Workers' Comp

An Advancing Industry

For nearly 20 years, Risk & Insurance® has awarded the annual Theodore Roosevelt Workers’ Compensation and Disability Management (Teddy) Award. And in that time, while change has been dramatic, the basic underpinnings of the workers’ compensation system remain about the same.

For more than 100 years, workers’ compensation has had dual objectives: treatment and compensation. Employers must treat a worker’s injury so that the employee can return to the job and, while the employee is off work, provide compensation to replace at least a portion of the wages lost because of the on-the-job injury.

Workers’ compensation remains state-based with 50 different systems throughout the United States. Each state has different provisions for medical treatment and the amount an employer provides to the employee for lost wages. In almost every state, many of those regulatory requirements have changed or been “reformed” throughout the years.

Worker’s compensation remains a no-fault system. Almost all benefits and medical treatment are provided without regard to whether the employee or the employer is responsible for the injury. In return for this bargain, employers are supposed to be free from liability from workers’ lawsuits (called the exclusive remedy), although more and more actions have been filed within the workers’ compensation system, generally not state or federal courts.

“Technology has changed the idea of customer service. Claimants today expect a response from us or our adjusters much more quickly. Speed is important.” — David North, CEO, Sedgwick Claims Management Services Inc.

When the Teddy Awards were first conceived, the focus was on the manufacturer’s safety programs. Today’s winners focus on safety and loss control, but also place emphasis on claims-handling processes, aggressive return-to-work programs and managed care opportunities for medical treatment. Technology has also transformed previously labor-intensive and costly claims-handling processes.

A number of major trends have developed since we began honoring organizations for their workers’ comp and safety practices:

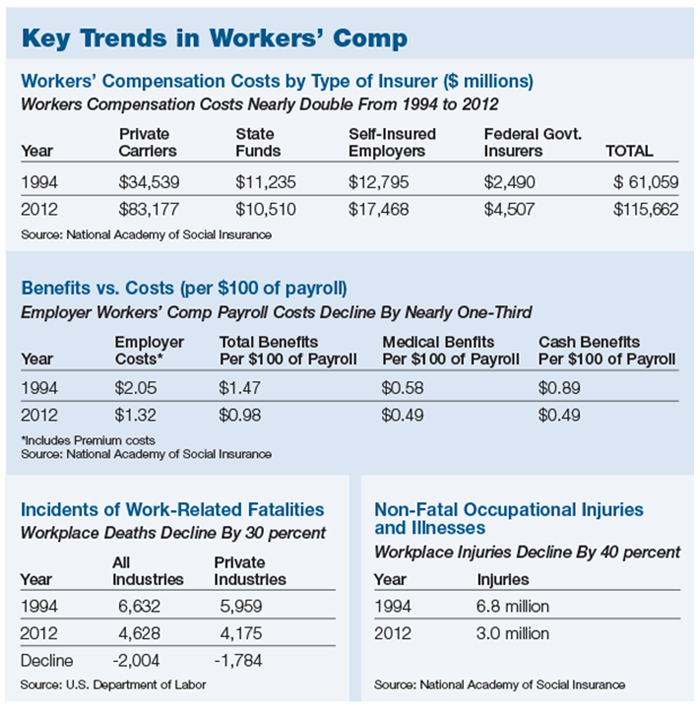

• Today’s workplace is much safer. The number of workplace injuries has declined by 40 percent since 1994.

• Medical treatment of injured workers has improved, in some cases dramatically, because of the increasing sophistication and growth of occupational medicine. Medical costs continue to rise, however, although the rate of medical cost increases has slowed in the last two years.

• The best workers’ compensation employers focus on an aggressive and effective return-to-work program. Return-to-work only began in earnest in the late 1980s.

• Technology has dramatically changed the way that claims are handled, promoting efficiency and cost savings. Today, most large employers, and Teddy Award winners invest in data analytics to improve safety, oversee medical treatment and manage return-to-work.

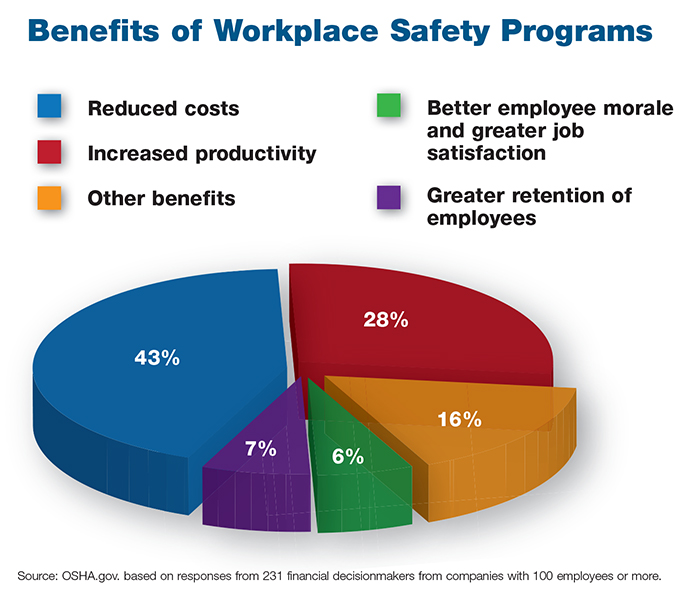

• Today, senior management is much more aware that a strong workers’ comp program can reduce costs and improve productivity. A poor program can be a direct hit to the bottom line, either in terms of much higher insurance premiums or expensive losses.

