Reputational Risk

A Captive Reputation

Following what seems like an unending stream of high-profile crises affecting businesses — across industries of all shapes and sizes — many business owners are instituting captive insurance programs that provide cover for reputational damage and response in the event of a crisis.

Captives have covered reputational damage risk for many years. Recently, the commercial insurance market has offered reputational cover, but for middle-market companies a captive program is likely to remain a better solution for some time to come. Establishing a reputational risk insurance program does, however, raise some issues.

One of them is that the practice of public relations (which drives reputational risk coverage) relies on the often intangible link between reputation and bottom line, and, therefore, determining appropriate policy limits and premiums can be a challenge.

How does an organization quantify the value of proper crisis response communications and how does one speculate or place a value on how much improper communications might have cost?

Forward-looking businesses should not let uncertainty cloud these decisions. Reputational risk management programs, with insurance provided by a captive insurance company, act as a vital shield in a new era of communications.

Forward-looking businesses should not let uncertainty cloud these decisions. Reputational risk management programs, with insurance provided by a captive insurance company, act as a vital shield in a new era of communications.

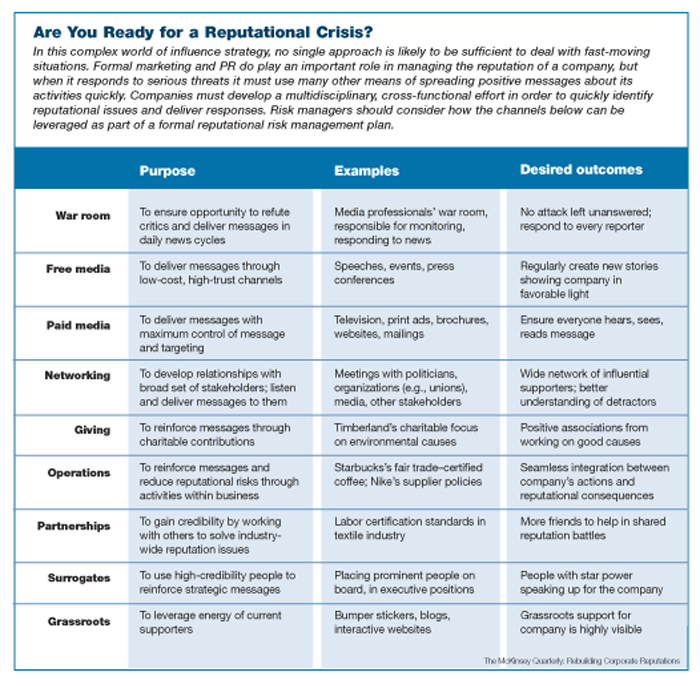

The aims of a reputational risk management and insurance program are to prepare for a reputational crisis, respond to a crisis and cover the cost of response and loss of business. The program should be structured along the following lines to address the realities of crisis preparedness.

• Scale. A crisis does not need to be catastrophic to have a major impact. Penn State University garnered national news in 2011, as did Rutgers University in 2013. Penn State’s crisis involved indisputable, horrific atrocities by one individual; Rutgers’ crisis involved irresponsible behavior and poor judgment by one individual, though nothing rising to the criminal charges on the level of Penn State, if at all.

The reason each school suffered a high-profile reputational impact was not only the incident itself, but the unacceptable communications responses, each seemingly motivated by self-preservation and a fear of negative publicity.

And each incident has the potential to irreparably damage the long-time relationships that keep these organizations vibrant. Time will tell.

A public relations “crisis” entails any situation that has the potential to impact an organization’s bottom line and ability to operate — with or without the potential for physical harm, loss of property or loss of life.

It may be as severe as the tragic and unfathomable deaths of more than 1,000 garment workers at Rana Plaza in Bangladesh, or as seemingly tame as a union negotiation, dissatisfied high-profile customer, or misplaced thumb drive carrying sensitive information.

When you expand the definition to include non-criminal negligence and irresponsible decision-making, the volume and types of scenarios for which you should offer coverage expands greatly. The impact on an organization’s bottom line could be deep — and all of it caused by reputational damage.

• Scope. A crisis does not need to attract major media attention to be taken seriously. Many crises with a detrimental impact never make it to a media outlet. Few crises that affect small- or mid-market businesses will have the New York Times knocking down doors. Some crises exist only in social media; others spread only through word of mouth among small communities of key stakeholders. A crisis need not make a lot of noise to have a devastating impact.

• Speed. The first statement in the aftermath of an event matters most, so the program should encourage insureds to feel comfortable responding quickly. Reputational risk management programs should provide crisis communications services in response to an incident or claim but, if communications support is only provided after the first statement has been made, it may already be too late.

While high-profile crises demonstrate just how important an immediate response (followed by consistent communications) to key audiences has become, even a less significant situation requires proper initial communications.

Improper initial communication affects the credibility of the business’s leadership (and, in turn, their ability to lead). It can stimulate new lawsuits and legal challenges, and ultimately can alienate the advocates and communities that it serves.

Why is an immediate response so vital? In large part because of the modern media climate. Just 10 years ago, an organization had days to respond to a crisis; five years ago, two to four hours. Today, the 24-hour news cycle demands a near instantaneous response.

If your organization isn’t prepared to establish a tone and provide perspective, someone else will do it for you: employees, antagonists, social media detractors, or the media itself. Nature abhors a vacuum.

An effective reputational risk management program must ensure access to crisis communications support quickly.

With a captive providing the insurance, the leaders of the business know that there will be no lengthy approval and authorization processes and that they can be comfortable reaching out for communications support. If they don’t ask for help, or if they only reach out for the “big” situations, they may be leaving themselves vulnerable, increasing the cost of potential claims.

• Preparation. For this reason, forward-looking providers are shifting their focus to promoting crisis communications preparedness. We subscribe to the philosophy that “a crisis may be unexpected but it should not come as a surprise.”

Any organization — large or small — can anticipate the specific scenarios they may face that may affect their ability to conduct business. They can prepare and have vetted initial statements for media that articulate their policies, procedures, commitment and sympathies; they can devise a plan for reaching their most important audiences with timely information; they can anticipate the questions they will receive. These planning steps — foundational elements of a Crisis Communications Plan — are rarely included in reputational risk management programs, but should be.

• Outlets. Executives need to think beyond the media and devote sufficient resources to the audiences that have a direct impact on their bottom line and ability to operate.

Especially for small- or mid-market insureds that lack robust communications teams, the media — traditional or social — suddenly taking an interest can be intimidating and overwhelming. Still, the media cannot monopolize your attention. The media are simply an intermediary; they have the potential to reach the audiences that can affect how you do business. In most cases, you will know how to reach key audiences, and should rely on direct communications to retain and restore confidence.

The risks to reputation are greater today than ever before. Resolving to manage those risks and their potential impact is an important strategic decision. The implementation of a reputational risk management program requires commitment. Combining it with a captive insurance program can help maintain focus as well as making sure that funding for losses and loss mitigation expense is quickly available when needed.