Reinsurance

In for the Long Term

Delegates at this month’s Monte Carlo Reinsurance RendezVous will have as many issues as ever to digest over coffee at the principality’s terrace cafes — not least the relentless rise in third party reinsurance capital and the insurance linked securities (ILS) market, which are making steady inroads into the books of business held by traditional property/casualty reinsurers.

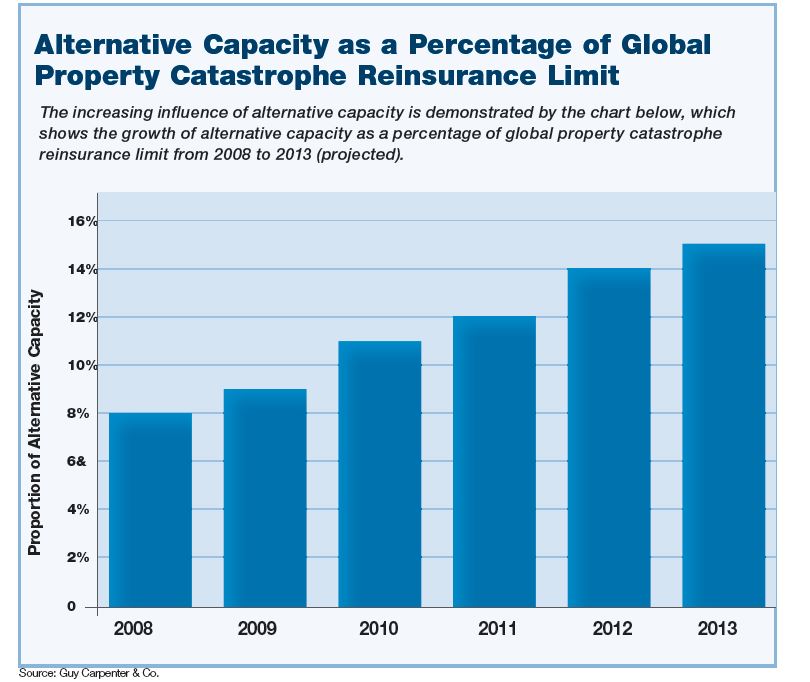

A report by Guy Carpenter suggested that around 15 percent of the global property/catastrophe reinsurance market will be represented by alternative capacity in 2013, including catastrophe (Cat) bonds, industry loss warranties (ILWs) and other collateralized reinsurance, against around 8 percent in 2008.

The threat to market share, pricing and profits — currently one of the high margin lines for reinsurers, will be “a hot topic at the RendezVous,” said Stefan Holzberger, managing director, Analytics at ratings agency A.M. Best.

“The demand for ILS is already leading to sharp reductions in rates. In fact, ILS investors drove down rates on Florida natural catastrophe by roughly 15 percent for 2013 renewals. The traditional markets felt this pressure and were forced to drop rates themselves to remain competitive,” he said.

So what this means for January 2014 renewals will definitely be debated by Monte Carlo delegates.

A recent research report by Michael Zaremski, an analyst at Credit Suisse, spoke of the increasing pressure that both third party capital and ILS are putting on the traditional players. Institutional capital market investors such as hedge funds, pension funds, high net worth individuals and specialist insurance-linked fund managers are increasingly venturing into the global reinsurance market.

Credit Suisse is, of course, widely recognized along with Nephila Capital (with an estimated $9 billion of assets under management) and Fermat Capital Management as being one of the main alternative capital providers that has done so much to shake up the market.

More recently, Leadenhall Capital Partners, the joint venture between Lloyd’s of London group Amlin and former Swiss Re alumni John Wells and Luca Albertini has enjoyed considerable success in growing its assets under management (AUM). In addition, the success of Securis Investment Partners since its first fund launched in 2005 persuaded Northill Capital to acquire a majority interest last year.

“P/C reinsurers are in the midst of a transformative period whereby competition from external ILS market growth is testing and transforming current business models,” wrote Zaremski. “Traditional reinsurers are weighing and/or balancing internal ILS platform start-ups, which pressures returns within reinsurers’ existing legacy portfolios given the competitive overlap of many ILS structures.”

He singled out for special mention the Cat bond market, which was taking up major chunks of business from reinsurers such as Validus — whose shares dropped sharply when the report was first issued, although the group has set up its own third party capital operation in the AlphaCat ILS funds and also has sidecar vehicles.

“Cat bonds will continue to make inroads into traditional reinsurers’ business,” Zaremski predicted. “Reinsurance has become more of a commodity, due to lower barriers to entry and vendor models.”