• Despite some dramatic exceptions, regulators have become more professional and less political. Political interference in workers’ comp regulation still exists but is less common.

An emerging regulatory trend is an effort to “deregulate” the industry with movements to “opt out” of the workers’ compensation system in Oklahoma and Texas.

More Sophisticated Processes

The most dramatic measure — workplace fatalities — has declined by 30 percent since 1994. In 2012, the most current available data, there were 2,004 fewer deaths on the job since 1994. 2014 Teddy Award judge Mark J. Noonan, managing principal of Integro Insurance Brokers and the firm’s senior knowledge manager for workers’ compensation, has more than 30 years of experience.

2014 Teddy Award judge Mark J. Noonan, managing principal of Integro Insurance Brokers and the firm’s senior knowledge manager for workers’ compensation, has more than 30 years of experience.

“People that died in 1994 now go back to work,” he said. “They don’t die from on-the-job injuries. It’s a credit to the quality of medical care and the progress of rehabilitation.”

Probably the most significant change is the continued growing importance of managed care, said David Patterson, division president of ESIS, the Philadelphia-based claims management company.

Patterson said, “It all began in the ’80s, but the sophistication and reach throughout the system today has resulted in both cost control and significantly more improved and more effective care.”

Dawn Watkins, director of integrated disability management for the Los Angeles Unified School District, and a Teddy winner in 2008, said the “biggest change has been an increased focus on quality medical care.”

LAUSD has a network of medical providers that provides services at a discounted rate, “but if an employee can’t get the care they need, we will step outside of the system. Our emphasis is on quality wherever it may be,” she said.

Patterson said that “the level of technology and the enhancement of treatment techniques have prompted many employers to look at the issue of medical effectiveness from a different perspective. Employers want to know how care helps get employees back to work sooner. Employers also look at much more than what is a fair price for medical services.”

The focus is more and more on the outcome of treatment, often defined by how soon an employee can return to work.

Maddy Bowling, longtime workers’ comp consultant and past Teddy Award judge, said that the biggest problem that she sees with managed care is that it has become transaction focused, with too little emphasis on utilization.

“Today, return-to-work issues never come up,” compared to years ago when labor unions went to strike over return-to-work contract provisions. — Yolanda Romero, former director of workers’ compensation, Southeastern Pennsylvania Transportation Authority, 2003 Teddy award winner

“Providers have proven to be adept at finding ways to counteract the lower fees they receive,” she said. “Instead, what often happens is that the employee sees the doctor more frequently or gets too many tests. That puts the emphasis on how well an employer manages its workers’ compensation program.

“The situation in physical therapy and with chiropractors remains a significant problem,” she added. “It’s far too common to see workers go to PT far more than they need, or receive an unnecessary CT scan.”

Consultant Peter Rousmaniere, a past judge of the Teddy Awards, noted, “We still don’t know if evidence-based guidelines are effective. How much do providers adhere to them? And does greater adherence result in better claims outcomes, even if there may be better medical outcomes?”

Safety, Loss Prevention and Return-to-Work

Not only are there far fewer fatalities on the job today, but overall workplace injuries have declined by 40 percent since 1994. In 2012, there were 3 million on-the-job injuries, down 3.8 million from the 6.8 million injuries in 1994.

“We have an amazing streak of reductions in injury frequency, of about 3 percent a year for more than 20 years,” Rousmaniere said. “Some of this is due to shifts in employment to lower-risk jobs, but that does not explain most of the improvement.”

Analytics has also improved safety. Integro’s Noonan said that “root cause analysis” is common today and is enabled by the large amount of data available to employers to identify what is really causing safety issues and find new solutions.

Analytics has also improved safety. Integro’s Noonan said that “root cause analysis” is common today and is enabled by the large amount of data available to employers to identify what is really causing safety issues and find new solutions.

Monica M. Lichtenstein, director of claims operations for Philadelphia-based ARAMARK, which won the Teddy Award in 2009, said, “Employers are now more involved. They have made a big commitment to safety to make sure that injuries don’t happen.”

She believes that this employer commitment to safety, along with a much higher emphasis on return-to-work, are the critical factors in the long-term record of declining injuries.

“Return-to-work was not as big a deal two decades ago, but today it is a critical factor. Today, we understand that workers who return to their jobs heal faster and suffer fewer complications, resulting in substantial cost savings to employers.”

