Catastrophe Claims

Technology to the Rescue

The growing scale and severity of natural and man-made catastrophes makes it increasingly difficult for insurance companies and claims handlers to access affected disaster sites. It can take weeks or even months for loss adjusters to see the true extent of damage caused by events on the scale of Hurricanes Andrew and Katrina.

But that’s changing with the development of technology such as drones, satellites and 3D imaging, which allow insurers to gather data and images quickly and efficiently, ultimately better protecting their clients against future risks.

There are still hurdles for insurers to overcome, starting with Federal Aviation Administration requirements for operating drones in U.S. airspace, as well as privacy issues, and the potential for property damage or civilian death in the event of a crash.

But uptake is still rising because of affordable hardware as well as increasing onboard instrumentation and offline data processing improvement.

“A lot of this new technology is great at assessing and understanding potential risks in a pre-loss scenario, as well as when an event happens,” said Sheri Wilson, national property claims director at Lockton.

“In some cases, there will always be the need for boots on the ground before the check is written, but this technology can certainly be used to get a more complete picture of what’s going on.”

Rise of the Drones

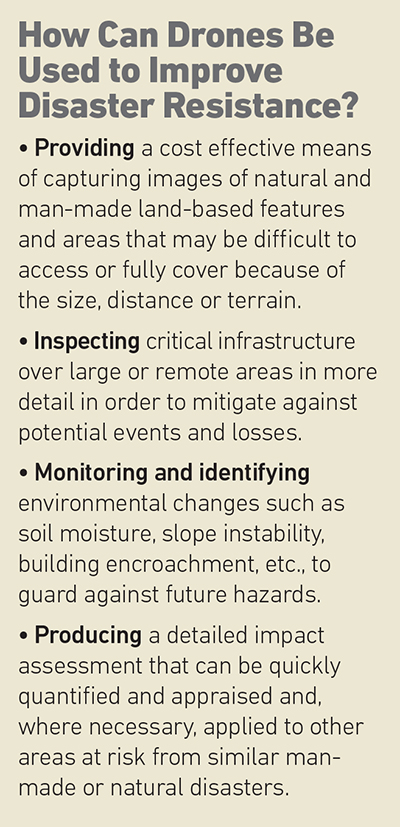

Jimmy Johnson, assistant vice president of commercial property claims at Zurich North America, said the main advantage of drones is the ability to provide access to difficult-to-reach disaster sites, allowing insurers and their customers to understand losses in greater detail.

“Being able to obtain information almost in real time, whether it’s taking pictures or communicating those losses, is a huge advantage not only to the insurer, but to their clients as well,” he said.

“The app allows them to record and send pictures and videos to the insurer to show them the extent of the damage and it is then uploaded to their server for them to assess.” — Andreas Shell, global claims executive of new technologies, Allianz Global Corporate & Specialty

Helen Thompson, director of commercial marketing at Esri, a geographic information system provider, said that another benefit is the speed of response, as well as use in hazardous situations, such as the port of Tianjin explosion last year.

“Drones are able to quickly assess large areas and identify, with human observation, the scope and scale of the disaster,” she said.

The main sticking point remains that only a handful of insurers, including State Farm, USAA and AIG, have obtained FAA approval to test drones for commercial use.

Gary Sullivan, vice president of property and subrogation claims at Erie Insurance, which was granted a license by the FAA last year to use drones for claims and in catastrophe situations, said that the biggest advantage is safety, as well as the time and cost efficiencies gained.

“It means the difference between keeping our employees on the ground versus the time and risk associated with having them climb a ladder to get onto a roof, and, ultimately, the imagery we obtain from a drone is just as good, if not better than we would otherwise be able to take,” he said.

Among the disadvantages, he said, were the need for a pilot’s license and having to get clearance to fly in no-go zones, for example, near airports and military bases.

Andreas Shell, global claims executive of new technologies at Allianz Global Corporate & Specialty, said one problem is that drones can only be used if the operator is in close proximity and maintains visual contact.

On top of that, he said, there are a host of legal and regulatory requirements.

“Right now, government agencies are tightening up these requirements more than ever due to the number of private operators currently out there,” he said.

Varying Image Formats

Video technology such as Skype and FaceTime has allowed insurers to develop smartphone apps that can be used to record property damage.

“In effect, they allow the customer to become a part of the claims process,” said Shell of Allianz.

“In effect, they allow the customer to become a part of the claims process,” said Shell of Allianz.

“[They can] send pictures and videos to the insurer to show them the extent of the damage.”

Such technology could be used in low value cases where sending out a loss adjuster may be more costly than paying the claim.

David Passman, national director of property claims for North America at Willis Towers Watson, said that when it comes to assessing wide areas of damage, satellites are often the best technology because they can capture a lot of data quickly.

The downside, he said, is that the picture quality may not be as good as a drone or 3D imaging.

“It enables you to take pictures before and after the event, and compare them side by side to determine not only what has happened to the property concerned, but also to the terrain around it,” he said.

“This can also help clients to put into action their business interruption or continuity plan, for example, by knowing what transport routes are open and putting in place an appropriate logistics strategy.”

Future of Technology

Thomas Haun, vice president of strategy for PrecisionHawk, an aerial data provider, said that as with all of these technologies, being able to quickly quantify the extent of damage and understand how safe something is, is critical in the response effort.

“Drones give you that ability to respond quickly and effectively to these types of disaster, but also to prevent or mitigate against future events,” he said.

However, Bud Trice, vice president of catastrophe services at Crawford, warned that despite the many advantages, the biggest challenge with this type of technology is fragmentation, with the possibility of each insurer deciding to go its own way with a different solution, many of which may be incompatible with one another.

Randall Ishikawa, vice president of property risk solutions at EagleView, a 3D imaging company, said that in the long run, technology could help expedite claims handling and reduce operational and claims costs for insurers.

“At the end of the day it can save money for the insurance carriers, and from an underwriting perspective it can determine the viability of the risk concerned as to what action needs to be taken at renewal,” he said.

Erie’s Sullivan added that the potential benefits are huge.

“From an industry standpoint there’s enormous potential because in the future you might be able to fly the drones much more often and to assess the risks on your books in order to identify potential hazards before they happen,” he said. &