10 People on the Move

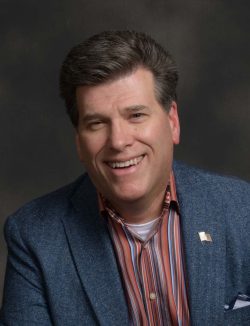

Vermont Captive Insurance Association Names Next President

Vermont Captive Insurance Association has chosen Kevin Mead to serve as its next president, succeeding Richard Smith, who led the organization for 12 years.

Recognized for his 16 years in trade association leadership, Mead is expected to “increase engagement, drive membership, and strengthen impact of VCIA,” per a press release.

Mead is heralded for having a wealth of association management and financial tact, exemplified in his previous experience engineering a merger of three global independent accounting associations to form PrimeGlobal, an organization which represented 2,000 partners and 14,000 employees in 90+ countries, according to the release.

After PrimeGlobal, he was the vice president of resource development for Spokane County United Way. Most recently, he was the executive director of a rare disease foundation.

“We are thrilled to have found someone whose experience and approach perfectly aligns to the continued development of the Vermont Captive Insurance Association as it represents and promotes the interests of its members,” Andrew Baillie, VCIA board chair, said.

“We are confident that Kevin’s broad experience will be very complementary to that of the experienced staff of VCIA.”

Brit Appoints New Chief Data Officer

Kanika Chaganty, chief data officer, Brit Ltd

Global specialty reinsurer Brit Ltd (Brit) announced the appointment of Kanika Chaganty as chief data officer. In the newly created role, Chaganty will be responsible for leading the organization’s data strategy and enhance how Brit underwrites and services claims, according to a press release.

Chaganty has over 22 years of technology, data and business transformation experience, with strong expertise in “the critical role of data within the insurance industry,” as noted in a press release.

She brings a diverse industry experience across financial services, health care, retail, and manufacturing sectors across EMEA, North America, APAC regions. Prior to joining Brit, she was with Vitality UK Group for nearly 10 years, most recently holding the role of chief data officer.

Sheel Sawhney, group head of claims and operations commented, “Welcoming Kanika in a newly created chief data officer role will enable us to fully leverage the latest data tools and capabilities to drive better outcomes for clients, trading partners and the sector at large.”

Clyde & Co Expands Global Aviation Practice with D.C. Hires

Orla M. Brady, senior counsel, aviation practice, Clyde & Co

Global law firm Clyde & Co hired Orla M. Brady as senior counsel at its Washington, D.C. aviation practice, which is part of the firm’s global aviation practice.

Brady was previously a trial attorney in the U.S. Department of Justice, Aviation, Space & Admiralty Section in Washington, D.C. At the DOJ, she was responsible for “all aspects of affirmative and defensive litigation involving suits by and against the United States on tort matters related to aviation and admiralty,” per a press release.

In addition to Brady’s appointment, Clyde & Co also recently hired international aviation lawyer Kenneth P. Quinn as a partner in its global aviation practice. Quinn is also based at the firm’s Washington, D.C. office.

Quinn brings over 30 years of experience acting as litigation, regulatory, enforcement, antitrust, and commercial counsel to numerous domestic and international airlines, aerospace companies, lenders and lessors, private equity and hedge funds, online travel and social media companies, developers, and other aviation companies, according to a press release.

He has previously served as the chief counsel of the U.S. Federal Aviation Administration, counselor to the U.S. Secretary of Transportation, and senior advisor to the U.S. Office of the President-Elect. He was also named a fellow of the Royal Aeronautical Society, where he serves on its member services board.

Commenting on the development of the Washington D.C. practice, the global chair of Clyde & Co’s aviation practice, Kevin Sutherland, said, “Orla Brady’s arrival from the U.S. Department of Justice, Aviation, Space & Admiralty Section, alongside industry expert Kenneth P. Quinn’s recent appointment, enables us to offer a leading regulatory, commercial, and trial capability from our Washington, D.C. office, across the U.S., and internationally.”

Insurance Office of America Adds Three Industry Veterans to Franchised Dealership Team

Mat Pope, risk management specialist, Insurance Office of America

Insurance Office of America (IOA) recently hired three insurance industry veterans with extensive backgrounds in the franchised dealership sector to join its team. Chip Sellas, Paul Elliott, and Mat Pope collectively bring more than 60 years of experience in the P&C market.

Chip Sellas brings over four decades of experience in insurance sales, marketing, and underwriting, and has helped over 250 franchised dealers find the best insurance options available for their needs, according to a press release.

He previously owned an insurance agency for 10 years and worked with one of the largest P&C insurers in the country, specializing in insuring auto, truck, motorcycle, agriculture, construction, and forklift dealerships.

Paul Elliott brings more than 20 years of insurance industry experience ranging from auto, heavy truck, and equipment rentals to dealerships, construction, captives, and renewable energy. The breadth of his P&C expertise provides him with a “comprehensive understanding of risk mitigation, claims management, and financing,” as noted in the release.

Mat Pope, CRM, has represented the franchised auto, heavy truck, and equipment dealership markets for over 20 years, working with over 250 dealers. Prior to joining IOA, Mat served as a senior risk consultant for Valent Group. Pope now serves in the role of risk management specialist at IOA.

Allianz Global Corporate & Specialty Expands North American Environmental Underwriting Team

Annalisa Ahumada, underwriting specialist, environmental impairment liability, Allianz Global Corporate & Specialty

Allianz Global Corporate & Specialty (AGCS) has expanded its environmental impairment liability (EIL) underwriting team in North America with three new hires.

Annalisa Ahumada has been appointed as an underwriting specialist in Chicago responsible for growth and management of AGCS’ environmental impairment liability business in the Midwest. She brings nearly two decades of experience managing and underwriting environmental risk.

Prior to joining AGCS, she held senior environmental underwriting positions at Chubb, Zurich NA, and AIG and was an environmental engineer for the City of Chicago Department of Environment.

As an AGCS executive underwriter in New York, Andrew Hill is now responsible for “driving new and renewal business opportunities for the environmental impairment business across the Northeast region” per a press release.

Hill’s industry experience includes environmental insurance, underwriting and environmental risk consulting. He previously held environmental underwriting and risk analyst positions at Chubb and Santander Bank.

Mark Heigh has been hired as an underwriting specialist in Philadelphia and will be responsible for driving environmental impairment liability business production in the Northeast. Prior to joining AGCS, Heigh worked at Philadelphia Insurance Companies and Chubb as an environmental underwriter.

Steve Tagert, regional environmental practice group leader, North America, said: “These new hires will help us deliver the market-leading insurance solutions our brokers and clients require to drive their business success, as well as bring additional knowledge to our expert team of AGCS EIL underwriters and specialists.” &