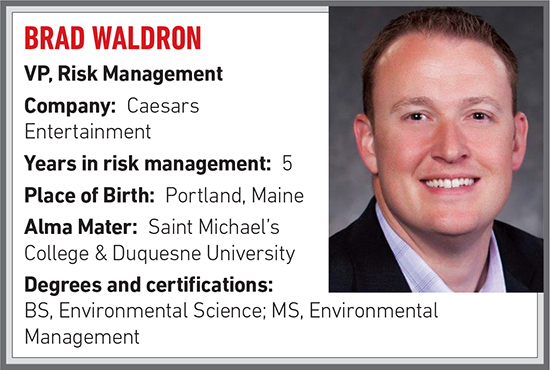

This Hospitality Risk Manager Says the Risk World Is Ripe for a Tech Revolution

R&I: Your background is in environmental management. Can you describe how you got your start in risk management and segued into the corporate level?

My role in risk management started at the corporate level. My entry to Caesars Entertainment was with the corporate engineering department, where I took on responsibility for environmental compliance. As with many organizations, there are typically synergies with health and safety, which fell under risk management.

When risk management was transitioned to a new leader, she added me as a change agent to improve the operational side of risk. I took on responsibility for risk control, EHS, claims handling, emergency planning, etc. and picked it up quickly.

R&I: What skills and perspectives do you bring from your environmental background that benefit you in your position with Caesars?

Even though my degree says environmental, my career was primarily spent in heavy industry focused on developing management systems to ensure compliance and operational control. The environmental discipline is like risk in that it has fingers which extend into all facets of an organization. Both disciplines are best performed with a strong understanding of systems and their interactions.

My background put me in positions where the concept of a safety net like insurance was nonexistent — operational efficiency and control were mandatory to successfully prevent loss. There was rarely something there waiting to cushion a failure. To me, the world of risk is just a different application of that same philosophy and mindset.

R&I: How is the risk management function positioned within Caesars Entertainment?

Historically, it was housed in the finance department. Earlier last year that changed, and I now report directly to our General Counsel. Within Caesars, risk management is an operational function first, likely partially driven by my belief that exposures have strong control opportunities. Don’t misunderstand, I have an exceptional risk finance group, but we focus on partnership and service to our properties to accomplish our goals rather than strictly mechanisms to finance losses.

R&I: How has your company’s risk profile changed over the past 5 years? What is driving that change?

We aren’t immune to any of the pressures other industries experience. Fluctuations in the economic and political landscapes drive the same types of shifts in our profile. I think our business model allows us to respond differently in many ways.

The risk world is ripe for a technology revolution, and we plan on pushing for that and riding the wave.

R&I: What are some trends or changes you’re watching specific to the entertainment industry? How will the industry change in the next 5 to 10 years?

As consumer tastes evolve, there is an increasing focus on experiential entertainment. Often, those have unique engineering or electronic components that force us to get outside the normal scope of reducing exposures. Those opportunities arise and develop more quickly than the risk world is used to adapting to. A lot of times we must work with several partners at once to find the solutions.

R&I: What role does technology play in your company’s approach to risk management, and how do you think technology will continue to shape the industry?

We embrace it! We would be naïve to presume that technology isn’t going to shape things. It’s made us more effective as a company. Right now, we are working internally on robotic processes and logic trains within our claims functions. By the time we’re done, customer service and claims handling will improve and take a fraction of the time through a system that will resemble simplistic AI. The risk world is ripe for a technology revolution, and we plan on pushing for that and riding the wave.

R&I: Do you consider Caesars to be a data-driven firm? What technologies are you developing to help expand your view of the risk landscape?

Our company is intensely analytical – from testing during the executive hiring and promotion processes, to our dedicated analytics teams and our gaming and customer datasets. I think it continues to surprise our external risk partners at the level of sophistication around data that we have internally and the manner in which we engage with their data programs. A large focus for us has been a more sophisticated connection between real-time behavioral safety data, injury records and claims data.

We recently dismissed a legacy software system on the health and safety side in favor of a system we built internally, because the commercial products haven’t been able to keep up with our structure and needs. We need fast and accurate information to support our desire to continuously evaluate and improve our programs.

R&I: What was the most impactful challenge you’ve overcome in your career? What were the key lessons learned?

Focusing on my role at Caesars, the largest success was a dramatic improvement in our casualty program. Many hospitality companies struggle to reduce that exposure, so we saw that as the place to start. Strong emphasis on frequency reductions, innovative medical management and strategic claims handling drove a 70 percent drop in frequency and a similar drop in cost over roughly four years.

What we learned is that you must overcome the “because that’s how we do it” status quo and drive change through collaboration. By getting people invested, we were able to make the substantial changes we knew would be necessary to succeed. We felt strongly that incremental tweaks were too slow, and we were willing to course correct midstream on larger initiatives if needed.

My team rallied around the concepts of quickly identifying failure and pivoting without hesitation. The results outpaced our expectations and brought the group closer together. It inspired them to look for opportunities for a repeat performance.

R&I: What about this work do you find the most fulfilling or rewarding?

The partnerships are by far my favorite part of this role. I enjoy working with our property leaders to help them solve complex problems or handle emergencies. I also value the relationship I have with some of our insurance carriers and underwriters who have really taken the time to learn who we are and why we do things.

Finally, the relationship I have with my internal team is second to none. They are the best team I’ve ever led, and the relationships within the group make everything possible. Call me old fashioned, but I think this business is unique in many ways as the personal connection still really means something.

R&I: If there were three things that fascinate you about risk, risk management and the future of risk analytics, what would they be?

First is that the amount of opportunity to grow and improve amazes me. I don’t think most people respect the amount of creativity which can be employed in this space. It inspires us to push boundaries and find new ways to achieve our goals.

Second is that analytics occasionally seem to be more focused on the aesthetic than meaning. Graphs and charts can be pretty, but unless they demonstrate a meaning that can be operationalized, they have no benefit.

Finally, there is still a significant amount of power in the hands of the insured that can be leveraged. However, keep in mind that pulling that lever can damage the relationships, which are so important.

“I think it continues to surprise our external risk partners at the level of sophistication around data that we have internally and the manner in which we engage with their data programs.”

R&I: What advice might you give to students or other aspiring risk managers?

Risk isn’t strictly a financial function — that’s only a small piece. Take a deep breath and observe everything around you critically with an eye on problem solving. Make sure you see the whole picture and interconnections in any scenario. Figuring out the variables that matter is the key. Once you have that from an operational perspective, setting up the equation and doing the math is easy.

R&I: What do your friends and family think you do?

They have no idea. Everyone knows a different piece that seems to resonate with them. Someone said I sounded like Ray Donovan — while an interesting spin, it’s not really accurate. But I didn’t correct them.

R&I: What is the riskiest activity you ever engaged in?

That’s an easy one: during relocating my family, I bought a house without my wife ever seeing it. It turned out okay, but nothing has ever scared me more.

R&I: Describe a project you are undertaking that will drive meaningful value to your organization. Who are you working with inside and outside the company? What unique skills are you and your team bringing to the project? What do you hope the project results will be?

Nothing my team does is without a significant designed impact, and we like to be out front. So, I’ll just say, stay tuned for a follow-up …