Sponsored Content by QBE

Three COVID-19 Concerns for Business Owners, and How Their Insurers Can Help

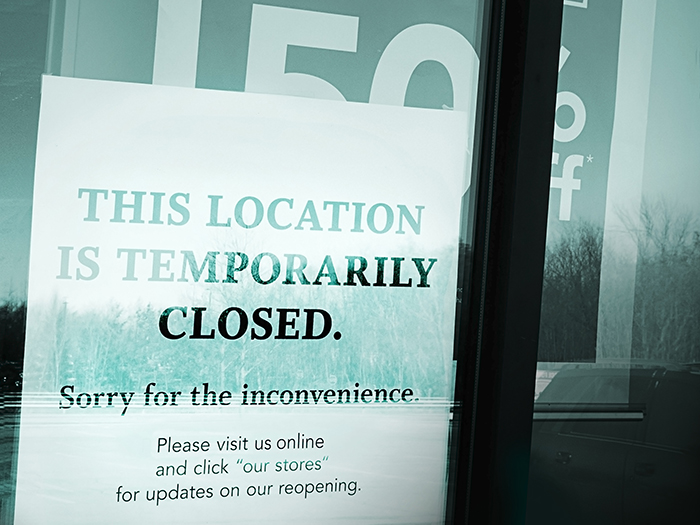

COVID-19 has brought disruption to every industry and sector, but brick and mortar businesses and certain real estate companies have arguably taken the hardest economic hit. With state-ordered shutdowns of non-essential activities and physical distancing guidelines in place, businesses that depend on people coming through the doors have no choice but to drastically reduce their operations or halt them entirely.

In turn, those businesses may be unable to pay rent to the real estate owners, while any laid-off workers may also struggle with paying rent.

The rapid changes due to the pandemic and the initial imposition and phased relaxation of the lockdown have also had a major impact on exposures to insurable risks. As strategic business partners and trusted risk advisors, carriers can help companies navigate their shifting exposures, reopen responsibly, and remain financially viable through it all.

Here are three ways insurers can address top concerns voiced by business owners during the COVID-19 pandemic:

Concern #1: I can’t afford to pay my insurance premiums.

Tom Fitzgerald, President of Specialty & Commercial, QBE North America

Insurance is a critical overhead expense – one that many businesses are currently struggling to afford. While some carriers are taking a blanket approach by offering the same premium discount to all clients, others are taking a more bespoke approach.

“No two businesses are the same, and an across-the-board discount may not be the best solution for every customer,” said Tom Fitzgerald, President of Specialty & Commercial, QBE North America. “We have been actively working with our customers to determine how their exposures have potentially diminished due to the evolving pandemic and lockdown situation, which allows us to adjust premiums appropriately in the middle of the policy term.”

A real estate company that depends on income from hotels, restaurants and retail outlets, for example, has a very different exposure base compared to a one that specializes in industrial space.

The former is likely to have many tenants under severe stress. Even as the businesses reopen, they may operate at reduced capacity for the rest of the year. But with less traffic, the need for security and maintenance personnel may also be materially reduced. That organization may request a mid-term policy audit on Workers’ Compensation in order to revise their exposure schedule, yielding premium reductions that accurately reflect risk.

The latter, which may have manufacturing or warehousing tenants that have only seen a mild impact due to COVID may instead request a two-month premium holiday, with an intent to pay those installments later as the economy rebounds.

“A bespoke approach allows businesses to make their premium payments and have valid and collectible insurance in place should something bad happen, but it’s also allowed repurposing of saved dollars to ongoing expenses such as continuing payroll or making lease payments,” Fitzgerald said.

Concern #2: My claims will take longer to process and get paid.

Eric Sanders, Head of Claims, QBE North America

While businesses grapple with the effects of the coronavirus, traditional types of loss continue to happen.

