U.S. Property/Casualty Industry Records $21.2B Underwriting Loss in 2023

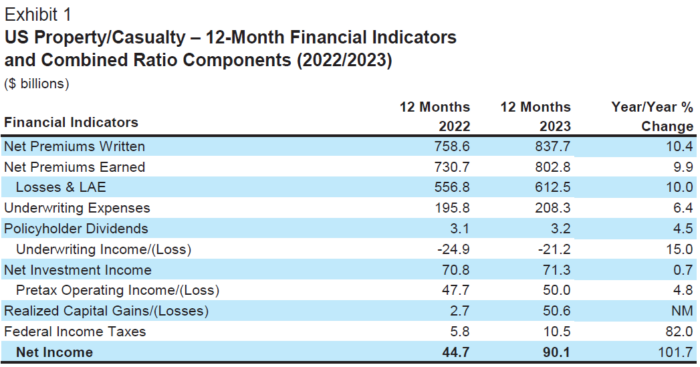

The U.S. property/casualty (P&C) industry recorded a net underwriting loss of $21.2 billion in 2023, a slight improvement from the previous year’s $24.9 billion loss, according to AM Best’s First Look report.

The report, which offers early insights into the P&C industry’s financial state, is based on data from companies whose 2023 annual statutory statements were received by March 8. These companies represent an estimated 97% of total industry net premiums written and 96% of policyholder surplus.

Despite a 9.9% increase in net earned premiums, the 2023 underwriting loss was driven by a 4.5% increase in policyholder dividends and a 10% rise in incurred losses and loss adjustment expenses (LAE), coupled with a 6.4% increase in other underwriting expenses. The personal lines segment, particularly the homeowners line of insurance, was primarily responsible for the weak underwriting results.

The industry’s combined ratio improved slightly to 101.6, with catastrophe losses accounting for 8.7 points on the 2023 combined ratio, up from an estimated 7.3 points in the previous year. This increase was driven by record severe convective storm losses. Excluding $2.0 billion of favorable reserve development during 2023, the industry’s accident year combined ratio was 101.8.

Earned net investment income remained virtually unchanged from the prior-year period. However, the lower underwriting loss boosted pre-tax operating income by 4.8% to $50.0 billion. According to AM Best, a $51.1 billion change in net realized capital gains at National Indemnity Company, a unit of Berkshire Hathaway, resulted in the P&C industry’s net income more than doubling to $90.1 billion.

This increase, combined with the impact of the change in unrealized gains, contributed capital, other surplus gains, and a significant amount of stockholder dividends at $108.0 billion, produced an increase in industry surplus to $1.0 trillion at the end of 2023. The data underscores the resilience of the U.S. P&C industry, despite the challenges posed by increased losses and expenses.

For more detailed findings from the report, visit AM Best’s website. &