Catastrophe

10 Years Later: Lessons From Hurricane Katrina

Businesses learned a great deal from the impact of Hurricane Katrina, but underwriters are concerned that institutional memories are fading and there may be “unintended complacency” about exposures to future catastrophic events.

It was Katrina that showed the impact of storm surge can often be more damaging than high wind speeds and that the physical size of the hurricane can affect the surge itself, according to Allianz Global Corporate & Specialty (AGCS).

There has been a steep rise in the cost of claims for extreme weather events — from an average of $15 billion a year between 1980 and 1989, to an average of $70 billion a year between 2010 and 2013, according to AGCS.

Windstorm losses account for approximately 40 percent of all natural hazard losses by number of claims and 26 percent by value, it said.

However, growth of exposure is far outpacing take-up of insurance coverage resulting in a growing gap in natural catastrophe preparedness, according to AGCS.

Jayanta Guin, executive vice president, researching and modeling at catastrophe modeling firm AIR Worldwide in Boston, said the damaging effects of storm surge convinced AIR of the need for a more detailed, hydrodynamic model as opposed to the simpler parametric approach that had been used.

Today, both AIR’s U.S. hurricane model and its recently introduced U.S. inland flood model use a physical modeling approach to capture flood risk.

“For both models, particular engineering attention has been paid to the current-day vulnerability of the levee system in and around New Orleans,” Guin said. “While that system has clearly been strengthened since Katrina, we maintain a healthy dose of skepticism about the levee systems’ longer-term upkeep.”

Vulnerable Structures

Katrina, which struck New Orleans on Aug. 29, 2005, also revealed new insights into the vulnerability of commercial structures, such as the large number of casinos built on barges along the Mississippi coast, he said. Now, there is greater recognition of the wide array of buildings that companies are insuring. As a result, underwriters’ view of the vulnerability of commercial assets has increased.

Video: National Geographic provides a day-by-day account of Hurricane Katrina’s wrath, from its birth in the Atlantic Ocean to its catastrophic effects: flooded streets, flattened homes, and horrific loss of life.

Lou Drapeau, director of risk management at the University of Kentucky in Lexington and vice-chairman of Disaster Recovery Institute International, said that before Katrina, most organizations did not have someone in charge of business continuity, but now many do.

Moreover, he said, Katrina “got a lot of people’s attention” on the need to coordinate risk management, emergency preparedness and emergency response, business continuity and disaster recovery.

“Those functions can’t exist in their own towers — they really have to work together,” Drapeau said. “Katrina really caused those four separate areas of an organization to work more closely than they have in the past.”

One of the lessons learned from Katrina is that the complexity — and losses — associated with hurricanes in highly developed areas with significant infrastructure are far greater than imagined, said Andy Castaldi, head of catastrophe perils Americas at Swiss Re in Armonk, N.Y.

Over time, carriers learned how to better estimate potential losses, but there are still “quite a bit of surprises,” Castaldi said, such as the damage due to storm surge from Katrina.

Thus, it’s important that manufacturers and other businesses be prepared not only to cover losses from property damage, but also from business interruption.

“People tend to forget how devastating events can be, and I’m not sure many companies have done enough to protect themselves financially with business interruption plans if they have extensive downtimes,” he said.

Losses escalate quickly due to the increased automation in manufacturing, Castaldi said. Thirty years ago, employees could come the next day after a hurricane, clean up and start working, but today, plants have robotics and other electronics, which are more susceptible to hurricane damage and more costly.

“It might take months for these highly specialized electronics to get repaired as there may be a long waiting list, which can cause bigger problems and bigger losses than ever before,” he said.

Monica Ningen, head of property underwriting U.S. and Canada for Swiss Re, said that the question commercial property owners often asked before Katrina was, “Can we afford to take steps to mitigate against these sort of events?” But the question after Katrina, is, “Can we afford not to?”

Short Memories

Ningen is concerned that many organizations are starting to forget about the disaster plans that were conceived after the hurricane.

“New risk managers are coming in and their organizations are forgetting the importance of response time and response in general,” she said. “Public and private entities need to figure out how to work together to find disaster preparation and mitigation solutions.”

Resiliency of an area after a catastrophic event can be measured in three ways: whether people have work, whether their home is habitable and whether children can go to school, Castaldi said.

“Corporations have to think beyond their four walls and make sure their workforce has adequate housing and schools that are properly protected,” he said. “There is such a thing as unintended complacency — the further time away from an earlier catastrophic event, the more people don’t prepare for another one.”

