Top Reinsurer Rankings Reshuffled to Reflect Adoption of New Accounting Standard

Swiss Re’s transition to IFRS 17 accounting standards has significantly reshuffled the rankings of the world’s largest reinsurers, moving the company from first place among traditional reporters to the top spot among IFRS 17 adopters, while the overall market delivered double-digit returns on equity despite facing over $320 billion in worldwide natural catastrophe losses, according to AM Best.

IFRS 17 is the International Financial Reporting Standard for Insurance Contracts that became effective in January 2023, fundamentally changing how insurance and reinsurance companies measure, recognize, and disclose insurance contract liabilities. The difference in accounting means the results of IFRS 17 and non-IFRS 17 reinsurers are not directly comparable, requiring a separate ranking, AM Best explained.

Market Hardening Delivers Strong Results Amid Record Losses

The global reinsurance market continued to benefit from the dramatic hardening that began in January 2023, with reinsurers maintaining strong underwriting discipline and favorable terms through renewal periods, the rating agency said. This market strength proved resilient even as natural disasters reached severe levels in 2024, with insured losses exceeding $140 billion globally.

Hurricane activity dominated the loss landscape for reinsurers, with Hurricane Helene and Hurricane Milton striking the southeastern United States within weeks of each other. The widespread flooding from Helene caused catastrophic damage across the eastern United States, with areas like Asheville, North Carolina, still recovering. Beyond hurricanes, severe U.S. convective storms generated over $50 billion in damage, while Canada recorded its highest-ever natural catastrophe losses at $5.6 billion, according to the report.

Despite this challenging loss environment, reinsurers achieved remarkable financial performance, AM Best said. The combination of improved underwriting results and higher yields on fixed-income investments enabled many market participants to exceed their cost of capital while building surplus to record levels. Among non-IFRS 17 reinsurers, the average combined ratio improved dramatically to 89.1 by year-end 2024 from 100.9 at year-end 2022.

Currency Fluctuations and Market Dynamics Create Volatility

The strengthening U.S. dollar significantly impacted reinsurer rankings, with most major currencies depreciating against the dollar throughout 2024, the report said. The Brazilian real fell 21.7%, the South Korean won declined 11.7%, and the Canadian dollar dropped 7.9%. Only the Japanese yen appreciated, gaining 1.1% against the dollar.

These currency movements particularly affected companies like Brazilian reinsurer Instituto de Resseguros do Brasil (IRB), which saw its ranking fall to 16th from 11th position, with reinsurance revenue declining 27.2% in U.S. dollar terms, though the decline was only 7.1% when currency effects were neutralized.

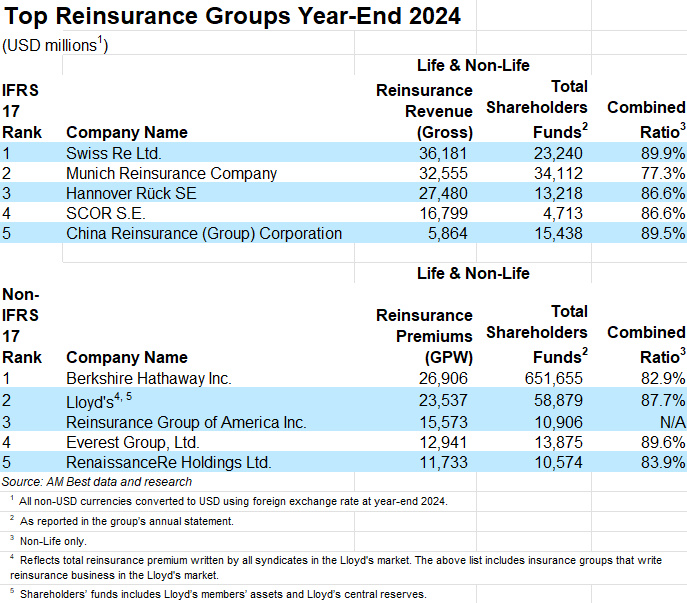

Swiss Re’s adoption of IFRS 17 created the most significant ranking disruption, as the company moved from leading the non-IFRS 17 category to topping the IFRS 17 rankings with $36.2 billion in reinsurance gross revenue. This transition pushed Munich Re from first to second place among IFRS 17 reporters with $32.6 billion in gross revenue — despite Munich Re’s underlying insurance revenue growing 9.3% when currency effects were removed.

Among non-IFRS 17 companies, Berkshire Hathaway now leads with $26.9 billion in gross premiums written, followed by Lloyd’s with $23.5 billion.

Among the top 50 reinsurers, Core Specialty demonstrated the most dramatic growth, rising 10 positions with a 52.5% increase in gross premiums written to $1.6 billion, as the company, founded in 2020, continues expanding its operations.

Capital Accumulation Presents Strategic Choices

The favorable market conditions have generated substantial capital growth across the reinsurance sector, AM Best said. Shareholders’ equity among non-IFRS 17 reinsurers reached a combined $1 trillion, growing 12.9% in 2024 following 19.5% growth in 2023. Some companies experienced exceptional capital expansion, with Ark Insurance Holdings growing 24.5% and Liberty Mutual increasing 22.3%.

This capital accumulation occurs alongside a notable absence of new market entrants, despite historically attractive underwriting opportunities. Rather than seeing new company formations, investment has flowed toward catastrophe bonds, with 144A issuance reaching record levels as investors are attracted by high risk-adjusted spreads and well-defined exposure parameters, according to the report.

Looking ahead, results for 2025 face uncertainty from multiple fronts, AM Best said. The California wildfires in January have already impacted first-quarter results, with many reinsurers reporting their worst quarterly underwriting experience in recent years. The Atlantic hurricane season will significantly influence full-year outcomes, while pockets of rate softening have emerged, notably double-digit declines for catastrophe excess-of-loss covers in the Japanese market during April renewals.

Through midyear, the market has seen pockets of rate softening, AM Best noted. “Some firms may choose to return this excess capital to shareholders rather

than deploy it at inadequate rates in coming years,” the report noted.

Obtain the report here. &