How Data, Automation and Collaboration Must Shape the Future of Risk Management

The risks of the future, both near and far, are growing in complexity because of their interconnectivity. This is precisely what makes risk mitigation so challenging; every action may cause an unknowable reaction on another area of business or on a business’s long-term viability.

Especially when it comes to global risks like COVID-19, climate change, political instability and social unrest, it’s difficult for business leaders to understand how threats will unfold over time and what the specific impacts will be on their organization.

With risks so big, where should risk managers begin? What actions can be taken today to mitigate the risks of tomorrow?

Insurance professionals all along the value chain agree on these points: better utilization of data will be critical in understanding emerging risks; insurance companies will be key partners in risk mitigation, which is becoming a greater priority than risk transfer; and public-private partnerships will be necessary to fund and execute the broad-scale changes needed to address some of the world’s most critical risks.

Data Is the New Oil

“The first step of preventing losses is figuring out what causes them,” said Mike Lebovitz, head of innovation at FM Global.

Mark Rieder, head of innovation, NFP

Most risk managers and underwriters gain this understanding through historical data like loss history and benchmarking reports, but there are two reasons why this approach is no longer sufficient.

First, as COVID-19 demonstrated, risks emerge and evolve so rapidly that historical losses are not always good indicators of future losses.

Second, gathering and analyzing claims data remains dependent on manual processes, meaning lots of information can get missed and the likelihood of error is high.

To fix these issues, risk managers need more structured, actionable data, and they need it in real time.

“IBM was quoted a few years back as saying that 90% of all data that exists had been created in the previous two years and only a small percentage of that data is actually being analyzed,” said Mark Rieder, head of innovation for NFP. Harnessing that untapped data will help to identify emerging loss trends and potential mitigation strategies faster.

“Data is the new oil. You have a slew of new tools that are either gathering data, storing data or influencing the way data is acted on — this is the part that drives behaviors that can improve outcomes,” Rieder said.

Collecting data is the easy part of the equation. The explosion of connected sensor technology has made it possible to capture volumes of detail. The storage and processing of data are the links in the chain ripe for innovation.

Artificial intelligence and machine learning will be essential in turning unstructured data into usable, actionable insights.

“The information that risk managers need — the loss drivers, traits and characteristics of a claim — is usually scattered across emails, Excel spreadsheets, loss run and policy PDFs,” said Jeff Mason, founder & CEO of Groundspeed Analytics, a data sciences company that builds solutions for insurance automation.

“We use AI to automate the process of identifying information that is important in these documents, cleaning it, normalizing, it, enriching it with AI, and sending it in a structured format to clients so they can understand and act on it.”

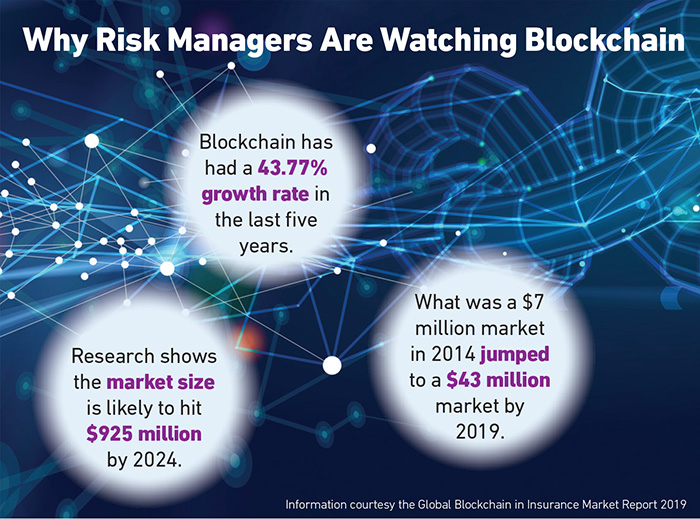

Blockchain, while not widely implemented, is likely to emerge as the best tool for safe storage and sharing of information. As a decentralized, distributed ledger, blockchain offers the benefits of real-time information to all stakeholders without sacrificing security.

