Blistering General Liability Exposures Spur Greater Retentions by Commercial Insureds

As capacity shrinks in many insurance lines, more organizations are looking to risk retention strategies to reduce their reliance on underwriters while keeping coverage at more affordable levels.

From captives and retention groups to structured risk programs, many retention strategies can present more options to increase coverage and reduce costs.

Organizations should create an analytical framework to model how risks might impact their costs, then use it to find which options fit their needs.

A Tightening Traditional Insurance Market

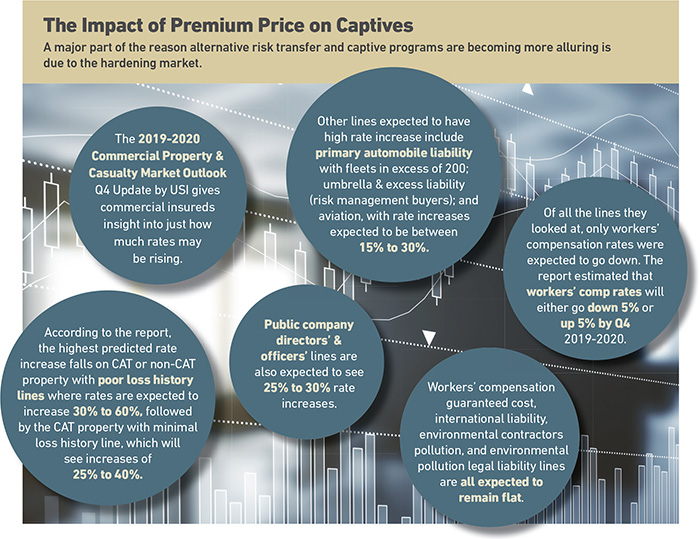

Nearly all commercial insurance lines can expect to see rate increases and reductions in capacity through 2020, according to the 2019-2020 Commercial Property & Casualty Market Outlook Q4 Update by USI.

The brokerage and consultancy noted the combination of attritional and CAT losses in the past several years are leading to price increases and coverage deterioration as major insurers scrutinize their businesses.

It’s a growing concern for many companies, said Michael Gruetzmacher, managing director of alternative risk at Aon.

As insurers re-evaluate and adjust their portfolios, it is hitting many clients with a “triple whammy of price increases, limit reductions and more aggressive terms and conditions,” he said.

In the property insurance market, much of this is attributed to the frequency of events and large losses that have happened in recent years.

In 2019, 409 natural catastrophe events caused more than $232 billion in damages, of which $71 billion was covered by insurance, according to Aon’s 2019 Weather, Climate and Catastrophe Insight Report.

Insured losses in the 2018 California wildfires topped $12 billion, and as of March 9, the 2020 tornadoes in Tennessee had caused at least $1 billion in damages.

Issues are even more severe in the casualty market, where companies now have “greater risks and a lot more to think about,” Gruetzmacher said.

Michael Gruetzmacher, managing director, alternative risk, Aon

“Social inflation,” which describes a broader definition of liability, larger awards and more anti-corporate legal decisions, is driving higher insured losses and bigger premiums.

Insurers are left trying to balance reserves while raising prices within clients’ ability to afford the coverage.

“A lot of it is on a case-by-case basis, but many are facing big price increases or limit challenges,” Gruetzmacher said.

“We’re trying to help clients figure out what it means and to understand it from a quantitative point of view.”

Excess liability is another area where many companies are challenged to find coverage, said Chad Wright, managing director and head of NA risk analytics and alternative risk transfer at Marsh.

“They’ve reached a point where decisions had to be made about existing unprofitable businesses and in areas where they can improve returns through underwriting,” he said.

More Options to Retain Risk

As traditional options tighten, more companies are looking to innovative products to retain risk. Alternative risk transfer (ART) solutions are now more common in the primary insurance market for companies of all sizes as providers and financers look for new means to meet the needs.

These solutions often combine traditional products and creative arrangements to reduce costs, fill gaps and bring new options to the table.

More than 40% of risk managers have used or expect to use alternative risk transfer solutions in the coming years, according to Marsh’s Excellence in Risk Management XVI report.

Among the C-suite and risk professionals, respondents said they were looking to ART solutions to finance hard-to-insure exposures, gain better value for insurance products and to manage casualty risk. Others also looked to ART solutions to address things like cyber, CAT, financial and professional risk.

There are many options for companies to consider, ranging from assuming more risk on corporate balance sheets to ventilating layers of coverage where pricing may not be efficient, Wright said.

Marsh works with clients to deliver analytics and expertise on alternative strategies like captives, self-insurance, risk retention groups and other innovative financing solutions.

“Our own book for alternative risk has increased in the past year by 200%,” Wright said. “There’s more interest in being creative, assuming more risk and coming up with unique solutions.”

Many companies are also becoming more sophisticated about the way they contemplate their insurance products, Wright said.

Whereas years ago risk managers mainly focused on procuring insurance products, many are now looking to other internal departments to make more realistic views about capital allocation and how to create the most value.

“Insurance creates significant value for parts, but large corporate balance sheets are bigger and more robust than they have been before. Middle market clients are starting to realize there are opportunities to think more creatively. The type of product that might have existed five or ten years ago is getting more complex,” Wright said.

Marsh found one-third of companies are actively looking for more information on risk transfer, and those surveyed said the most popular options included captives, structured risk programs, risk retention groups and integrated risk solutions.

Many risk managers are looking to these solutions to get more value while keeping costs down, Wright said.

Chad Wright, managing director and head of NA risk analytics and alternative risk transfer, Marsh

Captives remain the most promising, because they can be effective in financing self-retained losses for both small and large companies, Marsh said.

The owners get flexible options to finance emerging and unique risks like terrorism and cyber liability.

Seventy percent of respondents said they use captives to act as a formal funding vehicle to insure self-assumed risk, and half of those using a captive said they plan to expand use into other areas in the coming years.

Finding the Right Alternative

Organizations and risk managers considering greater risk retention should start by analyzing their current insurance coverage to determine whether it is cost-effective and whether there are any gaps.

One best practice is to start with models, Gruetzmacher said.

Aon will typically work with clients to build a model, then run the forthcoming year multiple times to understand potential risks, how much capital the client needs to hold and how much volatility they may retain if they don’t buy insurance.

Once an analytical framework is in place, they can consider options and what the cost structure may look like as certain risks are transferred, Gruetzmacher said.

Fortunately, many carriers are now more open to finding creative solutions, he said. For example, an insurer may consider a multiyear view where the client takes the first loss but transfers the second loss.

In another agreement, the insurer may pay for the loss but builds in post-loss funding where the client reimburses the insurer.

“There are different ways to think about how you want to transfer the risk … there are creative aspects that are looking at how to modernize the product, cover more risk and think without structure in more creative ways,” Gruetzmacher said.

Companies can turn to brokers that specialize in alternative risk to help determine what measures may be right for them. These brokers can quantify the probabilities and likelihood of events, then create models to determine how various creative risk transfer solutions might stack up compared to traditional insurance.

“It is one thing to [not only] think about how an insurer would price the risk but also what is happening to the client over a long period of time,” Wright said.

As forecasts indicate further tightening in commercial markets, organizations will have to consider broader and more creative risk transfer options, Gruetzmacher said.

“With the challenges in the marketplace, I don’t see more capital coming to insurance anytime soon, and as clients navigate [this market], it’s going to require them to think about taking on more risk. Now is the time to be thinking about these issues,” he said. &