Insurance Industry

The Spirit of Giving

By September of 2013, Aspen Insurance CEO Mario Vitale was a 37-year veteran of the insurance industry and a successful one at that.

All it took was one week visiting the village of Kiwoko, in Central Uganda for Vitale, back at home in New York, to wonder what he was doing with his life.

“I remember putting a tie on and looking at myself in the mirror and somehow everything I do every day, which I love — the insurance business — didn’t seem as important anymore,” Vitale recalled.

That September, Vitale had acted as the lead ambassador for a group of Aspen staff members who visited Uganda as part of Aspen’s work with The Adara Group, formerly known as the ISIS Foundation.

The Group originated in 1998 with the goal of bringing medical and educational support to poor villages in Uganda and Nepal.

Every year since 2007, Aspen Insurance has made contributions to The Adara Group and a group of “Aspen Ambassadors,” numbering between seven and nine people, visits Kiwoko and spends time getting to know the village members Aspen’s contributions help to support.

Video: This video from The Adara Group describes some of the work it has done in Nepal and Uganda.

To date, Aspen has contributed a substantial amount to The Adara Group’s efforts in Uganda. Of which, $640,000 has come directly from Aspen employees in the UK and the United States.

“The Aspen-Adara Group partnership is unique in the financial services sector, both in its depth of engagement with local communities and in the degree to which it has become embedded in Aspen’s corporate culture,” said Anubha Rawat, communications and partnerships director for The Adara Group.

“It has shown us the exponential power of linking the business sector with those in need in the developing world,” he said.

It’s not easy for Westerners to visit Uganda and keep their emotions in check. Although discouraged, tears are commonplace as insurance sector employees used to living in relative comfort confront the harsh conditions Ugandans live in.

During his week-long September trip, Vitale visited the neonatal center and maternity ward that Aspen’s support has made possible. He played with the village children, participated in daily prayers and otherwise immersed himself in a culture that almost automatically becomes beloved to those Aspen staff members that visit there.

“Nothing prepared me for the fact that this was really Ground Zero for the worst and the best of everything.” — Mario Vitale, CEO, Aspen Insurance

All in all, he said, he came away a changed man.

“Nothing prepared me for the fact that this was really Ground Zero for the worst and the best of everything,” he said.

By the best of everything, Vitale meant the boundless hope that Ugandans bring to their daily lives.

“I’ve never seen so much hope. They call Uganda the Pearl of Africa, and I think some of it has to do with the spirit. The spirit of the people is one of hope,” he said.

By the worst of everything, he meant the poverty and health challenges Ugandans face.

Those include high infant mortality and the ravages of more than a million citizens infected with HIV.

Expanding Crucial Medical Services

The Kiwoko Hospital started as a clinic under a tree in 1986 by an Irish missionary, Ian Clark, in the aftermath of one of Uganda’s devastating civil wars, which killed and displaced hundreds of thousands of people.

The hospital is now a 25-acre compound employing more than 350 staff, with 270 patient beds and offering medical services to a region of 500,000 people.

Funding from Aspen led to a three-fold increase in the size of the hospital’s maternity ward and its neonatal center.

When Aspen first started working with The Adara Group, fewer than one-third of the prematurely born babies in the Kiwoko Hospital survived. Now, the survival rate of premature babies is more than 80 percent.

“We saw the babies,” Vitale said. “We got a chance to hold them and interact with them. And we got to meet the doctors and the nurses and the skilled staff,” he said.

“I walked back a different person.”

Vitale likes to go on safaris, and when he traveled to Uganda, he brought with him a new set of clothing, boots and equipment with the intent to use them recreationally.

Once there, though, he decided to give them all away to the Ugandans.

“I felt guilty to own it and so I left it there in a basket. Nobody wanted to accept them. They said, ‘You can’t do this.’ I said, ‘Yes I can,’ ” Vitale said.

“I know that somebody there needed it a lot more than I did and there was no possible way that I could keep that stuff and leave there with a good conscience,” he said.

Taking Further Action

When he returned from Uganda, the first thing Vitale did was take a long, hot shower.

But then he started thinking about how he could involve others in the insurance industry to become involved with The Adara Group and make a difference in East Africa.

Last October, Vitale and Aspen organized a black-tie gala fundraiser for The Adara Group at the St. Regis Hotel in New York.

“We invited my friends in the industry, the brokers, the reinsurers, even competitors, and asked them to give generously to the cause and it was overwhelmingly supportive,” Vitale said.

The event netted more than $163,000 for the foundation.

Consider that in poverty-stricken Uganda, $4 buys a food package so that a destitute mother can feed her children; $75 covers a child’s school fees for a year and $50 pays for caregiver assistance for a child orphaned by HIV.