“Property losses from physical damage are still happening,” said Eric Sanders, Head of Claims, QBE North America. “Environmental claims are on the rise as buildings reopen since they were closed in a hurry. Cyber risks are on the increase with more people working from home, especially with unsecure networks and use of personal printers. General liability claims are concerning as customers enter businesses and don’t believe all precautions and safety measures have been taken. We are working with customers on all of these new exposures and more as we fully appreciate what the new normal holds for us. The pandemic has not put a pause on typical business risks and, in fact, traditional risks have new dimensions as a result of this pandemic.”

With so much disruption and limited ability for in-person interaction, businesses have inquired about their insurer’s ability to support them on much needed services such as inspections, adjustments, approval and payment of claims quickly. Insurers that invested in technology, however, suffered almost no hiccups in transitioning to virtual work on the scale brought on by the pandemic.

“QBE embraced technology a long time ago,” Sanders said. “Our virtual capabilities include a proactive messaging tool that expedites first notice of loss all the way through to digital payment. We have the ability to use image recognition software and satellite imagery to capture details of a loss with limited need for a boots-on-the-ground inspection. We have straight-through processing happening for simpler property claims, and an end-to-end platform for full desktop adjusting.

“All of this is to say that the disruption of the pandemic has reinforced our investment in technology and our innovative digital approach to claims handling focused on improving the customer experience,” Sanders said.

Concern #3: I’m unsure how to reopen safely and legally.

Reopening is not a straight path forward, thanks in part to regulatory variance.

Different states are moving at different speeds and may have different views on how business should be conducted safely. For owners of commercial properties across state lines, adhering to variable and fluid guidelines presents a challenge and a risk.

How will you control access to your property, ensure social distancing, execute proper cleaning and sanitation, and monitor symptoms among employees? Do your plans align with local government guidance?

“You have to understand how the regulations change your obligations as a business or impact your risk profile,” Fitzgerald said. “If an employee or customer files suit alleging they were exposed to the virus due to unsafe practices in your building, noncompliance with local guidelines will certainly weaken your defense. If you’re a real estate company, you’ve got to make sure you’re communicating with your tenants and making sure everyone understands their roles and responsibilities in following guidelines.”

“Any carrier working across the US should have a robust regulatory function. At QBE, we have strong partnerships with our legal, regulatory and compliance and loss control teams. They are absolutely essential to ensure we stay on top of the flow of information,” Sanders said.

Understanding local guidelines is of course just the first piece of compliance. Insurers can bring their internal risk expertise to bear in helping clients develop reopening plans and protocols, including checklists for property sanitation, cyber security best practices for remote work, and guidance on employee leave policies.

Insurer as Trusted Advisor

Though the pandemic has affected everyone differently, it has nonetheless highlighted the need for clear and open communication, flexibility, and agility. Insurers that have been best able to serve their clients reach out proactively, collaborate on premium adjustments, and maintain high standards of customer service despite the lack of face-to-face interaction.

“We reached out to our broker and agent partners and let them know to bring forth any clients that need help, because we want to address their situation specifically,” Fitzgerald said. “As the pandemic rolls on, we’ll keep revisiting the situation as it evolves. Any carrier who says they care about the companies they insure should be taking this individualized approach, because no two clients are experiencing the same issues.”

Integration across all the carrier’s departments, including underwriting, claims, loss control and legal/regulatory teams, is also vital to executing a bespoke approach because it ensures a 360-degree view of a client’s circumstances as it moves from its initial response to the pandemic to recovery and reopening.

“We act as one team, and that’s really important when you’re facing a situation like this because it enables us to bring both a pre-loss and post-loss view to the situation,” Sanders said. “As exposures change, we act as a trusted advisor and commit to being there for clients when they need us most.”

To learn more, visit https://www.qbe.com/us.

The statements and content herein are informational only and are not applicable to a particular account or claim. For specific guidance or legal advice, please contact your broker or lawyer.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with QBE North America. The editorial staff of Risk & Insurance had no role in its preparation.