Claims

Work to Be Done

Results of a survey of claims practitioners conducted in May and June of 2013 and released this fall reveal a workers’ compensation claims industry, that as busy as it is, has a lot more work to do.

Rising Medical Solutions, a medical management and cost containment company based in Chicago, hired an independent researcher to look at four key areas: prioritizing core competencies, staff development and training, medical performance management and the impact of technology and data. The primary researcher on the project was Denise Zoe Gillen-Algire, a principal with Risk Navigation Group, LLC.

In putting together the survey, Algire worked with a 12-member advisory panel that included executives from carriers, consultants, brokerages, self-insureds and others.

Members of the advisory panel included Fred Boothe, vice president of insurance services with BrickStreet Insurance; Raymond Jacobsen, managing director with Aon Benfield; Laura Crowe, risk management director of Presbyterian Healthcare Services; and Tim Mondon, vice president of bill review with Zenith Insurance.

The survey gathered the views of 258 claims professionals in a variety of organizations, including reinsurance and excess carriers, third-party administrators, insurance carriers, government entities, risk pools and self-insureds.

The survey raked up a lot of interesting data that’s relevant to the industry, but perhaps one of its most striking findings was in the area of incentivizing, training and retaining staff.

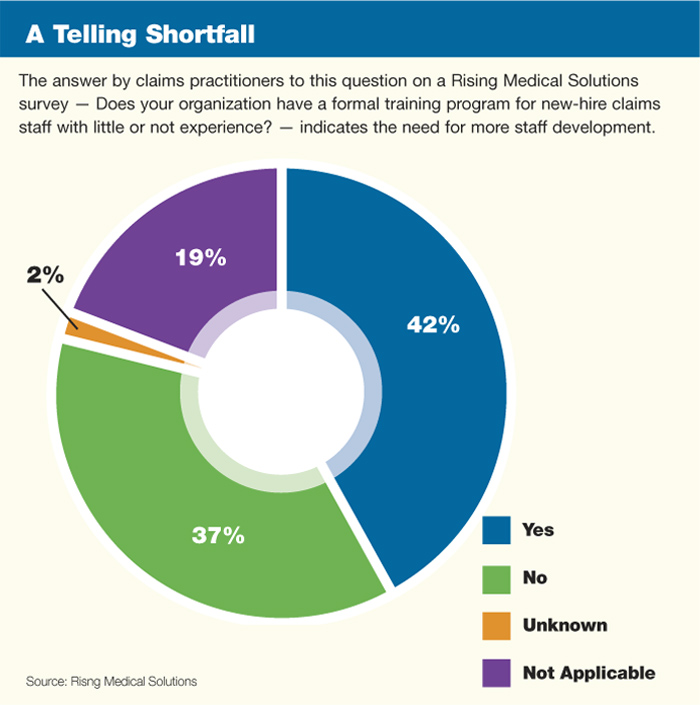

To the question, “Does your organization have a formal training program for new-hire claims staff with little or no experience?” less than half of those who answered the survey — or 42 percent — responded that they did.

Fully 37 percent of those who responded said they did not have such a program. In the area of senior claims staff training, 49 percent said that they provided technical training and development but 30 percent said that they did not.

During a roundtable discussion on the topic that was held around the time of the study’s release, panel members pointed to some of the drawbacks claims organizations face if they don’t spend more time and money on training and incentivizing employees.

“I think a lack of investment in training and staff development, and also incorporating that into a company’s culture, really has a detrimental effect on the end product and the customers we serve,” said Fred Boothe of BrickStreet.

As we know, combined ratios in workers’ compensation have reached unpalatable levels for many carriers, who have pulled back the amount of capital they are willing to place as cover on this risk.

It seems that putting fewer resources into the crucial area of claims management isn’t exactly a step in the right direction.

But implementing effective training is complicated, according to Anne Kirby, the chief compliance officer and vice president of medical review services with Rising Medical Solutions. Kirby participated in a Sept. 25 webinar –hosted by Risk & Insurance® –that took a deeper dive into the survey findings.

“I was looking at the training and how the training compares from a new hire to a senior claims person and my first thought is that new-hire training is very different from senior claims training,” Kirby said.

“More emphasis on training would not only improve the financial results and provide opportunity for growth but it would also assist with things like succession planning; it could reduce turnover and help retain employees, and may provide incentives for individual success and ultimately be more rewarding for the group.”

— Raymond Jacobsen, managing director, Aon Benfield.

“The senior claims folks have more on-the-job training, they are going to conferences, they are looking at a bigger-picture focus and I think what we have seen is a trend of more business-trained MBA’s moving into these senior positions,” Kirby said.

“Part of what is driving that is the need for quantitative analysis,” she said.

Another member of the Sept. 25 panel agreed that a better emphasis on training is in order here.

“More emphasis on training would not only improve the financial results and provide opportunity for growth but it would also assist with things like succession planning; it could reduce turnover and help retain employees, and may provide incentives for individual success and ultimately be more rewarding for the group,” said Raymond Jacobsen, a managing director for Aon Benfield.

Back to Basics

Another key finding of the study helped to reaffirm one of the industry’s core purposes.

