The Cost of Supply Chain Thefts Skyrockets Despite Stable Incident Count

Organized criminal enterprises engaged in cargo theft are shifting tactics to pursue bigger payoffs rather than increased volume, resulting in supply chain crime incidents costing 60% more in 2025 than the previous year, according to Verisk CargoNet’s annual supply chain risk report.

The data tells a striking story: while the overall number of cargo-related crime incidents barely budged, losses skyrocketed.

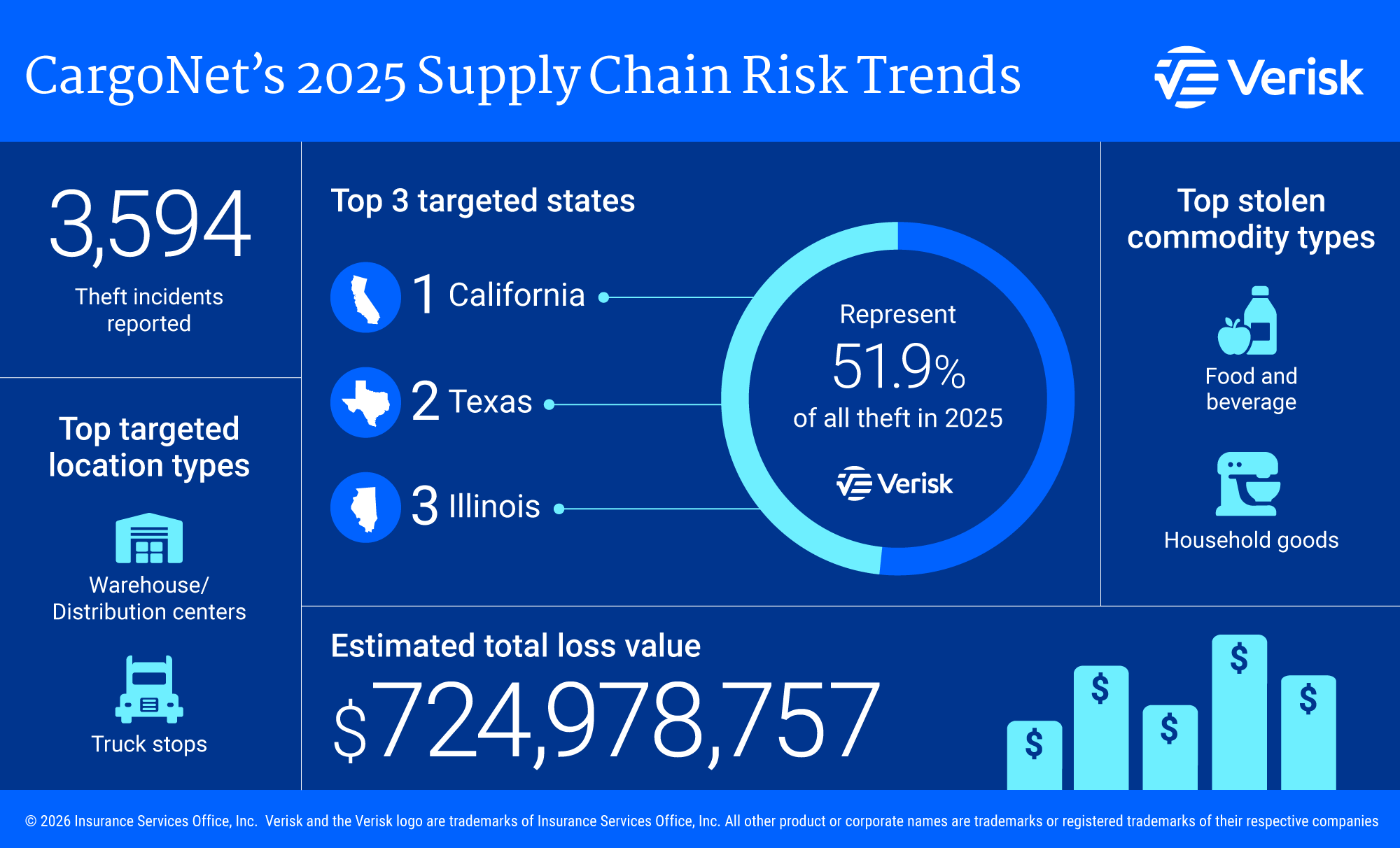

Verisk CargoNet documented 3,594 supply chain crime incidents across the United States and Canada in 2025, nearly identical to the 3,607 recorded in 2024. Confirmed cargo theft incidents climbed 18%, reaching 2,646 cases, and the average value per cargo theft surged 36% to nearly $274,000, up from approximately $202,000 the previous year.

Geographic patterns reveal thieves are growing more strategic about where they operate, according to Verisk CargoNet. While California remained the hardest-hit state with 1,218 cargo theft incidents, criminal activity has migrated from traditional hotspots like Los Angeles County to less-monitored regions. Kern County, California, thefts jumped 82% and San Joaquin County, California, saw a 44% spike last year. Beyond the West Coast, New Jersey, Indiana, and Pennsylvania each reported significant increases ranging from 24 to 50%.

The commodities targeted have shifted dramatically. Food and beverage thefts nearly doubled in volume, reaching 708 cases, with meat and seafood particularly vulnerable in the Northeast and tree nuts more frequently stolen on the West Coast. Metal theft surged 77%, propelled by copper demand, while criminals abandoned bulk consumer electronics in favor of high-margin enterprise computing equipment and cryptocurrency mining hardware.

Rising Sophistication Signals Growing Threat

These trends underscore a troubling reality for supply chain stakeholders: “Criminal enterprises are becoming more selective and sophisticated, targeting extremely high value shipments rather than relying on opportunistic theft,” according to Keith Lewis, vice president of operations at Verisk CargoNet. This calculated approach explains how the industry experienced such dramatic financial losses even as incident frequency plateaued.

The shift extends beyond simple theft. Verisk CargoNet said that deception-based schemes are expected to proliferate in 2026, with criminals focusing on redirecting shipments away from legitimate carriers and circumventing compliance controls traditionally built around the tendering process. Additionally, increased enforcement of motor carrier regulations may inadvertently create new vulnerabilities, the report said, as tighter controls could reduce available carrier capacity and expand opportunities for criminals to acquire established motor carriers with clean load histories and establish fraudulent operations.

View the full report here. &