Upfront

E&S On the Upswing

Follow the money: That’s what the P&C industry has been doing successfully as it works aggressively to expand its business in excess and surplus (E&S) lines.

E&S premiums increased to $25.44 billion last year, growing nearly 11 percent in 2012, following a 3 percent increase the prior year, according to Charlottesville, Va.-based SNL Financial, a provider of financial information.

“These increases are especially notable in light of recent history,” according to SNL’s recent report. “In 2009 and 2010, premiums were on the decline.”

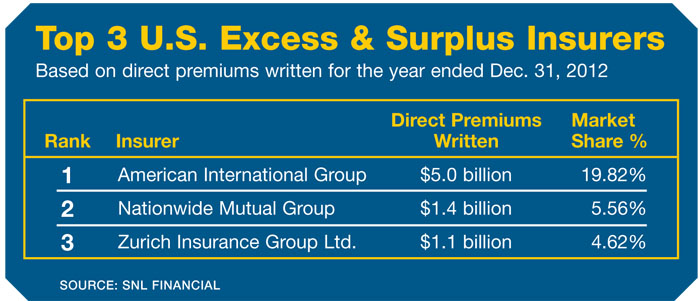

Market leader AIG controlled 20 percent of the market in 2012, while Nationwide, the next-largest competitor, had a market share of about 6 percent.

Market leader AIG controlled 20 percent of the market in 2012, while Nationwide, the next-largest competitor, had a market share of about 6 percent.

About 21 percent of AIG’s P&C business is devoted to E&S, which had direct premiums written of $5 billion in 2012, a decrease of nearly 6 percent, according to SNL.

“AIG is clearly the leader in U.S. E&S lines. They have such a dominant position,” said Thomas Mason, senior industry analyst, Insurance, SNL Financial.

Warren Buffett’s Berkshire Hathaway, however, has the potential to make some waves now that it has hired away four senior AIG executives. Among those recruited was the former president of Lexington Insurance Co., which accounted for the vast majority of AIG’s E&S premiums of $4.23 billion last year, according to SNL.

“It’s possible that Berkshire Hathaway can build out its operations pretty quickly,” Mason said, “but it’s a pretty wide gap to close in order to get up there with AIG.”

In 2012, Berkshire Hathaway had $404.6 million in E&S direct premiums written, and a market share of 1.6 percent. E&S accounted for just 2 percent of the company’s P&C business, according to SNL.

“It really hasn’t put much of a focus on E&S in the past,” Mason said, but he noted that luring the AIG executives indicated a change was probably in store.

“Berkshire Hathaway can pretty much turn on a dime,” he said. “They have tons of money to throw at any particular line that they want to.”

Brian Wanat, national practice leader of the financial services group at Aon Risk Solutions in Chicago said: “Standard players are quite concerned about Berkshire Hathaway’s move. Clearly, that company could become a major force in E&S. It’s a huge commitment for both Berkshire Hathaway and these executives.”

PwC noted that E&S had once been seen as “the wild, wild west of Insurance,” but now has become more attractive as a way for P&C carriers to “bolster the bottom line,” according to the firm’s report, Success Through Excess: How Property and Casualty Insurers Are Boosting Profits by Entering the Excess and Surplus Market.

“The E&S market,” it stated, “holds promise for insurance carriers looking to fuel growth through new products while managing operational costs and risks.”

The PwC report, issued last September, noted that the lack of a dominant player in the market besides AIG increased the odds that new entrants may gain a competitive edge and win market share.

“In fact, there was a general slippage of underwriting talent over many years across the industry.”

— Joseph Calandro, managing director, insurance advisory practice, PwC

Added one senior industry executive: “Berkshire’s move is just testament [to what] PwC is talking about. Historically, companies in E&S have made more money than those in standard lines, and Berkshire Hathaway recognizes this.”

Meanwhile, many other E&S players have recorded astonishing premium increases over the past year, among them QBE Insurance Group Ltd. (75 percent), Starr International Co. Inc. (96.5 percent) and Swiss Re Corporate Solutions (66 percent).

Much of the premium growth can be attributed to having a better understanding of the risks being covered, and pricing accordingly, said Joseph Calandro, managing director of the insurance advisory practice at PwC and former head of enterprise risk management at ACE.

“In the past, insurers were preoccupied, first and foremost, with getting business in the door, making returns predominantly off of the asset side of the balance sheet,” he said. “In fact, there was a general slippage of underwriting talent over many years across the industry.

“But with interest rates at or near zero today, that strategy no longer works,” Calandro said. “As insurers re-underwrite their books of business, they’re paying far more attention to risk and volatility in the E&S arena and elsewhere, adjusting what they charge to be far more in line with those exposures.”

At the same time, demand from the buy side remains strong, said Larry Warner, president of Warner Risk Group in Celebration, Fla., and former staff officer of risk management at Mars Inc.

“I field calls about these specialty E&S products on an ongoing basis,” he said. “They remain attractive from an international perspective, for any unique risk that needs higher limits than is available in the standard, admitted markets.”

Nevertheless, the premium increases probably result more from higher pricing than demand, said Henry Good, principal and risk management consultant at Global SIRC LLC and former director of insurance at Rohm and Haas in the United States.

“What’s interesting here is what may be happening to attachment points,” Good said. “Are customers buying less insurance and just paying more for what they’re buying? If the attachment points are increasing, that tells you they’re probably not buying more insurance but what they’re paying for a particular line is increasing.”

E&S insurers themselves said both better underwriting and increased demand are behind the line’s growth.

“The improving economy is causing businesses to perform better and to grow,” said Michael Miller, president and COO of Scottsdale Insurance Co., Nationwide’s E&S subsidiary. “A large portion of the business we write is commercial, so when businesses are thriving, accounts come our way.

“We also are seeing the standard lines companies pushing business back over into the E&S market,” he said. “This is because they have been writing risks that are not performing at their current price points. This is the typical cycle we see in the E&S industry: When the standard lines get out of higher-risk accounts, that business swings back to E&S and our market grows.”

Aon’s Wanat said that a number of factors are contributing to a growing E&S premiums marketplace: new products (such as cyber E&O); a more robust IPO market (D&O premiums for companies going public tend to increase in both size and scope); and a slight hardening of the D&O market overall — depending upon the risk.

“There have been very high-profile technology companies going private in the last year, and they face cloudier days in the insurance arena,” he said. “That means much more exposure and associated need for higher limits. In some cases, you’re seeing hundreds of millions of dollars of new liability coverage going public.”

But not everyone believes the dramatic increase in premium writing makes sense — at least to the extent that insurers themselves are pushing the business so much.

Brian Evans, senior vice president and head of E&S casualty at Swiss Re Corporate Solutions, said the “competitive level among E&S players has heated up in the last year, both in renewals and new business, and there’s more aggressive underwriting.

“I just don’t understand this: With interest rates so low, the business all comes down to underwriting profits — so why this competition in the E&S space?”

Nevertheless, he said, some industries, such as hospitality (particularly alcohol-related coverages), property management and grocery chains are all “making successful submissions” as they move away from standard coverage and go into E&S.