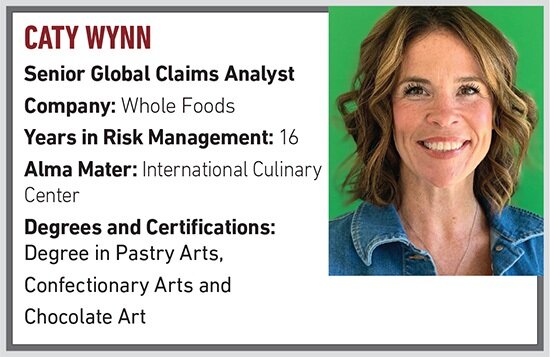

Whole Foods’ Caty Wynn on the Importance of a Mental Health Lens in Workers’ Comp

R&I: What was your first job?

I was a pastry chef. My goal was to be a pastry chef, and someday have my own show on the Food Network; I was going to be huge. I was working 80-plus hours a week, including nights, holidays, and weekends. I decided when I became a mom, I knew I couldn’t do that and juggle both. That’s how I got into workers’ comp. My father is a physician, and I was picking up files for him and doing marketing at a carrier and I thought, “Oh, they look busy. That looks fun. Maybe I’ll try that out.”

R&I: How did you come to your current position?

I started out doing self-insurance and then moved to a co-op type where it was owned by all cotton farmers and ginners. And then I went to Gallagher Bassett, where I was a senior adjuster, and then moved to the carrier side, Zenith Insurance. From there I moved to Whole Foods in 2017 for work-life balance, and I love the employer side so much more.

R&I: What has been the biggest change in risk management and the insurance industry since you entered into it?

The biggest change in risk has been in technology, specifically AI. I think it’s been important to the success that we’re seeing in the claims-handling process and helping out injured employees across the country. I think that’s one of the best things as far as workers’ comp that’s evolved, and it’s working well.

R&I: What is the biggest challenge you have faced in your career?

At one point in my career, I handled five different regions. Understanding each region, each leadership team and the different thought processes and nuances was challenging.

R&I: Who has been your mentor and why?

A year ago, I became connected with a mentor for professional growth, and I wanted to choose somebody who was successful and highly respected.

As I handle the Northeast and North International regions for Whole Foods, I’ve worked with our senior vice president, Northeast operations, Nicole Davia. I worked with her for years, and I always admired her. There’s a presence about her that when she walks into a room, she owns it. She is very highly respected and highly accomplished. And I thought, “That’s everything I want for myself professionally.”

R&I: What is the risk management community doing right?

I’m glad that risk management is really focusing on mental health. And you see that in a lot of the topics that were presented at National Comp 2023 and the conferences that have occurred just this year alone. We’re really refocusing on the mental health aspect and the wellbeing of our injured workers.

On the claims side, we spend so much time trying to mitigate exposures to get the best outcome. Now, we’re shifting gears. We find now that if we spend more time focusing on the injured worker, we actually end up getting what we all want, which is the best outcome, not only from a bottom-line standpoint but ultimately the best outcome for the team members. I love that we’re really focusing on the importance of mental health and the outcomes.

R&I: What do you think the risk management community could be doing a better job of?

To be quite honest with you, there’s nothing “sexy” about workers’ comp, both as a field and as a job to have, but it is needed and an important field to be in. Everybody that plays a role in workers’ comp is important, no matter if you’re a defense counsel or if you’re the injured worker, the carrier, or the risk manager. It doesn’t matter.

Workers’ comp represents a cost, it doesn’t represent a profit by any means. We have to advocate for what we do to make it more exciting, because there are exciting things about it that don’t appear so until you get into it.

R&I: How would you say technology has impacted the risk management profession?

For us, specifically at Whole Foods, we partner with Gallagher Bassett, our third-party administrator on an app they have that’s called “GBGO app.” We push that so much for our team members to use.

An injured worker will usually call about their next appointment or when their check is coming, these are all questions they would usually reach out to their resolution manager for, which they now can access on the app. It’s a time saver for them when we provide that technology but, more importantly, take away all of their “unknowns.”

R&I: What is your favorite book or movie?

My favorite is the first and second of “The Godfather,” but on a lighter note, I love “Something’s Gotta Give.” My favorite book is “You Are a Badass,” by Jen Sincero.

R&I: What have you accomplished that you are most proud of?

First, from a personal note, my children and marrying my husband (who happens to be my best friend). I’m most proud of that, because I left handling claims to find a work-life balance, and it allowed me the time that I lost with family to focus on my husband and my children and keep my work entirely separate. From a professional standpoint, the return-to-work program put together in partnership with my team lead, Lukasz Karwowski. The program is ever-evolving. Seeing the results monthly has been rewarding.

R&I: What is the riskiest activity that you’ve ever engaged in?

I swam with dolphins this summer in Jamaica, and the instructors gave me clear directions on what to do, and I did the exact opposite. The dolphin took a sharp right, and we went on a fun little extra ride that I didn’t have to pay extra for. I’m pretty sure my husband and daughters were a little jealous since I got an extra ride. &