There have been more than a few battles over safety and return-to-work issues over time.

former director of workers’ compensation at the Southeastern Pennsylvania Transportation Authority

Yolanda Romero, the former director of workers’ compensation at the Southeastern Pennsylvania Transportation Authority, a 2003 Teddy Award winner, said that when she began working at SEPTA 20 years ago, her ability to manage a workers’ compensation program that was “out of control” was hamstrung by its relationship with its labor unions.

“We suffered an eight-week strike over the issue of return-to-work.”

After some initial setbacks, and lots of work with the union on the new return-to-work contract provisions, SEPTA saw a dramatic drop in its workers’ comp costs because of those contractual changes.

“Today, return-to-work issues never come up,” she said.

Technology and Data

The impact of improvements in technology probably has had the greatest impact on day-to-day claims handling.

Years ago, adjusters had to spend a large chunk of their time entering data or filling out paper forms. David North, president and CEO of Sedgwick Claims Management Services Inc., said that the advances in technology “have enabled adjusters to do the routine and regulatory requirements of the job much more efficiently.”

That enables the adjuster “to use his or her collective knowledge and expertise much more than ever before.”

Watkins of LAUSD said, “When I got into the business in 1982, we had two basic computers for every four claims examiners. And all you could do with the technology then was enter the reserves and the payments. Everything was so time-consuming because it was all on paper.

“Today, everything is on the desktop. We do much more analysis and it’s far easier for us to handle and oversee our relationships with our partners, such as our TPA.”

With the large amount of claims data now available for analysis, “we have found that we can now, using analytics, identify early on those claims that have a high potential for litigation. We can take action that can avoid legal actions and respond to the needs of the claimant far better,” Watkins said.

ARAMARK’s Lichtenstein noted that data analytics and predictive modeling have been improving at an accelerated pace in the past few years.

In 2009, when ARAMARK was awarded its Teddy, the company had a relatively sophisticated analytics operation for the time, but “today, we really benefit, even more so, from our investment in predictive modeling. We understand its value even better. It has a huge impact on how our claims are handled. We use it in a number of medical areas, particularly with our pharmacy benefit manager to identify usage trends,” she said.

The impact of technology has reached down to the adjuster and claimant.

“Technology has changed the idea of customer service,” Sedgwick’s North said. “Claimants expect us to be accurate and have different choices about how to receive information. We need to be able to respond by phone, email and text.”

Communication technology has also changed the relationship and the expectations between the adjuster and the injured worker.

In contrast, Noonan questions the impact of technology. “I think the biggest issue is that we have taken the humanity out of the claims process,” he said. Even with all technology advances and efficiency improvements, he said, adjusters frequently have too many claims to handle. They don’t take into consideration “that people who are injured are people.”

Regulation

For years, employers criticized state regulation of workers’ compensation for ongoing political interference, corruption scandals and huge differences in regulatory environments from one state to another.

The system remains far from perfect. This year, for example, members of the California legislature were indicted for what has been described as a $500 million scam involving kickbacks and bribes. And this summer, a Florida judge ruled that the state’s workers’ comp system was now illegal because, in effect, it no longer provided the compensation required by law.

Last year, the Oklahoma state legislature passed a new law that gave employers, under some prescribed provisions, the ability to opt-out of the state workers’ compensation system. Texas has allowed employers to opt out since its system was created, but now there is a developing national movement to push for an employer’s ability to opt-out in other states.

“Employers want to know how care helps get employees back to work sooner. Employers also look at much more than what is a fair price for medical services.” — David Patterson, division president, ESIS

But, most employers, especially larger employers, say there have been significant improvements in many of the state systems.

“I think the regulators are more sophisticated, more dedicated and more professional,” Noonan said. “There are not as many political appointees.”

The biggest change probably has been the adoption of a series of new disability laws complicating the workers’ compensation and benefits processes.

Watkins of LAUSD said there are a whole host of state and federal disability requirements that didn’t exist in the 1980s.

“Today, in disability, there is much greater emphasis on return-to-work and reasonable accommodations,” she said.

Companies must balance and manage the requirements of the Americans with Disabilities Act, the Family and Medical Leave Act, equal opportunity issues and a host of other regulations and laws that impact workers’ compensation.

Interestingly, there has been recent speculation about the impact of the new health care law. Sedgwick’s North said, “I have yet to see that the Affordable Care Act has had a significant impact on workers’ compensation. It may and it could affect how health care is delivered in the workers’ comp environment.”

But, he added, the changes in the law have encouraged an ongoing dialogue that may benefit the workers’ compensation community.

Since Risk & Insurance® started the Teddy Award program, most of the winners have been self-insured or large deductible employers who have greater control over their workers’ compensation costs and management of their programs.

Workers’ compensation columnist and president of Workers’ Comp Central David DePaolo said the self-insured are an exceptional group. “Self-insured employers have had a totally different experience from most employers, especially small business who continue to see high premiums and higher costs.”

Clearly, from the experiences of Teddy Award winners, it’s the commitment of senior management to its workers’ comp program that is the key to success.

“Today workers’ compensation is an issue for the C-suite,” said Noonan. “Senior management now recognizes that workers’ compensation is an issue that is worth their time.”