2017 Most Dangerous Emerging Risks

Foreign Economic Nationalism

Economic nationalism not only has an impact domestically but presents significant risks for the global economy as well.

Political risk research firm The Eurasia Group cites “independent America” as a top risk for global stability and warns that 2017 will see a “geopolitical recession” that marks “the most volatile political environment in the postwar period, at least as important to global markets as the economic recession of 2008.”

Add to that the way other nations are turning inward and sealing their own borders in response to stalled economies, a surge in refugees or a shift in the way terror attacks are carried out by individuals, often inspired by social media.

In Europe, Britain voted to withdraw from the European Union, a.k.a. “Brexit.” In South America, Venezuela closed its borders with Brazil and Colombia.

All of this inward focus has the potential to create what the Eurasia Group calls a “G-Zero world” — a world with no global leader.

With no clear political leader, there’s also no unifying voice on security, trade or social values. There’s no coordinated response on climate change, capital flows or the internet.

With no superpower setting the agenda and global uncertainty about rising economic nationalism, the world order could fall into disarray.

“The established norms of the past 50 years quickly eroded,” said Dan Riordan, president of political risk, credit and bond insurance at XL Catlin.

“It didn’t start last week. It started over a period of time but we’re definitely reaching a different dynamic and that’s creating a lot of uncertainty,” he said.

Governments adopting nationalistic economic policies may renege on foreigners’ contracts, leaving businesses to foot the bill or renegotiate deals.

Some countries, such as Venezuela, have already seized property from foreign-owned businesses, namely natural resources such as oil, in the name of “the people.”

Global institutions may lose clout or be victimized by political retaliation.

The ripples of economic nationalism are creating worldwide uncertainty. Along with that comes emerging economic and political risks that may defy traditional forecasts and that may happen at a rapid-fire pace never before faced by risk managers.

“So many of the tools the risk manager is using today are mostly useless because of the complexity we have right now,” said Dante A. Disparte, founder and CEO of Risk Cooperative.

Disparte attributes the global rise in economic nationalism to several factors. There’s greater global income inequality; a growing dependency on individual commodities for government revenues; too many countries hitching their economic fortunes to China; and oil-producing countries that work outside proscribed multilateral agreements, he said.

“Broadly speaking, multinational corporations find it hard to cope with this kind of rise of economic nationalism,” Disparte said.

Multinational systems, such as the World Bank and World Trade Organization, have been sources of stability in the world. If individual nations shun these global systems to work directly with some countries while leaving others out, there may be a rise of tit-for-tat reprisals, Disparte said.

It could lead to increasing political incidents and international investors being harmed as a way of sending a signal to those policymakers, he said.

Dante A. Disparte, founder and CEO, Risk Cooperative

“Don’t be surprised if the consequences become much more severe,” he said.

Trade embargoes, the expropriation of assets, freezing accounts — these tools that the U.S. and Europe keep in their arsenals when trying to send a signal to another country — can be sent back in a return volley. Companies will be the ones that will pay the most direct price, as will consumers and society, Disparte said.

Political Violence

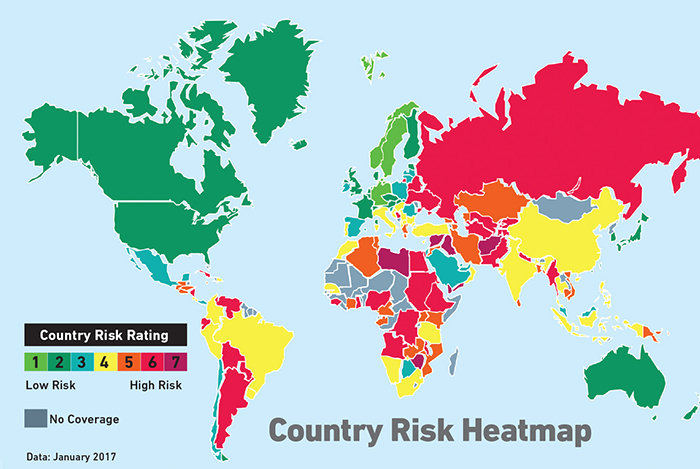

The paradigm shift from globalization to nationalism is creating a lot of uncertainty, as well as growing concern about currency risk and political violence that can lead to targeting assets in certain countries, Riordan said.

A country looking to send a message to the U.S. might be more likely to target an Exxon oil rig than disrupt sales of Proctor & Gamble shampoo products because of the impact it can have back in the home country.

“Companies trade with each other, countries do not.” Disparte said. “It’s McDonalds, BMW, Boeing; these are the companies that are trading with the world.”

The country is merely the platform where the trade is occurring. In an era of protectionism and trade barriers, and potential risk of expropriation and nationalization of assets, businesses face significant risk, Disparte said.

Those companies with an iconic brand attached to a certain country or nationality can be targeted for political reasons, Riordan said.

“I’m a firm believer myself that trade among countries usually leads to peace,” XL Catlin’s Riordan said.

“Risk-prone industries really need to carefully weigh their posture and the posture of their home country. They become an extension of the United States or an extension of England, which under this new political era is going to effectively anger a lot more people on the planet.

