Risk Scenario

Paying Back the Viking

Disclaimer: The events depicted in this scenario are fictitious. Any similarity to any corporation or person, living or dead, is merely coincidental.

Part One

The government’s floating, storm tracking robots, riding on the ocean swells off of the North Carolina coast, felt Kenneth before anyone else did.

To them, at first, Kenneth felt just like a shoulder shrug of the ocean. But the storm, a brawny Category Four when it struck land, would carry a rougher touch for the business owners there.

The ship-building industries along the coast got it bad. Johnson Industries, a third-generation naval parts manufacturing business, saw most of its manufacturing floor washed away.

The morning after the storm struck, Heady Johnson, the president of Johnson Industries, and Wiley Ferris, his controller, took a tour of what remained of the factory.

The view was dismal. Three feet of salt water covered the factory floor and there appeared to be substantial damage to the walls and roof of the facility.

“What do you think?” Heady asked Wiley, after a long, grim period of time the two spent looking down on the factory floor from Heady’s office.

Heady could tell Wiley’s brain was working extra hard, so he gave him all the time he needed to answer.

Before he answered, Heady looked out the window, toward the outer wall of Viking Spirit, his Norwegian-owned competitor. At first glance, Viking looked like it had got it just as bad if not worse.

Wiley followed his gaze over at Viking. Then he spoke in his slow, careful poker player’s drawl.

“We have property, business interruption and contingent business interruption coverage in place,” Wiley said.

“I can’t see why they wouldn’t be enforceable,” he said.

Then Heady jerked his thumb over towards Viking.

“But so does our competitor over there, I bet.”

Wiley considered. “And then some,” he said. “And then some probably,” referring to Viking’s German-backed limits.

“What are your plans to….?” Wiley started to say but then Heady jumped in with his idea.

“If we move really quickly we might have a chance here,” Heady said and he looked at Wiley to make sure he had his full attention. He had his attention.

“We will be back up and running before Viking over there. I am going to lose out on some contracts, but so are they. The question is who loses out on more.” Heady said.

Heady continued, “I want the adjuster in here first thing in the morning. If we can agree on what needs to be repaired, we’ll get it done, and we can restart production before Viking has their drawings finished.”

“Hurricane Kenneth was a big event,” Wiley warned. “We’re really gonna’ have to work hard to get the insurers’ attention.”

“That’s why you’re here,” said Heady as Wiley went to call the adjuster.

“Oh, hey Wiley!” Heady called out. “And I want all my lost sales paid while I crank the repairs into high gear.”

“We might have to give a little to get a little,” Wiley said with a grin.

“It will be worth it,” Heady to said to no one in particular.

Part Two

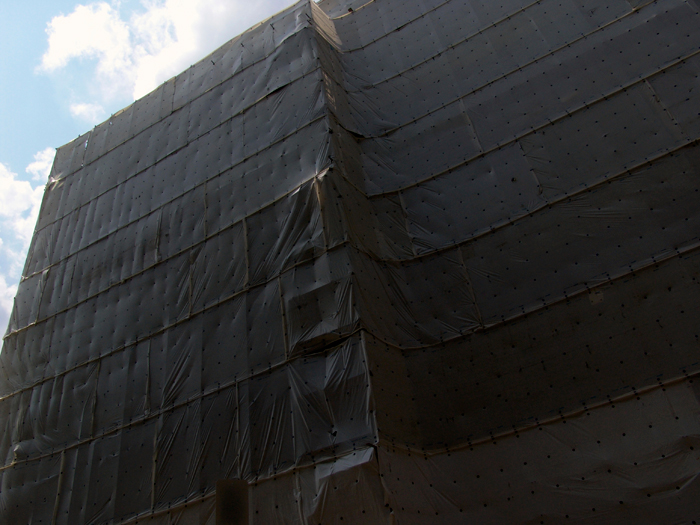

It’s five months past the day that Kenneth struck. Heady Johnson puts down his reading glasses, swivels his chair, snatches up his coffee cup, and looks out on his factory floor. To the right of a massive, plastic industrial tarp, workers are putting the finishing touches on the roof and wall repairs to the northeast corner of the factory.

The gleam of the new aluminum siding is evident, and bright steel rivets catch the light.

To the left of the partition, Johnson Industries workers are on the job. New equipment is on the factory floor and operations and compliance personnel are doing their walk-throughs, making sure everything is set up safely and efficiently so the plant can resume at least partial production.

Heady looks out his window to the Viking operation and gets an idea. He taps the speed-dial on his office phone.

“Hiya,” Heady’s office manager Darlene Harris replies.

“Darlene, I’m going to step out for a bit. No more than 20 minutes or so. I’ve got my mobile on me,” Heady says.

“Sure thing,” Darlene says.

In the bright spring sunlight on the quay, Heady pops on sunglasses, zips up his windbreaker and pulls up his collar against the wind. Almost everybody around here knows him, but he’s trying to mute his appearance as much as possible.

Keeping his head down and his hands in his jacket pockets, Heady strolls down along the quay, walks past the entrance to the Viking Spirit administrative offices and heads away from there and toward the water, in the direction of the Viking Spirit factory bay doors.

This place was once called Marine Supply Inc. and it was founded by one of Heady’s grandfather’s rivals. The Norwegians bought it eight years ago and promised to make a lot of noise with their bigger bankroll.

They weren’t making much noise now other than a few workers finishing the clean-up efforts that started four months ago.

Heady has been watching the factory for weeks now, looking for some sign that rebuild would begin: but nothing.

__________

In his London office, Raif Lennox, the globe-trotting marine broker for Viking Spirit, slams his phone down.

