Alternative Risk Management

Repurposing Aging Captives

Many companies could be losing out on thousands or even millions of dollars in tax benefits as well as significant cash flow and cost savings by neglecting or leaving their old captives dormant, according to industry experts.

Captives are effectively insurance subsidiaries used by a parent company to insure against its own and affiliates’ risks.

Such is their popularity, particularly in property and casualty, that it’s estimated that more than 90 percent of Fortune 500 companies now have at least one captive.

However, there are many dating back to the 1970s, domiciled offshore in places like Bermuda or the Cayman Islands, that are no longer used or have been put into runoff.

The risks of having an older captive are numerous — exposure to long-tail claims, the loss of institutional claims knowledge and records, and many are written without an aggregate limit.

But increasingly now instead of putting the captive into runoff or a solvency scheme, risk managers are starting to use them as part of a broader risk management strategy to deal with their legacy and emerging liabilities.

As a spin-off, this enables companies to potentially derive an accelerated tax benefit if the captive is properly structured, increase their cash flow, use their capital more efficiently and see significant cost savings.

“It’s fundamentally about using the captive to provide a dedicated funding source to meet legacy liability claims in a tax-efficient manner,” said Daniel Chefitz, partner at Morgan Lewis & Bockius.

Dormancy Risks

Michael Serricchio, senior vice president of Marsh Captive Solutions’ captive advisory group, said that the main reason for a captive becoming dormant is a company not realizing its intended purpose or value.

“Maybe there’s been a change of risk manager or the management team and whoever set up the captive is no longer there and the captive is sitting there doing nothing because there’s no perceived value or it’s not properly understood,” he said.

“But even if the captive is just sitting there dormant or it is in runoff, you are still incurring running costs and claims, not to mention the capital that’s tied up in it.”

Chefitz said that among the main risks associated with a dormant captive are obligations to meet new legacy claims, a lack of control over the flow and handling of claims following a merger or acquisition, and exposure to liability from released trapped equity.

Sean Rider, executive vice president and managing director of consulting and development at Willis Towers Watson, said that the biggest risks of having a dormant or older captive were adverse claims development and investment outcomes.

“The main risk is leaving it dormant for too long. Then it’s ultimately harder to get it started up again and ready for when you really need the coverage.” — Gloria Brosius, corporate risk manager, Pinnacle Agriculture Holdings

Gloria Brosius, corporate risk manager at Pinnacle Agriculture Holdings and a RIMS board member, said that the longer a captive is left dormant, the harder it is to get it up and running again.

“The main risk is leaving it dormant for too long,” she said. “Then it’s ultimately harder to get it started up again and ready for when you really need the coverage.”

Call to Action

Chefitz said that dormant captives are often revived because of a need for additional insurance to cover legacy liabilities such as asbestos, product liability, toxic tort and environmental claims.

“Typically this arises when a company has a large reserve on its books, and a need for additional risk transfer,” he said.

But oftentimes risk managers and companies will be prompted into action when a loss occurs, said Jason Flaxbeard, executive managing director of Beecher Carlson.

“What will usually happen is that something bad occurs,” he said. “Companies will then start to question why they have that captive and that’s when decisions need to be made. But a well-managed captive shouldn’t have that issue.”

In this situation, Serricchio said that it was essential to undertake a thorough strategic review of the captive.

Sean Rider, executive vice president, Willis Towers Watson

“The first question you need to ask is, ‘Does it make sense to keep the captive or even have it in the first place?’ ” he said.

Rider said that risk managers need to decide whether these older or dormant captives can be used as an execution tool within the company’s risk financing strategy.

“It’s really about understanding the captive’s role in facilitating an evolving risk financing strategy and how it can be used going forward,” he said.

Managing Legacy and Emerging Liabilities

The main advantage of resurrecting a dormant captive is for a company to deal with its legacy liabilities by fully insuring against any outstanding or future claims, said Chefitz.