“I recommend companies start thinking about the concept of corporate activism. Not all these risks can be insured or hedged through traditional means.

“They need to prove to the market and to their customers that they can be trustworthy counterparts. The market will be more lenient to these types of firms.”

One insurer, AIG, revised one of its products to address the growing potential global threats corporations face. Late last year, AIG raised its property terrorism insurance limits globally to $1 billion from $250 million in many larger cities, typically those classified as Tier 1 terrorism risks.

The larger capacity is available to clients on a stand-alone basis or as expanded limits within AIG’s large limits property insurance offering, which provides clients with all-risk coverage limits up to $2.5 billion per occurrence.

“Risk managers need to ask the question, ‘What are we going to do if this area that we are counting on is no longer politically stable for one reason or the other?’ ” said Louis Gritzo, vice president and manager of research at FM Global.

“The big thing is just uncertainty,” Gritzo said, “The level of uncertainty is higher than it’s ever been.”

Hypothesizing about what will happen or why will never get an exact answer. But be prepared, so if you have to pull operations out of one country or find an alternative supplier, you are not starting from ground zero, Gritzo said.

Risk managers may need to ask “what if” questions that probably a few years ago they were not asking, even about some developed countries that may not have been a risk in the recent past.

To begin with, companies need to take basic assessments of their international operations and partners, and political risk insurance products.

When Steven Minsky, CEO of LogicManager, was working on a risk assessment with a client operating in 15 different countries, he noticed the company focused mainly on the countries that contributed the most revenue.

Don’t focus on the risk facing any individual country, Minsky said. Instead, look at what the likely risks are across regions and then focus on how big an impact those aggregated risks can have on your business.

“Some small-dollar countries can cause huge scandals,” Minsky said.

Dan Riordan, president of political risk, credit and bond insurance, XL Catlin

“One giant mistake is to say, ‘I’ll write this country off because they aren’t main revenue drivers.’ That is going to bite the company big time because it’s an unmanaged risk.”

XL Catlin’s Riordan recommends clients assess their local partners overseas, whether it’s a supplier, exporter, importer, investor or joint venture partner.

Business must have a good local partner that is politically and commercially adept, he said.

Assess all joint venture arrangements, whether that’s trading, investing or supplier relationships and what laws protect those agreements. Know the provisions for dispute resolutions, such as arbitration in an international setting, rather than going to a local court where you may not be treated fairly.

Stay up to date on the changing political climate. There’s a lot of information available and much of it is free, said Riordan.

For example, most U.S. embassies around the globe have a Foreign Commercial Service and those tend to be good sources of information on local partners and local business practices.

The Commercial Service mission is to promote the export of goods and services of American companies and develop and protect U.S. business interests abroad.

Also connect with international bankers, accounting firms and insurers to obtain in-depth analysis and risk assessment on each country’s political and socioeconomic risks.

Creating Opportunity

Several risk experts agree that the emerging global uncertainty can also create a lot of opportunity for international corporations with a well-prepared risk management team.

During periods of intense uncertainty, when most of the market is paralyzed, it is an enormous once-in-a-lifetime opportunity to leap ahead, Disparte of Risk Cooperative said, “as counterintuitive as it might seem.”

“There’s an opportunity in this uncertainty,” he said. “I think there’s a big chance for organizations to spring forward.”

Minsky of LogicManager sees a general overreaction to the political climate right now, and he cautions that emotion may blindside people to the real issues.

“You can look at this as a really hot issue right now, or take a step back and say that this is part of the landscape of the international arena,” he said. Enterprise risk management helps take that subjectivity and emotion out of the risk scenario.

“You can still be personally concerned about it, there’s nothing wrong with that. But when you are thinking about it from the company standpoint, there’s still positives in this,” he said.

“Risk management enables companies to react to change and uncertainty faster than competitors, which can push a business forward.

“This is an opportunity to gain new sales and market share,” Minsky said. “That is a massive competitive advantage.”

For risk managers, weathering the changes requires “going back to basics,” Riordan said.

“There will be challenges for companies that relied on international norms of trade and investment, and organizations built to protect them like the World Trade Organization and World Bank.”

He said companies should examine the changing environment from an ERM standpoint to examine how it changes their risk appetites.

Ultimately, he said, “if they regularly are assessing their risks, they can still be successful.”

“It’s a fascinating period,” Riordan said. “It’s not Armageddon, but it is changing.” &

________________________________________________________________

2017 Most Dangerous Emerging Risks

Artificial Intelligence Ties Liability in Knots

Artificial Intelligence Ties Liability in Knots

The same technologies that drive business forward are upending the nature of loss exposures and presenting new coverage challenges.

Cyber Business Interruption

Cyber Business Interruption

Attacks on internet infrastructure begin, leaving unknown risks for insureds and insurers alike.

U.S. Economic Nationalism

U.S. Economic Nationalism

Nationalistic policies aim to boost American wealth and prosperity, but they may do long-term economic damage.

Coastal Mortgage Value Collapse

As climate change drives rising seas, so arises the risk that buyers will become leery of taking on mortgages along our coasts. Trillions in mortgage values are at stake unless the public and the private sector move quickly.