Water, Freezing and Fire Damage Top Small Businesses Claims

An analysis of more than 1 million small-business insurance policies reveals that water and freezing damage claims have risen significantly over the last decade to become a top risk alongside burglary, while fire damage remains the costliest incident, averaging $80,000 per claim, according to The Hartford.

The landscape of small-business risk has evolved notably since 2015, the analysis found.

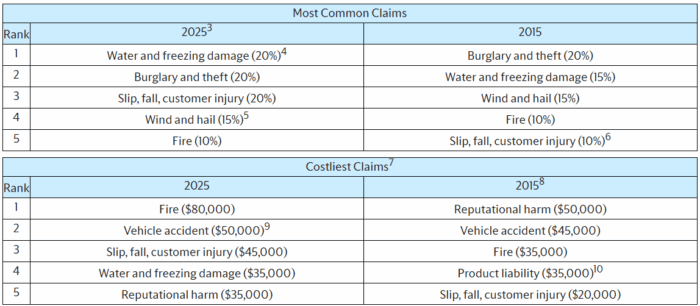

The Hartford’s 10-year comparison highlights that claims stemming from water and freezing damage increased to 20% of total claims in 2025, up from 15% in 2015. This rise ties water damage with burglary and theft as the most frequent reasons for small businesses to file a claim. Conversely, wind and hail claims have remained steady at 15% over the decade.

While claims frequency tells one story, severity tells another, according to The Hartford.

Fire damage has solidified its position as the most expensive claim type. The average cost for fire-related incidents jumped to $80,000 in 2025 from $35,000 in 2015. Vehicle accidents and customer injuries followed as the next most expensive categories, costing an average of $50,000 and $45,000 respectively.

Challenges in Liability and Litigation

Beyond property damage, the report identifies a challenging environment for small business general liability. The frequency and cost of slip, fall, and customer-injury claims have both increased over the 10-year period. In 2015, these incidents ranked fifth in frequency; by 2025, they climbed to the third spot, representing 20% of claims.

The financial impact of these liability claims has more than doubled, rising over the past decade to an average of $45,000 from $20,000. The Hartford’s analysis attributes this trend partly to “social inflation”—the growing influence of litigation and legal system abuse—which is resulting in higher settlements and costlier verdicts for small-business owners.

Implications and Mitigation Strategies

To combat these rising costs and risks, businesses are encouraged to adopt proactive measures and leverage technology. The report outlines several actionable steps for risk mitigation:

- Water Damage: Install water sensors for early leak detection, maintain indoor temperatures during cold snaps, and ensure staff know the location of shut-off valves.

- Theft Prevention: Utilize video cameras to monitor motion, improve lighting, and conduct background checks on employees.

- Liability Reduction: Clean spills immediately, use weather monitoring systems to prepare for icy conditions, and review contracts to ensure correct liability protections are in place.

Learn more about the report here. &