This can be achieved by using the captive to establish a dedicated funding source to supplement the existing insurance coverage or to fill in any gaps in a tax-efficient manner, he said.

It also enables the company to maximize the value of its historical insurance coverage by smoothing the cash flow, he added.

“If a company has legacy liabilities, rather than trying to avoid or defer it, a sensible approach is to use the situation to your advantage by fully funding the legacy liability. This will then enable you as a risk manager to focus on your emerging and ongoing liabilities instead.”

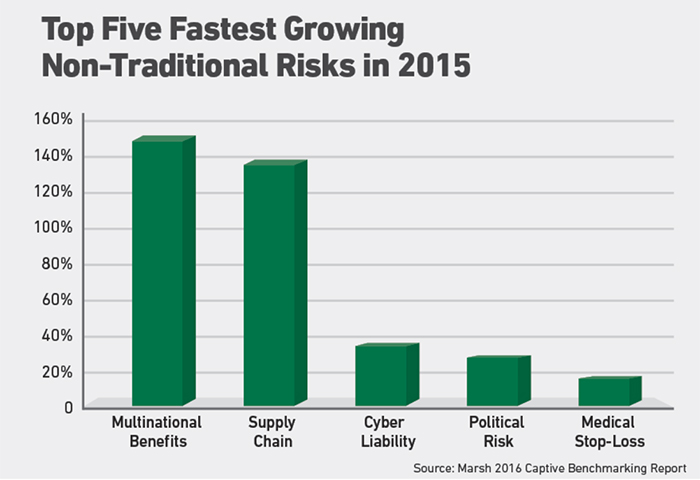

Serricchio said that a dormant captive could also be used for writing emerging and non-traditional risks such as employee benefits, supply chain, cyber security, medical stop-loss and environmental risks.

Flaxbeard added that the current soft market allowed risk managers to be more creative with their captives through the sale of add-on products.

“Many companies are going into ancillary products that they can sell to their clients alongside their core products, such as extended warranties,” he said.

Tax Benefits and Issues

If qualified as an insurance company for tax purposes, captives can also provide a host of other benefits, said Chefitz.

By insuring these existing reserves on a company’s balance sheet with a captive, they are then effectively moved from the parent to the captive’s balance sheet, he said.

Daniel Chefitz, partner, Morgan Lewis & Bockius

He added that the loss reserves from a captive were immediately deductible, thus accelerating the tax deduction within the parent’s consolidated group and monetizing the associated deferred tax asset.

Furthermore, the premium paid to a captive is also tax deductible if certain tests are met, he said.

“The increased cash flow as a result of the accelerated tax deduction can be invested in a tax-efficient manner and used to support the treasury goals of the organization,” he said.

When added up, all of these deductibles could potentially provide companies with thousands or even millions in tax benefits.

Meanwhile, another advantage has been provided under the recent 831(b) tax code change, with the annual limit at which captives and insurers can elect not to be taxed on their premium income being increased from $1.2 million to $2.2 million, effective from 2017, said Gary Osborne, president of USA Risk Group.

“This is a real opportunity for companies to put some good risks into their captive and to derive the tax efficiencies,” he said.

Domicile Choice

Another key consideration for companies looking to redomicile their captive is the self-procurement tax under the Nonadmitted and Reinsurance Reform Act for surplus and excess lines, said Flaxbeard.

“This is a problem for many companies who may look to redomesticate to their home state,” he said.

“Some have got around this by setting up a branch to write direct policies to the parent company incurring captive premium tax rather than a self-procurement tax.”

Among the other factors when considering a domicile are the captive’s legal, management and operational structure, as well as its capital use, said Chefitz.

Ultimately though, Rider said, companies need to consider whether it’s worth changing the captive’s structure or moving it at all.

“You need to consider whether the original domicile is still the best domicile and whether the original structure is still the best structure for you, or should you abandon the captive altogether and transfer the liabilities to a new one,” he said. &