

The lack of coverage under conventional policies has some questioning whether broader coverages or new products are needed to help protect against future blockages.

“Maritime insurance is old; as we all know, it goes back centuries,” Baker said, “and so maybe this isn’t just a question around maritime insurance, but perhaps there’s an opportunity for the insurance industry to have a look at the product and the appropriateness of product.”

Insureds may look for coverage in the form of supply chain and contingent business interruption insurance, though those policies, too, have their weaknesses.

LaRocca noted that while contingent business interruption policies don’t require damage to a policyholder’s business, they often do need physical damage to a business partner or supplier to trigger the policy.

“Those policies do require physical damage,” he said. “So that would be for business interruption and also any contingent business interruption that might be out there as well. Those policies would require a physical damage trigger on from a covered peril.”

“The blockage of such a vital chokepoint impacts not just container shipping, but all segments of the Asian-Persian-Gulf-Med-East Coast U.S. supply chains.” —Captain Andrew Kinsey, senior marine risk consultant, AGCS

In the future, better technologies and data analytics systems will help vessel and cargo owners find damage that could trigger a policy. Baker used the example of using technology to detect whether a crate of bananas had a temperature excursion that would cause the goods to spoil.

“The growing sophistication of the Internet of Things allows cargo to be monitored in real time, so you could say, ‘Well, actually, the power to the refrigerated cargo unit has gone off for 12 hours. That means the bananas are off. In fact, we’re going to pay your claim before the bananas even hit the dock, because we know that they’ve gone bad,’ ” he said. “So much of container vessel cargo now is monitored.”

Vessels and cargo owners may also find protection by using a parametric cover. Unlike traditional insurance policies, which pay out for the actual loss incurred, parametric covers a predefined event — like a canal blockage — and then pays out using a predetermined scale.

“One can consider more of an event-based cover or a parametric-type cover. These are created for your specific events, and your concerns, and the financial impact that you might feel,” LaRocca said.

“These are for a predetermined, very quick claims payout providing financial relief at your greatest time of need.”

Building Resilient Supply Chains

Though some are calling for broader and different types of coverage, others think it’s time to return to risk management basics. As in, why was the Ever Given passing through the Suez in the first place?

“One could argue that the pace of shipping development and the size of the new generation of container ships has overtaken the physical capabilities of the Suez Canal as one of the world’s major shipping arteries,” Baker said.

Captain Andrew Kinsey, senior marine risk consultant, AGCS

Vessels are unlikely to get smaller, however. Over the last 20 years, ships have only grown larger as global trade systems become more interconnected, making the risk of another blockage even higher.

“When I started in the cargo insurance business about 25 years ago, the largest vessel carried about 6,500 TEUs, which is 20-foot containers. Today, there are vessels that carry 22,000 to 24,000 TEUs,” O’Connor said.

Ships have ballooned in size over the years to align with our inventory practices. Gone are the days of massive warehouses storing mountains of inventory. Now, most businesses rely on just-in-time deliveries to stock their products.

We saw this problem play out early in 2020, when stay-at-home orders spurred by the COVID-19 pandemic caused toilet paper shortages as people engaged in panic-buying. Rather than turn to a large well of inventory to restock common items like canned foods and sanitary products, many retailers were forced to leave them off the shelves.

“There’s nothing like a shortage of toilet paper to really make people understand the importance of the supply chain,” said Captain Andrew Kinsey, senior marine risk consultant at AGCS.

“One of the things that this pandemic has shown us and even an incident like the Ever Given has shown us is that supply chain efficiency has overridden supply chain resiliency,” Baker added.

Businesses are unlikely to restart stocking a ton of inventory to protect against delays, though, as they simply “don’t have the warehouse capacity,” Kinsey said.

“Rather than focusing on the efficiency and low cost, we really need to look at a resiliency model for re-imagining some of our supply chains,” he continued.

One way to do this would be through diversifying the shipping routes for cargo vessels. Right now, most cargo passes along East-West trade routes, which rely on the passage of two small canals, the Suez and the Panama.

“We need to look at revisiting and look at utilizing the North-South trade routes more,” Kinsey said.

“If we’re really looking at recognizing a resilient supply chain, it’s not just going through Atlantic and Pacific basins via Suez or the Panama Canal. It’s also looking at the potential for re-imagining some of the sourcing in a North-South scenario.”

Kinsey also expects that the blockage will lead to a complete refitting of the tugs in the Suez Canal, just as the Exxon-Valdez oil spill led to a re-engineering of the tugs near Prince William Sound’s Bligh Reef 32 years earlier.

“Not only do we need the tugs to have sufficient horsepower to escort these vessels, we also need to design a tractor tug that can actually effectively control or help control the heading of these vessels,” Kinsey said.

Whatever happens, the Suez Canal blockage has proven that the rockiness of global supply chains is no laughing matter: “The blockage of such a vital chokepoint impacts not just container shipping, but all segments of the Asian-Persian-Gulf-Med-East Coast U.S. supply chains,” Kinsey said.

“As we’re seeing, it only takes one ship to get stuck, and it has a domino effect.” &