Health Care Costs

The ACA and the Bottom Line

Even before President Obama signed the Patient Protection and Affordable Care Act into law in 2010, company executives began choosing sides. Some believed the PPACA would increase employee health care costs and financially cripple employers, while others hoped it would lower costs because the insurance pool would be expanded to include younger, healthier individuals.

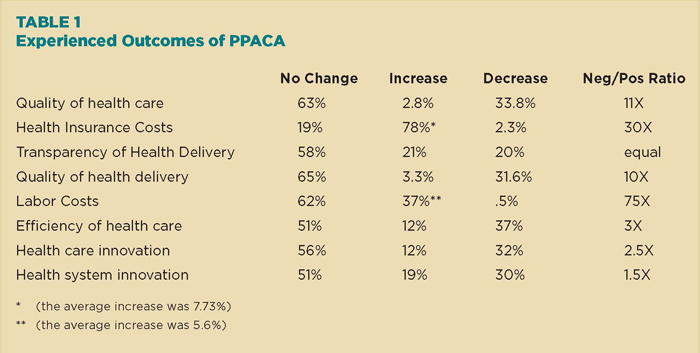

After four years, a survey from the University of South Carolina’s Darla Moore School of Business found that more than three-quarters (78 percent) of respondents are reporting higher health-insurance costs — averaging 7.73 percent more.

Nearly four in 10 (37 percent) stated that their labor costs have increased — averaging 5.6 percent — as a direct result of the health-care reform law.

The results were based on responses from 213 chief HR officers at medium- and large-sized U.S. firms.

Shifting Costs to Workers

One major result of those increased costs has been a significant move toward consumer-directed health plans (CDHP). More than seven in 10 companies (73 percent) have already moved — or plan to move — to CDHPs, which typically call for high deductibles, according to the survey.

“Four to five years ago, insurance companies were [pushing] CDHPs as a way to introduce more market mechanisms into the health market,” said Patrick M. Wright, a professor in strategic HR management at the University of South Carolina, who directed the school’s annual survey.

At the time, he said, roughly 15 percent of surveyed employers adopted that strategy.

“That’s a huge jump. What the [Affordable Care Act] did is basically give companies carte blanche to launch CDHPs,” he said.

Employer-sponsored health insurance will suffer the same fate as pensions, practically becoming extinct — Patrick M. Wright, professor in strategic HR management, University of South Carolina

Recent headlines also coincide with the survey’s findings on the impact of the ACA on employers.

Starting Jan. 1, 2015, Wal-Mart will no longer offer health insurance to employees who work less than an average of 30 hours per week. More than 30,000 workers will be affected. Other retailers, such as Target and Home Depot, already have made similar decisions to eliminate health-insurance benefits for part-timers.

And the impact of the law is still uncertain, since the ACA’s employer mandate was delayed until next year. The mandate requires that businesses with more than 50 full-timers provide health insurance or pay a penalty.

Wright said some employers are holding off from making any decisions until the mandate officially kicks in.

Strategies Required

He said the survey’s overall message to companies is that they will need to adapt to a new regulatory environment and figure out strategies to mitigate rising insurance costs.

Wright said he believes employer-sponsored health insurance will suffer the same fate as pensions, practically becoming extinct, as a growing number of companies seek to divorce health insurance from the employment relationship.

Despite the survey’s responses, others cite other reasons for rising health care costs.

“You have to look at your company, who you’re competing with and really make the case for what direction you’re going down the road.” — Lenny Sanicola, senior benefits practice leader, WorldAtWork

David Newman, executive director at the Washington, D.C.-based Health Care Cost Institute, said other contributing factors include the recession and a long history of health care inflation.

He also noted that high-deductible health plans were growing in popularity even before the ACA was passed.

Newman also said that survey results do not always paint an accurate picture. There’s often a “disconnect” between how people respond on surveys and their ultimate actions, he said.

For example, he said, many employers vowed to drop health insurance if the ACA became law. Instead, they adopted a wait-and-see attitude.

Likewise, survey results can differ. According to the 2014 Employer Health Benefits Survey by the Kaiser Family Foundation, there were modest increases in average premiums — 3 percent for family coverage and 2 percent for single coverage.

But whichever numbers you look at, he said, increases are much lower now than in previous years.

“We can speculate to our heart’s content,” Wright said. “I would be looking more at whether the recession has structurally changed health care in some way to keep costs lower than we’ve historically seen.”

Impact on Employees

As more employers shift toward CDHPs, Wright said, each organization should challenge themselves to make such plans affordable to minimum- or low-wage workers who lack savings or live paycheck to paycheck. How can they pay a steep $4,000, or higher, deductible?

Employers must also question the role health care in the company’s employee-value proposition, said Lenny Sanicola, senior benefits practice leader at WorldAtWork in Scottsdale, Ariz.

For instance: Is health care insurance a magnet or differentiator? Will dropping insurance and paying a penalty be a better alternative? What will the impact be on employee relations or attraction and retention? Will employees expect a bump in pay?

“You have to look at your company, who you’re competing with and really make the case for what direction you’re going down the road,” he said, adding that the University of South Carolina survey validated much of what he’s seen in other surveys or heard from employers.

Companies that decide to stay in the health care game need to explore options or develop innovative strategies to manage costs, he said.

Sanicola offers several to consider: Implement wellness initiatives with incentives, introduce spousal surcharges, pay less for dependents but more for individual coverage, or create reference-based pricing where the company only pays the average price for procedures or tests such as MRIs.

He said many large companies also contract with hospital systems and providers to deliver quality care at lower costs for big-ticket items such as knee or hip replacements.

Employers should prepare themselves to thoroughly explain any changes in health plans, especially CDHPs, which may require some handholding, he said.

In addition to providing vendor hotlines and conducting face-to-face meetings, he said, companies can train a handful of employees to act as ambassadors — to address questions from co-workers. Employers should also consider extending access to spouses — who often make family decisions.

Many companies continue to struggle in helping to educate employees to be better health care consumers.

They need to do “a better job of giving people tools to help them price out [services] . . . and navigate the system,” said Sanicola. “That’s really half the battle.”