In the area of prioritizing key competencies, those who answered the survey were asked to rank, in order of priority, the competencies most critical to claims outcomes. Disability and return-to-work management topped the list, followed closely by medical management.

Since, in its essence, the purpose of workers’ compensation coverage is to get workers healthy and get them back to work, panel members expressed relief that the professionals surveyed had their sights so clearly set on those goals.

“I fully expected medical management to be No. 1, but I am thrilled with the selection of disability management and return-to-work being No. 1,” Jacobsen said.

“I have had a concern over the years that sometimes we as an industry find ourselves being distracted on certain trends or new ideas and what it bears down to is this 100-plus year old system of workers’ compensation and the doctrine of an exclusive remedy, really, the intent is to protect the workers’ right to return back to work after an injury, and sometimes other issues have captured our attention,” Jacobsen said.

What’s captured everyone’s attention recently, and rightly so for the impact it could have, is the implementation of the Affordable Care Act.

Like many this magazine has interviewed recently, Risk Navigation Group’s Algire said the Affordable Care Act could have a substantial impact, in the short-term at least, on access to care, which in turn could impact the ability of employers to get their workers healthy and back to work.

But she and other members of the Sept. 25 panel think that a focus on incentivizing care providers could produce good results.

“Because there is a significant concern around access to care I would encourage employers to partner with outcome based providers and health care organizations,” Algire said.

In addition, direct contracting with health care providers and using risk/reward strategies in employee wellness programs should also produce good results if properly managed, she said.

“The Affordable Care Act language includes provisions that would allow employers to use risk/reward programs,”Algire said.

“If we think about the significant impact of obesity and other comorbidities on the overall cost of health care as well as the workers’ compensation system, this really could be a good strategy for organizations,” she said.

In the area of medical management and its link to return-to-work goals, the survey finding that 66 percent of those surveyed do not use medical provider outcomes and performance measures is notable.

The survey found that only a small number, 26 percent, measure provider performance. The researchers theorized that the probable factors affecting the limited use of provider performance and outcome measures are statutory limitations in some jurisdictions and even more likely, limited understanding of measures and how to use them.

“It’s a complicated area and it’s complicated for two reasons,” Rising Medical Solutions’ Kirby said. “One, it’s knowing what to look for; and No. 2, is having the right tools to use to look,” she said.

The use of an integrated claims system, something many survey respondents said they don’t possess, is key in this area. But what argument will win investment in integrated claims systems from those in the CFO’s office?

Algire thinks she has at least one answer.

“I would say the primary return is a decrease in claims leakage,” Algire said. “There is significant leakage or opportunity for leakage when you have all of these data points, all of these systems not talking to each other.”

We said at the outset that the industry has a lot of work to do. And in the use of data, using it effectively, the workload is heavy.

In the area of medical provider performance outcomes, for example, claims organizations need to have at their disposal good data, but whether to perform that analysis themselves or outsource it in turn needs to be analyzed.

“Most workers’ compensation carriers can’t do this for you because they don’t have the data; and without having it in a central place, you can’t analyze your providers,” BrickStreet’s Boothe said.

In return-to-work, Boothe said, a tricky place is in analyzing the work of specialists, who frequently have difficult medical issues to address with workers’ compensation patients.

“In the medical community, how do you measure this and are you being fair to the provider?” Boothe asked.

“In the specialist community, they are getting the worst of the worst,” he said.

“Everything should be analyzed for outsourcing,” Jacobsen said. That means a cost-benefit analysis that looks not only at expense but also the impact on total loss ratio that a service provider could deliver. Jacobsen said that is work that is cut out for actuaries.

Data, Data, Data

Good data and lots of it, is increasingly valued in workers’ compensation claims management. How much to invest in technology, though, is a nettlesome question for the workers’ compensation claims management community.

Among the survey respondents, 26 percent said their organizations spent between 1 percent and 3 percent of their annual budgets on IT systems for workers’ compensation. Eleven percent of those surveyed spent between 4 percent and 6 percent. Perhaps most unsettling is the fact that 45 percent of those surveyed didn’t know what they spent.

With the difficulties that many organizations face in gathering, integrating and analyzing data, data warehousing is increasingly being seen as a solution. The researchers found that 50 percent of those responding are using a data warehouse to consolidate or integrate systems for reporting purposes.

Broken out, 73 percent of the 77 insurance companies that responded to the study are using data warehousing, 53 percent of third party administrators are using it and 33 percent of self-insureds are using it.

Organizations considering data warehousing need to ask themselves some important questions, Aon Benfield’s Jacobsen told Risk & Insurance® and its webinar audience.

“First, what do you want to accomplish and what do you want to have as outcomes?” Jacobsen asked.

Needs will vary depending on the organization, but focus areas could include workers’ compensation fraud, physician performance, duration of disability and use of narcotics.

There are a lot of studies done in the workers’ compensation area due to its impact on human health and happiness and its painful cost points.

But in looking at data, Kirby of Rising left us with one thought perhaps worth spending some more time considering.

“I would really focus on learning about your own data, your book of business and your history because that is where the value is.”