Building an Effective Defense Against Nuclear Verdicts: Key Strategies for 2025

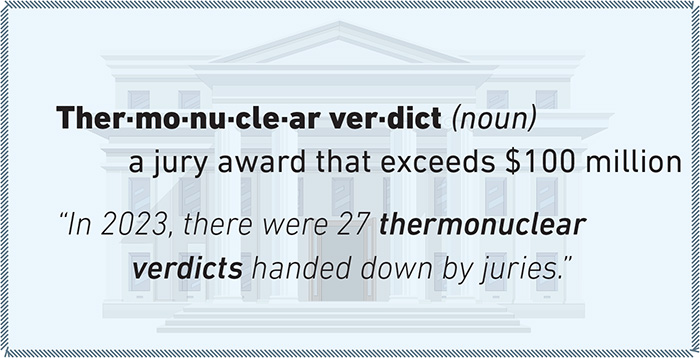

Judicial hellholes. Reptile theory. Third-party litigation funding. Social inflation, nuclear verdicts — thermonuclear verdicts. With enough jargon-heavy strategies available for the plaintiff’s bar, it’s no wonder insurers and their insureds have been on the receiving end of unfavorable litigation.

That isn’t to say there aren’t instances where legal action might be the best action; no one party is infallible. But a jury award in the millions — perhaps billions — can at its most extreme shutter operations and leave hundreds out of work.

Building a defense against potential nuclear verdicts need not feel like a burden should a claim find its way to court. Understanding what the legal landscape is like, building up a prevention strategy, and having a defense team in place will make all the difference should a nuclear verdict be on the horizon.

What the Legal Landscape Looks Like in 2025

Litigation is a dynamic, ever-changing environment. With the advent and increased adoption of AI technology and a changing political landscape on both national and state levels, 2025 could prove an interesting year.

“Artificial intelligence and the changing political landscape are likely going to impact how the industry evolves in managing claims moving forward; in 2025, 2026, and beyond,” said Bill Liebler, Marsh’s U.S. and Canada chief claim officer.

“We’ve seen some tort reform, but we also anticipate there’s going to be a bigger push from the defense side, both at the federal and state levels, in this regard,” he added.

Third-party litigation funding, or TPLF, should be top of mind as well. This is the practice in which a third party funds the legal actions of the plaintiff or plaintiff’s counsel in exchange for a percentage of the settlement or award. It’s also commonly referred to as litigation financing, lawsuit lending or legal financing.

“It’s a huge industry. The last number I saw was close to $22 billion in investment,” said Maria Fazzolari, VP of claims, professional and specialty, Nationwide. “There’s increased awareness, not just by insurers, but by courts and by legislatures, that there needs to be some regulation.”

At this point, TPLF is a highly unregulated industry, with many of its operations conducted covertly. And it’s growing exponentially.

“It’s being expanded into all sectors and is being broadly adopted and accepted by all kinds of plaintiffs’ lawyers and all kinds of insureds in terms of how to handle their litigation. This $20 billion industry is currently expected to grow at a rapid rate over the next 10 to 12 years, which, when compounded, will mean we’ll be looking at a $60 billion industry,” added Fred Fein, partner, Clyde & Co.

Defending Nuclear Verdicts in Court

When a case has the potential to go nuclear, it needs to be discussed upfront by all parties of the defense. Everyone needs to understand the realities associated with a nuclear verdict, from the monetary impact to the reputational risks.

“Certainly, plaintiff’s lawyers have become adept at utilizing the threat of a nuclear verdict to change the landscape of or attempt to change the landscape of the claim,” said Francine Minervini, SVP, chief technical claims officer, Arch Insurance.

A combination of post-COVID claims, TPLF, social inflation and more are driving court verdicts. Reptile theory, a tactic that relies on juries’ innate instinct to seek safety and shelter, is often utilized to play on emotions in favor of the plaintiff.

If the plaintiff’s counsel can successfully paint the picture of gross negligence against the “little guy,” then the possibility of a nuclear verdict grows.

“It’s important to have a very proactive response to litigation with early investigation and strategic evaluation,” said Fazzolari. Training claims management to be proactive can give defendants a leg up. Getting defense counsel involved early is key.

“These steps are really geared towards getting as much information as early as possible to the counsel, and if possible, reaching an early resolution that avoids the costs of a long, drawn-out litigation,” Fazzolari said.

Minervini agreed: “Once a claim is in court, investigation is critical. Selection of the appropriate defense counsel, communication with the insured in terms of designing a plan of action for defense, risk transfer considerations, deciding whether or not to utilize mock trial as a tool for creating a more efficient defense — all that is critical.

“Constant communication between the insurer and the insured as the defense is coming through … will be effective.”

Communication is perhaps the single most important component of insurance. The more information shared between legal and claims, the better a defense can be built. If a lawyer is left in the lurch in terms of information, they will only be able to react as information arises in court, which will damage the defense.

“When a case comes in, you have to make sure your claims team, legal team and the insured are communicating and working together to fully investigate the case from the get-go,” Fein said. “If you want to try to resolve matters as early and avoid protracted litigation, you need to get your arms around as much as possible as soon as possible, from the facts to the law to the key witnesses and documents.”

Prevention Is a Tool of Necessity

Defending against nuclear verdicts can begin long before a claim even arises. Prevention starts as early as the underwriting process, when insurers ask questions to better understand clients’ businesses and get them coverages that best align with their needs.

“What gets communicated gets managed,” Minervini said. “In order for claims and the insured and the underwriters to develop an effective claim prevention strategy, there needs to be communication about the business, its employees and the day-to-day operations. What contracts do they have and what are the exposures they have? All this allows the insured, the underwriters and the claims folks to develop strategies to foster claim prevention that impacts the bottom line.”

Insurers and their clients can also prevent claims by leveraging new technologies available to them, like data analytics, which can give better insight into claims patterns.

As Liebler noted, “insurers in particular can leverage data to identify patterns and trends that may help indicate the higher risk of a claim potentially becoming one that would be a nuclear verdict. By analyzing historical data, they can help develop strategies to address the risks proactively.”

He also said that because insurance companies have millions and millions of lines of claims data, they’re able to distill that data against industry benchmarks to identify outliers that may indicate higher risk of social inflation.

“We’re seeing this informing insurers’ decisions at the macro level, the type of businesses they write, etc., the things they can do from a pre-loss standpoint to make sure the claims don’t happen,” Liebler said.

Another tactic to prevent claims is to get granular on the types of claims. Prevention services are not new to the industry, so it’s key to find services that are proficient in specific industries.

“Nationwide offers loss prevention services that inform insureds on risk management,” Fazzolari gave as an example. “We have risk management services geared towards specific risks for specific lines of business, such as senior living facilities, construction, and other industries.”

And then, above all, keeping a claim out of court is best prevented by working with claimants: “It comes down to treating claimants fairly and reasonably and respectfully,” said Fein.

“Oftentimes, people will run to court and file suit, because they just get frustrated by the process, like unreasonable delays and lack of information … empathy and sympathy are a huge factor. Communicating with [claimants] more frequently and updating them as to how things are going, setting reasonable expectations as to when things are going to occur, when claims might get paid, how long things are going to take, will help ease their frustration,” Fein said. &