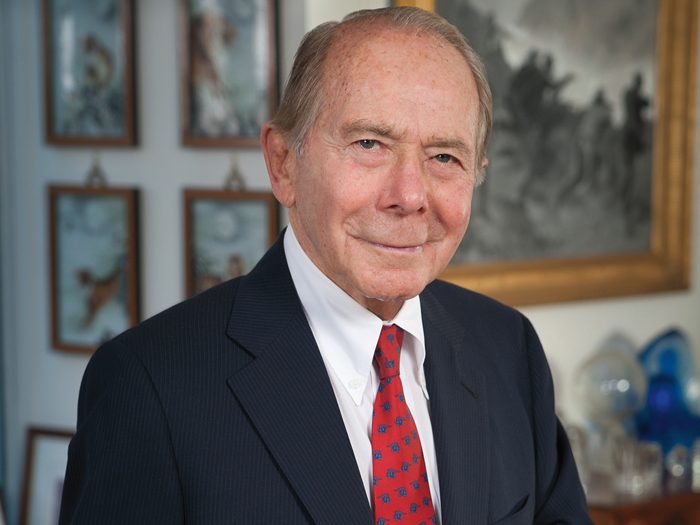

Insurance Executive

Greenberg Settles Case with New York AG After 12-Year Fight

AIG’s former CEO and CFO settled a civil accounting fraud case last week that spanned 12 years, stretching back to the administration of former New York State Attorney General Eliot Spitzer.

In settling the case with current NYAG Eric Schneiderman, former AIG Chairman and CEO Hank Greenberg and Howard Smith, AIG’s former CFO, agreed to payments totaling $9.9 million; $9 million on the part of Mr. Greenberg and $900,000 on the part of Mr. Smith.

The case was mediated by noted attorney Kenneth Feinberg, who also mediated between British Petroleum and claimants in BP’s Gulf of Mexico oil spill and who will also be managing the claimants’ fund connected to the Volkswagen emissions scandal.

As part of the settlement, there was no admission of wrongdoing on the part of Greenberg, now the chairman and CEO of the Starr Companies, or Smith.

In a statement released Feb. 9, the New York Attorney General’s office said the $9.9 million represented bonus payments Greenberg and Smith received between 2001 and 2004. Despite the terms of the mediated settlement, the AG’s statement implied that the agreement amounted to an admission of fraud by Greenberg and Smith.

Both men strongly dispute that characterization of the settlement.

At a press conference in New York on February 13, Greenberg’s attorney David Boies, described the payments as nothing more than a “nuisance settlement” given the fact that the NYAG’s office had originally sought some $5 billion in damages.

“The New York Attorney General’s case had totally collapsed at trial,” said Boies.

In all, the civil actions initiated by Spitzer in 2005 amounted to nine separate charges.

One of the last two actions to reach settlement is related to a loss portfolio that AIG received as a reinsurer from Berkshire Hathaway subsidiary Cologne Re Dublin in the fourth quarter of 2000. Unbeknownst to Greenberg and other executives at AIG, a portion of the portfolio had already been reinsured elsewhere.

Thus, AIG’s acceptance of the portfolio resulted in an erroneous increase in its loss reserves, since the transaction involved little or no actual risk. An innocent accounting error that they were not aware of, not fraud, Greenberg, Smith and their attorneys argued.

“Nowhere in the agreed statement by Mr. Greenberg is there any reference to any accounting being fraudulent, let alone that Mr. Greenberg was aware of any fraud,” Boies said on Feb. 13.

“There was nothing in those transactions that we knew were wrong when they were done,” Smith added.

The second case, known as the Capco transaction, involved allegations that AIG attempted to confuse investors by equating underwriting losses with investment losses.

“The New York Attorney General’s case had totally collapsed at trial.” — David Boies, attorney for Hank Greenberg

Greenberg’s conflict with Spitzer is a long and painful one and can reasonably be said to have had a substantial impact on the nation’s and the world’s economy.

Under pressure from Spitzer, Greenberg was forced out as Chairman and CEO of AIG in 2005, having spent 40 years with the company.

At the time of Greenberg’s forced resignation, AIG had a presence in more than 130 countries and $180 billion in market capitalization. Three years after Greenberg’s removal, the company’s insurance of credit default swaps resulted in an almost catastrophic failure. The rest is, literally, history.

AIG required an $85 billion two-year government loan, which it has since paid back; but it had to sell off key assets to do so.

“AIG is currently a shadow of what it had been,” Greenberg said in a statement released on Feb. 13.

“It was an international asset and no longer is,” Greenberg said.

“It employed over 100,000 people and now it is about half of that.”

Greenberg is pursuing a defamation case against Spitzer for comments Spitzer made about him after leaving the AG’s office in 2006. Spitzer lasted a year as Governor of New York before allegations that he consorted with prostitutes drove him out of that office.

Greenberg also spoke out at the press conference in opposition to New York’s Martin Act, which gives state prosecutors broad powers to prosecute business leaders without having to prove fraudulent intent.

“That law should be changed, it should be knocked out,” Greenberg said.