“Our platform offers the preservation of privacy and security through its private and permissioned blockchain architecture. This makes it suitable for use involving multiple firms around the globe with a need to share data but also a necessity to preserve their own privacy,” said Ryan Rugg, global head of the industry business unit at R3, an enterprise blockchain software firm.

Companies that take advantage of these technologies to unlock data insights now will be better equipped to understand and respond to emerging risks as they unfold.

Insurers Shift from Risk Transfer to Risk Reduction

Gaining access to these technologies, however, remains a challenge. That’s where insurers will play a critical role going forward.

Though the insurance industry has its own struggles with digitization, its investment in emerging technology makes it well-positioned to put relevant tools in front of clients that can help mitigate their specific exposures. Last year, Insurtech investments topped $3.26 billion, according to a Deloitte Financial Services report.

“We’ve been in the business of helping clients mitigate risk for years,” Lebovitz said. “We see our role as identifying new technologies that have the potential to help our clients become safer or more resilient and bringing them to the market on a broader scale.”

Internal adoption of AI-driven risk assessment platforms are also helping carriers gain a more granular view of risks, supporting more disciplined risk selection and pricing. All of this feeds carriers’ ability to provide a more accurate view of risk for their clients and more tailored recommendations for risk reduction.

Ryan Rugg, global head of the industry business unit, R3

At a time when insurers increasingly compete on services, rather than products, the detail of risk insights provided could be what differentiates an insurer from its competition.

Adoption of automation also assuages one of the most critical risks facing the industry itself: a looming talent shortage. Roughly 400,000 positions will go unfilled this year in key areas like underwriting, sales and claims administration.

Digitizing manual processes using AI and blockchain not only frees up existing employees to work on higher level tasks but also can be a tool to attract more tech-minded talent.

“With low-value, manually intensive tasks automated thanks to blockchain, valuable time is freed up for the workforce to spend on higher-value tasks. With this, comes the opportunity to upskill,” Rugg said.

“The potential efficiency gains for both the insurer and the insured are dramatic, with no burden on either entity having to gather, reconcile and submit documents. This is going to make insurance much more efficient to deliver, making organizations more productive and profitable.”

Partnerships Matter in Mitigating Global Risks

The World Economic Forum (WEF) breaks down global risks into five categories: environmental, economic, technological, geopolitical and societal.

Over the long-term — defined in this case as the next 10 years — climate-related hazards such as natural disasters, extreme weather and loss of biodiversity consistently rank among the top threats. The COVID-19 crisis was playing out as this issue went to press.

Other significant short-term risks relate to political instability, the unreliability of multilateral alliances, and economic disparity. The WEF connects these two buckets, though, by stating that “without urgent attention to repairing societal divisions and driving sustainable economic growth, leaders cannot systemically address threats like the climate or biodiversity crises.”

When it comes to global threats, the private sector can help governments prepare for future threats without ignoring immediate concerns.

“The traditional public sector financing model is reactionary. So, that means using money to rebuild your old roads that had originally been earmarked to build new ones. If you preemptively finance using insurance, you can take a whole different viewpoint around risk management and transfer — one that is more proactive about long-term resilience,” said Nikhil da Victoria Lobo, head Americas, public sector solutions, Swiss Re.

“We can provide the capital to help communities build back better, meaning after a disaster they rebuild to a higher standard of resiliency so they’re prepared for the next event. We also want our partners to ‘build better before.’ In this case we would be encouraging our partners through funding with NGOs/ banks and other bodies to retrofit properties and strengthen vulnerabilities to avoid losses in the first place. This build better before should result in savings on future insurance costs which would more than finance the initial upfront investment,” said Andy MacFarlane of AXA XL’s Public Sector Partnership Working Group.

“There’s a growing recognition of the benefit of using the private sector to provide risk capital and transfer risk off of the public balance sheet, off of taxpayers and on to private companies better able to take on risk, said David Priebe, chairman, Guy Carpenter.

“But the value of these partnerships over the long term lies more in the transfer of knowledge. We’re helping public entities quantify risk so that they can prioritize and plan more effective risk mitigation efforts,” he said.

“It’s a combination of providing capital support and building more sustainable way for them to manage their risk on their own over the long term.” &