Equally concerning for reinsurers was the recent report from Swiss Re that Cat bond pricing has fallen by as much as 35 percent in the past year and made them for the first time as cheap as traditional reinsurance, or possibly even cheaper.

Cat bond issuance peaked in 2007 at $8.2 billion in the aftermath of hurricanes Katrina, Rita and Wilma, but 2013 is on course to match and possibly exceed that figure, according to Swiss Re.

However, the group’s head of ILS Structuring and Origination, Markus Schmutz, doesn’t believe that it will entirely replace traditional reinsurance. “Cat bonds will always complement the traditional market and sponsors will place a certain share of their [reinsurance] program into this market to get diversification,” he predicted.

A Growing Share

Others commented that while the relentless advance of the ILS market is not about to be halted, it is still relatively small compared with the overall reinsurance sector and, as Holzberger pointed out, is mostly limited to catastrophe risk. The majority of ILS deals to date have covered U.S. windstorm and earthquake, and European windstorm.

“Within the reinsurance market segment, nontraditional capital providers are estimated to make up roughly 15 percent of capacity — although this will likely increase in the years to come,” he added.

Paul Schultz, chief executive of Aon Benfield Securities, said prospects for further growth in ILS are strong, due to the established track record of good investment returns that they have demonstrated coupled with the fact that there are currently fewer opportunities to invest in alternatives than there have been traditionally.

He also admitted that the managers of alternative capital are ensuring that they have the necessary underwriting and analytical talent. “Some of our colleagues at Aon Benfield are among those who have moved over to the new providers to take on the role of analyst and manager.

“Whether the market will continue to grow or will plateau sometime in the near future is hard to say although we really don’t foresee any decrease in the flow of capital coming into the industry,” Schultz added.

This view is based partly on the fact that a fairly long decision-making process precedes any decision made by institutional investors to commit to a particular market. “The 2008 global financial crisis demonstrated the low-correlated nature of the returns provided by ILS, which has encouraged more of them to enter the market — particularly the pension funds,” he said.

This trend was noticed relatively early on by the more astute traditional reinsurers, which responded to growing investor interest in the reinsurance market by establishing their own ILS or collateralized reinsurance vehicles, but others are belatedly putting similar plans into action.

Alastair Speare-Cole, chief executive of JLT Reinsurance Brokers, said that the convergence market created by the coming together of insurance and the capital markets has, so far, proved to be highly transparent, with even investors in vehicles such as sidecars confident that they are taking a slice of the portfolio in a narrow area for only a limited period of time.

“This investment proposition is undoubtedly a threat to the existing players, who are losing major chunks of business,” he noted. “And as the asset class becomes steadily deeper and more liquid, so it continues to attract new capital.”

It could also, in time, see the new capital venture beyond P/C reinsurance, Speare-Cole suggested. “Liability classes are certainly more problematic an investors’ proposition and there are many different issues involved. Nonetheless, we might see a more tradable position emerge over time, for example focusing on the ‘dead’ business with a run-off portfolio.”

Room for All?

But should traditional reinsurers necessarily regard these newcomers as a threat, or is there enough business out there to keep all parties happy, especially given the tougher new capital adequacy requirements set out under the Solvency II regime?

“As respects capital requirements, the allocation of AUM to the insured event risk class by the capital markets is but a small fraction of the total,” Peter Hearn, global chairman of Wills Re, pointed out. “Assign a 1 percent asset allocation to insurance event risk and it would equal 87 percent of the estimated global reinsurance P&C surplus.”

He noted that the pension funds also enjoy a competitive advantage over traditional reinsurers relative to their cost of capital, enabling them to write P/C reinsurance at a lower margin than the longer-established market participants.

Hearn added that the prolonged low interest rate environment that has resulted from efforts to kick-start economies on both sides of the Atlantic has undoubtedly contributed to the influx of new capital into the reinsurance market. Once rates begin to climb again, other forms of investment will regain their attraction.

“There are potentially several other factors that could bring about a reduction in the current inflows,” Hearn said. “These are, in no particular order, capacity and/or margin compression, significant loss activity, model uncertainty, inflation and alternative asset classes offering similar returns but less volatility.”

It would take a very large loss to staunch the influx of new capital.

As Speare-Cole noted: “A loss in the region of $20 billion no longer qualifies as a major event. To cause disruption, the figure either needs to be substantially more — or some totally unexpected development occurs, something that has never been factored in by the market and fundamentally challenges the basic assumptions that underpin the new capital.”

A.M. Best’s Holzberger agreed. “These [new] investors understand the risk, and demand for alternative vehicles such as ILS still far exceeds supply,” he said. “It is possible that a year of ILS losses could scare away some capital market players, but the reality is that there would likely be several new entrants ready to take their place.”