The American West Is Burning. Better Risk Management Means ‘Hardening’ Homes and Businesses

There’s no getting around it — the soaring summer temperatures and droughts caused by global climate change are going to make wildfire seasons worse as the years progress.

While we’re still in the thick of this year’s wildfire season, experts are predicting it could be just as bad as 2020’s record-shattering summer when 10.27 million acres were burned, registering about $19 billion in economic losses.

This year, wildfire season began in late June when a possible lightning strike kicked off the Sylvan fire in Colorado on the 18th. The National Interagency Fire Center (NIFC) predicted that this fire season will subside by September.

The organization also placed California and the rest of the Pacific Northwest in the above-normal category for wildfire risk this year.

More alarming, however, is the fact that NIFC modified its prediction for the Northern Rockies to warn of the risk of higher-than-normal fire potential for Idaho, Montana and most of Wyoming this year.

Factors like the severe drought plaguing the West Coast are contributing to increased risk.

Zesty.ai, a climate risk analytics company for insurers, noted wildfires destroy approximately 87% more acres during drought years compared to non-drought years.

As wildfires become an increasingly pressing risk for states other than California, insurers are reconsidering their appetite for the risk, and the market for property insurance is hardening. New technologies are stepping in to evaluate risk, and insureds are taking action to reduce the chance of fire damage in an effort to keep insurance rates affordable.

Looking Beyond California

Historically, the lion’s share of U.S. wildfires have occurred in California, but now other states are seeing more frequent and larger fires.

“Wildfires used to be viewed as a California-centric issue,” said Jim Gloriod, chief executive officer of Aon Construction Services Group U.S.

“California is still the biggest area of concern, but five other states had over a billion dollars’ worth of wildfire damage [in the last few years].”

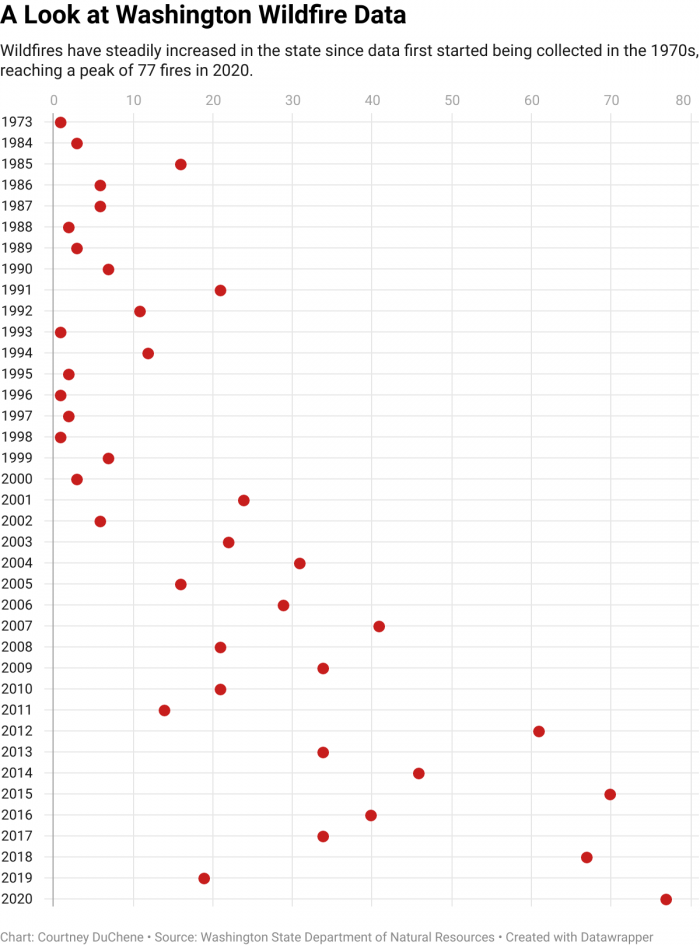

Washington has seen a steady uptick in wildfires. Over the last five years, the state has had between 19 and 77 wildfires per year. Comparatively, the state only had between two and seven wildfires per year between 1986 to 1990. In 2020, the state saw the largest number of fires on record with 77 fires burning 713,000 acres, according to data from the Washington State Department of Natural Resources.

Washington has seen a steady uptick in wildfires. Over the last five years, the state has had between 19 and 77 wildfires per year. Comparatively, the state only had between two and seven wildfires per year between 1986 to 1990. In 2020, the state saw the largest number of fires on record with 77 fires burning 713,000 acres, according to data from the Washington State Department of Natural Resources.

In Oregon, California and Washington’s Pacific Northwest neighbor, 1.07 million acres burned last year — the second largest acreage-burn on record for the state — according to the Oregon Statesman Journal. It cost $354 million to fight the fires and 4,009 homes were lost. Between 2015-2019 Oregon lost only 93 homes.

This year, Oregon’s wildfire season is already off to a disastrous start. In July, the Bootleg Fire became so large it began changing the weather, with pyrocumulus clouds forming due to the extreme heat.

“There have been a lot of losses, primarily in Oregon,” said Zesty.ai CEO Attila Toth.

The South and Western U.S. has not fared much better. Last year, three of the four most devastating wildfires in Colorado history occurred, Aon reported, and Texas, Georgia, Alabama and Florida are all predicted to suffer from wildfires in the coming years.

Insurers Losing Appetite for Wildfire Risk

The combination of recent catastrophic losses, expanding wildfire geography and longer fire seasons is causing some insurers to rethink their willingness to take on wildfire risks.

Jim Gloriod, chief executive officer, Construction Services Group U.S., Aon

Rates have been rising in the commercial property market for years, and 2021 is no expectation.

In its 2021 U.S. Property Market Outlook, Risk Placement Services predicted insureds would see rate increases as high as 15% in the first half of 2021 on accounts without losses (those with losses can expect larger rate hikes), and they name climate change as a primary driver. The report noted that California saw a massive market exodus after the 2020 wildfire season.

In California, the state’s insurance regulator backed changes that would cut off access to the state’s high-risk insurance pool in an effort to discourage construction in fire-prone areas.

“I don’t think anyone would say that the cost of wildfire insurance right now is reasonable,” Gloriod said.

New technologies are helping insurers identify properties within CAT-exposed zones that are less prone to wildfire risk.

Zesty.ai has partnered with Farmers Insurance on a program that uses artificial intelligence, high-resolution aerial imagery, building material and code data, and a property’s location to determine the risk of wildfire losses.

Delos Insurance Solutions, which was co-founded by a former aerospace engineer, partnered with the global specialty reinsurer Canopius U.S. on a similar venture that uses satellite technology and AI to identify properties deemed less risky for insurers.

Insureds can also take steps to mitigate their risk. Clearing small shrubs and other brush around properties can help reduce risk, which could make an insured’s property more attractive to insurers.

Even with risk mitigation strategies and new technologies, the market will likely continue to harden as insurers adapt to the reality of increasingly strong fires across the western U.S.

“After these past five years of really destructive wildfires, the insurance industry is just trying to wrap their minds around how to offer effective wildfire coverage,” Toth said. &