Global Cat Losses Near Average Through September, Eyes Now on Late Season Storms

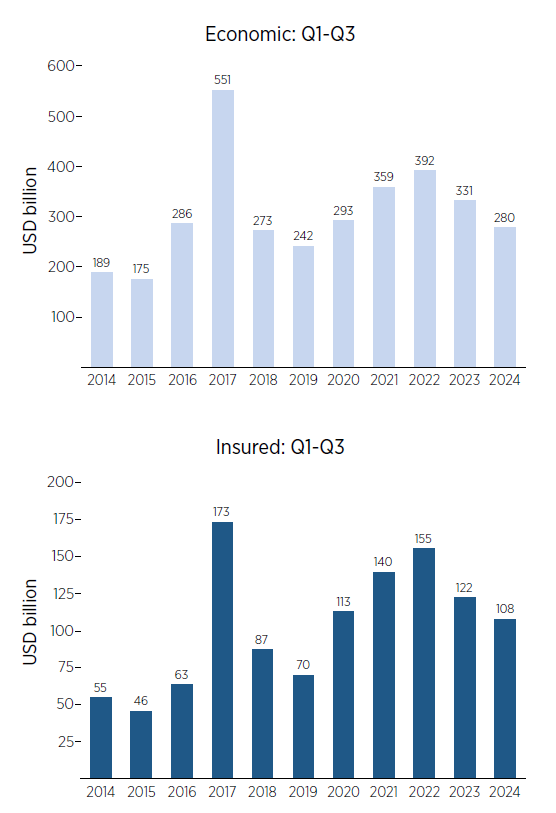

While economic losses from global natural catastrophes through Sept. 30, 2024 were near or slightly below the average seen for that nine-month period over the past decade, insured losses from these events were slightly greater than the 10-year average, according to a report from Gallagher Re.

Economic losses from all natural perils reached at least $280 billion, lower than the 10-year Q1-Q3 average of $309 billion, while insured losses covered by private markets and public entities hit $108 billion, 5% above the decadal average, Gallagher Re reported.

The higher-than-average insured losses were driven by more frequent low to mid-size events, particularly in regions with greater insurance coverage, such as the United States, though these figures do not include the substantial costs incurred from Hurricane Milton’s impact on Florida in early October.

“The recent landfalls of Milton and Helene in the United States – coupled with the significant third-quarter impacts from catastrophic flooding events in Europe, Asia and Canada – underscore the escalating volatility and intensity of weather and climate events,” stated Steve Bowen, chief science officer at Gallagher Re.

“The global implication of compounded losses from these events highlights the urgent need for enhanced risk management strategies and innovative insurance solutions to better protect communities. It is clear that the industry and its collaborative partners must join forces to better adapt to this new normal of increasingly intensified natural catastrophe activity,” Bowen added.

Economic Loss Trends and Drivers

In the first nine months of the year, there were 13 individual events with economic losses greater than $5 billion, including five that exceeded $10 billion. The four costliest events were Hurricane Helene in the United States, China’s seasonal floods, Storm Boris in central Europe, and Typhoon Yagi in Asia.

Worldwide, there were at least 51 individual billion-dollar economic loss events through September, surpassing the decadal average of 45. The United States experienced 30 of these events, followed by Asia with 11, Latin America and the Rest of North America each with 4, Europe with 2, and the Middle East with 1. Notably, 49 out of the 51 events were weather or climate-related.

The dominant loss drivers in the first three quarters of 2024 were flooding, tropical cyclones, and severe convective storms (SCS), which together accounted for 85% of economic losses. These three perils have been the primary cause of significant financial impact, highlighting the ongoing challenges posed by extreme weather events across the globe.

Insured Loss Trends and Impacts

Notably, there were 28 events around the world producing insured losses of $1 billion or more in the first nine months of the year, which ties with 2020 for the second highest Q1-Q3 total on record. Even more striking, a record-breaking 19 of this year’s events resulted in insured losses of $2 billion or more.

SCS ranked as the costliest peril, accounting for $57 billion in insured losses globally, over half the total. The U.S. bore the brunt of those insured losses, with $51 billion stemming from this peril — surpassing $50 billion in claims for the second straight year.

In the U.S., insurers faced at least 15 billion-dollar SCS events, including a record 11 multi-billion-dollar events.

Tropical cyclones and flooding were the second- and third-costliest perils, with $22 billion and $15 billion in insured losses, respectively. Hurricane Helene’s $10-$15 billion price tag represented the highest individual insured loss during the non-month period. Hurricanes Beryl, Debby and Francine combined for an additional $8 billion in insured costs.

Notably, weather and climate-related events drove a staggering 95% ($103 billion) of Q1-Q3 insured losses, with the remainder due to earthquakes, volcanoes or other non-atmospheric events.

“After an unexpected lull in Atlantic hurricane activity during the peak months of August and September, there was an expectation that the remainder of the season might experience an increased level of development. Hurricane Milton became the fifth hurricane to make landfall in the US this season; the second highest number of US hurricane landfalls on record,” Bowen noted.

“It was also the tenth major hurricane (Category 3+) to strike the continental U.S. since 2017 after it went 11 consecutive seasons without one (2006-2016). This remains a peril where a single event can dominate annual industry losses.”

View the full report here. &