“For the love of all that’s holy!!” Raif practically shouts at his office walls.

His fellow managing director Andrew Narvel, pops his head in, half irritated at the noise, half-curious.

“What is it mate? Did you drop yet another thousand quid on Liverpool?”

“Little early for that isn’t it?” Raif replies, not in the mood for Andrew’s attempt at a friendly jibe.

“It’s a little early for that kind of outburst if you want to know the truth,” Andrew says by way of correction.

“Sorry,” Raif says before putting his face in his hands then looks up to his trusted friend.

“Essen Re is trying to give me a twist over this hurricane claim I’ve got in the states!”

“The Viking property?” Narvel says.

“Yes, the Viking Property! The company and the adjuster still can’t agree on the scope for the rebuild, and now Viking is dragging their feet on whether to rebuild there at all. Meanwhile, no one wants to budge on any of the coverage issues that have come up.”

“Viking will get paid,” Andrew says.

“Yes. I’m sure they’ll get paid. But I can’t tell you when, and I’d bet that thousand quid that this claim will go to arbitration before it is settled.”

__________

Back in Carolina, Heady and Wiley are putting their heads together again in Heady’s office.

“I’m hearing from a fella’ in New York that it’s going to be a few more months before Viking gets paid,” Wiley says.

“There is nothing going on over there,” Heady says, jerking his head over to the Viking site.

“It’s no coincidence that we got paid as quickly as we did. That was a smooth move meeting the insurers half way on the building scope and some of the coverage issues they were passionate about,” Wiley said.

“Yeah, and the accountants tell me that we are close to wrapping up the business interruption claim as well,” Heady added.

Heady’s email chirped, and he started clacking at the keyboard.

“Look at that. Department of Defense bids for the new sub propellers are due in a month. I say we skate to where the puck is going to be, to use a Yankee expression, (Wiley smiles), bid aggressively for that propeller work and try to pick up all the money when Viking can’t get to the table.”

“Because they might not get to the table in time,” Wiley said.

“They’re not even going to be at the restaurant,” Heady said.

Part Three

It’s nine months after Kenneth struck and Heady is in his office in the late afternoon, repeatedly punching a key on his computer keyboard.

The way it works with Department of Defense contracts is that the department posts the contract winners on their website at 5 pm daily.

The submarine propeller contract is due to be announced and Heady is making the tip of his index finger numb from tapping “enter” on his keyboard.

And then it comes up.

“Johnson Industries of Weatherington, N.C. is being awarded…..”

Heady doesn’t need to read the rest. He knows what the contract is and how much it is for. This is an eight figure contract and the energy of it rushes through Heady’s veins.

“Yeeeehaahhhhhh!” Heady yells with a Rebel yell that brings up helmeted, safety goggled heads on the factory floor, 20 feet below him.

Heady runs to his office window and throws it open, giving the hand across the neck, “Cut it” motion to one of the crews.

The chief of the crew grins and motions his men to shut it down. Heady’s waving his arms in a “come to me” motion like you see from someone calling out a pilot on an aircraft carrier flight deck.

The men gather and tear off their goggles and helmets. They can see from the excitement in Heady’s face that this is big.

As the production line quiets down, Heady yells the news.

“We got the contract! “Twenty seven million dollars!” Heady yells down to the floor.

Wiley phones his wife.

“We got it! You know what this means. It’s gonna be a late night!”

__________

The claim strategy that Heady chose has now born some delicious fruit. Yes, Viking Spirit got paid, but it was too late.

Not only did Johnson Industries win the Department of Defense contract but they also got around Viking Spirit on a cruise ship supplier contract that Viking had wrested away from them nine years previously.

Repairs are finally underway at the Viking facility across the harbor, but those rivets being put into the building’s new walls just might be owned by Heady Johnson’s company before too long.

Burned by its coastal U.S. hurricane claim experience, the management of Viking Spirit has contacted Heady and some of his other competitors about a possible sale. Viking Spirit has got plenty to do in Asia and Scandinavia these days and could be persuaded to drop the Carolina operation at a nice discount.

Because of his quick thinking, his focus on his business and his creative approach to claims settlement, Heady Johnson might end up being just the man to take them up on their offer.

Summary

A quick-thinking business owner grabs an edge by meeting the insurer halfway on a property and business interruption claim and getting back in business before a key competitor even settles their claim.

1. A calamity is an opportunity: Catastrophic events are an opportunity to take a fresh look at your business and the economic landscape. Other businesses, including competitors and key suppliers, will be affected and there could be opportunities afoot. You may also have the ability to reconfigure or rebuild in a better location if your coverage allows for it.

2. Move quickly: Maintaining good relationships is key, but you want to get your adjustor onto the site of a major event as soon as you can. Stay in front of the claim process. Large catastrophes put a burden on insurers’ resources and time, and the squeakiest wheels get the grease.

3. Give a little to get a little: Negotiating successfully with a carrier on a claim in the wake of a major event involves strategic thinking. Think about how compromise in one area can result in gains in another – particularly when it means getting back to business faster.

4. You direct the action, but get help: As the quick-thinking Heady Johnson shows us in this scenario, he wasn’t going to wait for anyone to tell him how to gain a competitive advantage. But, he knew enough to enlist the help of his colleagues and outside experts. Claims don’t happen every day, so having an experienced claims advisor on your team will help drive the claim process.

5. Pay attention: Circumstances are always changing. Don’t assume that the status quo will stay that way. Heady Johnson wasn’t daunted by his competitor’s bigger balance sheet. Even the stoutest competitor can be outfoxed; especially after disaster strikes.