Cheryl Harper, president of RIMS’ South Louisiana chapter, lived through Hurricane Katrina — her house flooded and her employer had 8 feet of water in its offices.

Harper is operations manager for Catholic Mutual Group in New Orleans, the Louisiana office of the Roman Catholic Church’s self-insurance fund, which provides insurance and risk management services for the Archdiocese of New Orleans and two smaller Louisiana dioceses.

After Katrina, the organization set up temporary offices in Baton Rouge and didn’t return its operations to New Orleans until January of 2006.

Crucial Lessons

Businesses must have a solid business continuity plan in place that is updated annually, including emergency contact numbers for all employees, she said. Fortunately, with hurricanes there are advance warnings, so if an event is forecast, Harper makes sure she reconfirms that information before any storm hits.

“It’s important to be able to reach your team by several different methods, as after Katrina we had no cell service, but we could text,” she said.

“You need to invest a little more money on the front end for a secure roof, which will help prevent substantial damage when the next storm does come.” — Cheryl Harper, operations manager, Catholic Mutual Group

Since the organization’s servers were damaged due to flooding during Katrina, the Catholic Mutual Group now has a back-up server in northern Louisiana that it can access remotely. If Harper and her team need to evacuate in the future, she plans to take the minimal amount of operational equipment to make sure she can access the remote server and provide services from any location.

Moreover, the organization published a hurricane manual, which includes emergency contact information as well as guidance on property protection, claim reporting, remediation, reconstruction, and templates for contractor bidding and other forms. Before any storm hits, her company puts remediation companies on standby.

Another crucial lesson learned after Katrina was to strongly encourage parishes and other members to install standing seam metal roofs in new buildings or replace outdated roofs with them, as those roofs typically hold up better during hurricanes, she said.

This is particularly important now that named storm deductibles are anywhere from 2 percent to 5 percent of the insured value of the building. Replacing with this type of roof can be very costly, but it will save the building from interior water damage and extensive remediation from typical roof damage in a storm.

“You need to invest a little more money on the front end for a secure roof, which will help prevent substantial damage when the next storm does come,” Harper said.

In addition to roofs, AGCS recommended examining and shoring up all “building envelopes,” including walls and windows, and making sure gutters and other drainage systems are clear of debris or vegetation, so water can properly run off during a storm event.

“These steps allow us to better support clients in determining potential repairs or maintenance needs,” said Thomas Varney, the company’s ARC regional manager for North America in Chicago.

Businesses should also make sure to adhere to four primary areas of windstorm loss mitigation, according to AGCS’ report “Hurricane Katrina 10: Catastrophe Management and Global Windstorm Peril Review,” released August 18:

- Pre-windstorm planning includes the development of a comprehensive, well-tested emergency plan, site and equipment inspections, and preparations for possible flooding.

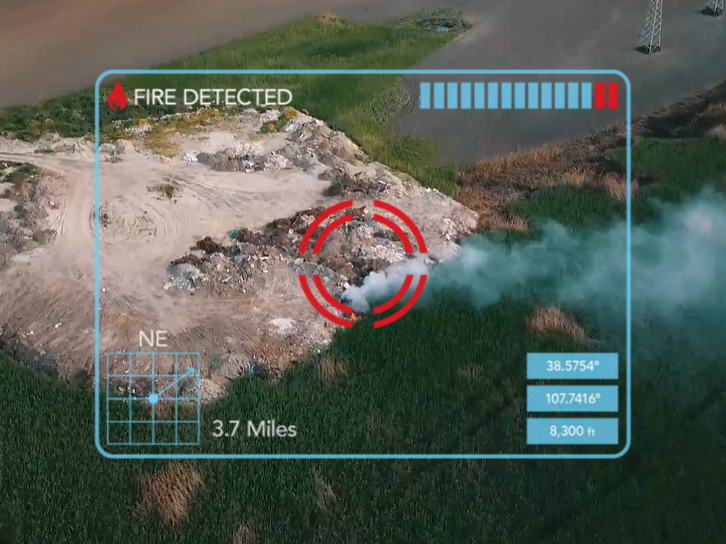

- During a windstorm, response personnel should monitor for leaks, fire and damage.

- After a windstorm, the site should be secured to prevent unauthorized entry. An immediate damage assessment should be conducted if safe to do so.

- Business continuity management is crucial as just-in-time production, lean inventories and global supply chains can easily multiply negative effects. Property damage and business interruption are usually covered by insurance policies, but often there is loss of market share, suppliers, clients and staff. Businesses should develop and test business continuity plans and communication cascades.