Aspen Re employee Susan Cannarella, who took an initial trip to Uganda in 2008 as an Aspen Adara Group Ambassador, is now the largest individual contributor to The Adara Group’s work with the Kiwoko Hospital.

Inspired by the need and her drive to help, Cannarella founded Beads4Dreams. The nonprofit buys paper beads from the Women’s Craft Group at Kiwoko and turns them into necklaces, bracelets and other works of art, which are then sold at craft fairs, church bazaars and the like.

As of the end of 2013, Cannarella’s nonprofit returned 100 percent of those proceeds to the people of Uganda, more than $63,000.

“As I sit here on the plane on my way home from Uganda, I am flooded with emotions ranging from great joy to deep sadness,” Cannarella wrote in a recent blog post on The Adara Group website about her most recent visit to Kiwoko.

“I am very happy to be heading home as I have missed my family and friends, but at the same time, I am also sad to leave my new friends and ‘family’ from Aspen and Kiwoko Hospital,” she wrote.

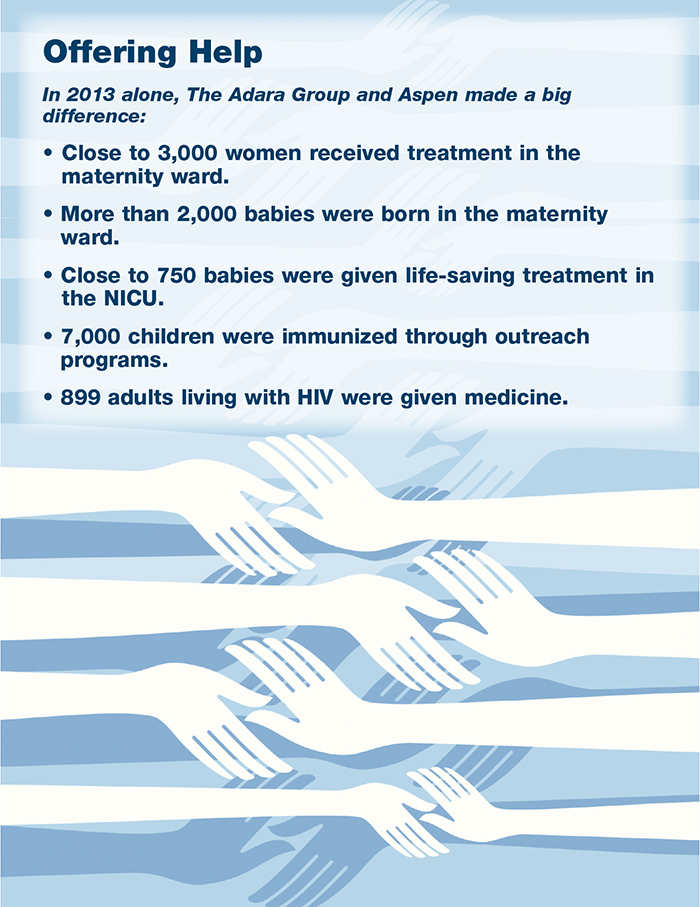

Making an Impact

From its founding in Bermuda 16 years ago by Audette Exel, Sharon Beesley and a small group of friends and supporters, The Adara Group has gone on to make an important impact in Uganda and Nepal.

It is a common practice in Nepal for child traffickers to trick parents in remote rural villages into sending their children away to what they believe will be boarding schools.

In 2006, The Adara Group located 136 children in a basement in Kathmandu who had been trafficked from their homes in the remote mountain district of Humla.

The foundation initially found safe housing and rehabilitation services for the traumatized children.

Through a painstaking process, the foundation treated the children and worked around political strife in Nepal to return the children to their families by 2009.

In addition to the contributions of Vitale and Aspen, The Adara Group connects to the insurance industry in another substantial way.

Audette Exel is vice chairman of the board of the Steamship Mutual Underwriting Association Trustee. Steamship Mutual is one of the world’s largest P & I (Protection and Indemnity) clubs for the shipping industry.

Video: Audette Excel talks about why she started The Adara Group.

Her history in financial services is illustrious. Before establishing The Adara Group, Exel was managing director of Bermuda Commercial Bank and one of the youngest women in the world to run a publicly traded bank.

During 1995 and 1996, Exel was chair of the Bermuda Stock Exchange and served a six-year stint — 1999 to 2005 — on the board of the Bermuda Monetary Authority.

In 1995, Audette Exel was elected a “Global Leader for Tomorrow” by the World Economic Forum. She has certainly lived up to that billing.

For more information on The Adara Group, including ways to contribute, click here.