Insurance Agent and Broker M&A Deal Count Declines in 2025

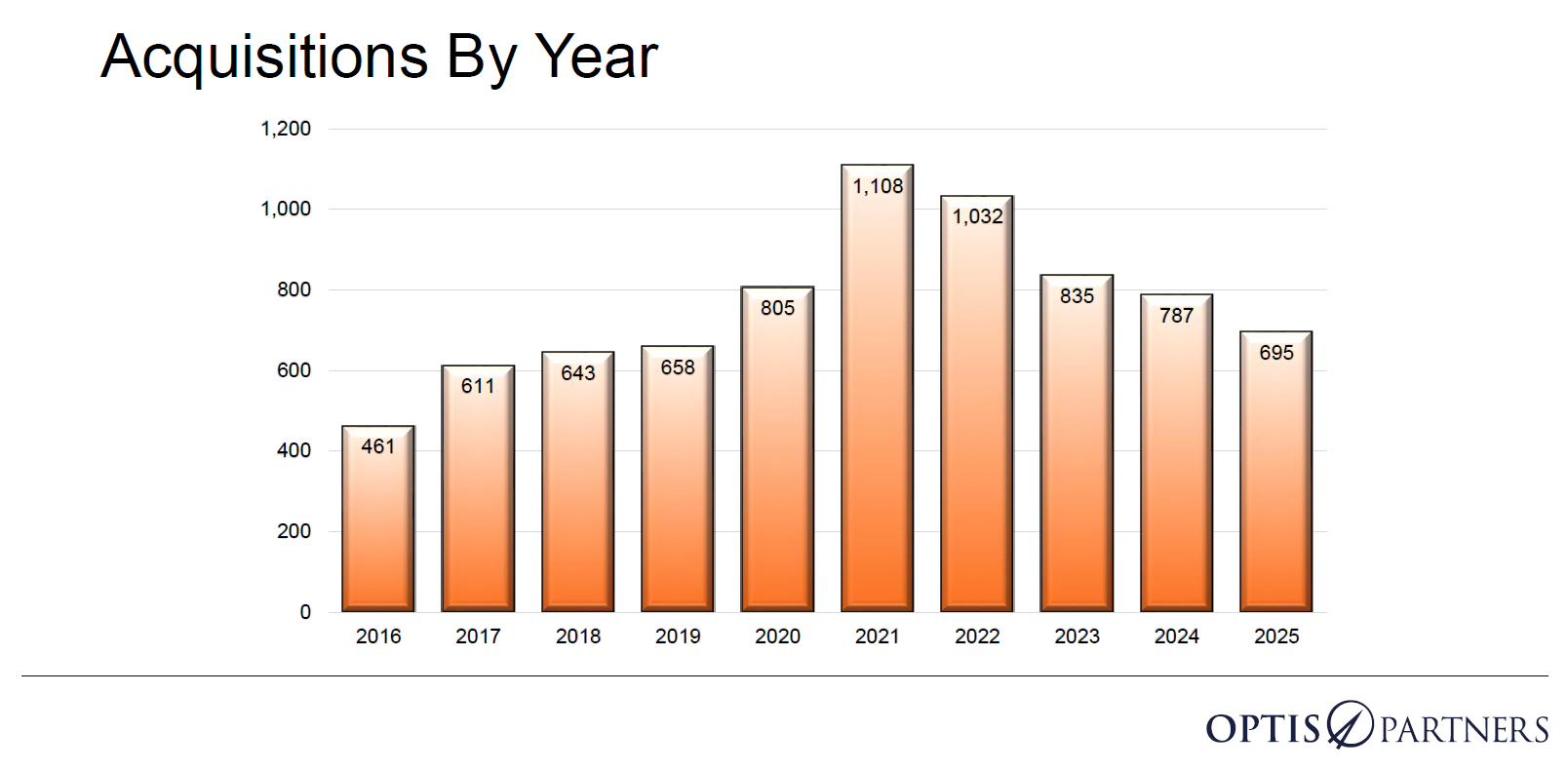

M&A deals involving agents and brokers in 2025 saw a significant departure from the robust activity levels of recent years, according to OPTIS Partners’ year-end analysis.

There were 695 total transactions in 2025, down 11.7% from 787 in 2024, and 24% below the previous five-year average, according to the report. The final quarter of 2025 proved particularly challenging, with only 157 deals closing—the fewest since 2019 and roughly half the five-year quarterly average.

The slowdown in M&A transactions affected virtually every category of buyer, according to OPTIS Partners. Private equity-backed brokers reduced deal activity by 10% compared with 2024, and fell 23% below their five-year average. Publicly traded brokers saw a sharper decline of 27% year-over-year, while privately-owned firms’ activity contracted by 9%. The only exception to the trend came from bank-owned brokers, though this category no longer represents meaningful market activity, OPTIS Partners said.

Among the most active acquirers, leadership positions shifted. Broadstreet Partners maintained the top spot with 69 deals in 2025, despite a 23% decline from the prior year. Hub International followed with 49 deals, down 20%. Inszone Insurance Services completed 45 transactions, down 6%, while World Insurance Services expanded aggressively with 34 deals—a 113% increase from 2024.

Emerging Firms Rise as Established Players Retreat

An intriguing contrast emerged between long-established acquirers and newer entrants, according to the report. “The longer-established firms are slowing while newer emerging firms are increasing their pace,” the report’s authors said.

Since 2015, private equity-backed buyers increased by 78% to 41 firms in 2025, while all other buyer categories—including public brokers, privately-held firms, and insurance companies—collectively declined by one-third over the same period.

Despite the overall volume decline, the number of significant transactions actually increased in 2025, OPTIS Partners said. Six firms with over $25 million in revenue changed hands, including major deals such as AssuredPartners’ $2.9 billion sale to Arthur J. Gallagher and Accession Risk Management’s $1.7 billion transaction with Brown & Brown.

The consolidation trend extends to the buyer base itself. Only 95 firms announced acquisitions in 2025, down from 104 the previous year, continuing a four-year downward trajectory.

What’s Next for the Industry

“The story of 2025 is more like that of 2019 than any year since. Similarities include annual deal pace between 650 and 700 and a relatively even distribution of deals through out the year. In fact, 2019 and 2025 are the only years when the Q4 deal volume was lower than the other quarters and that December was not the busiest month to close,” OPTIS Partners said.

The M&A landscape includes an estimated 30,000 independent agencies under $1.25 million in revenue, the vast majority without succession plans, the report said. This supply of acquisition targets will likely sustain consolidation efforts despite the slower pace of activity.

View the full report here. &