Sponsored: Liberty Mutual Insurance

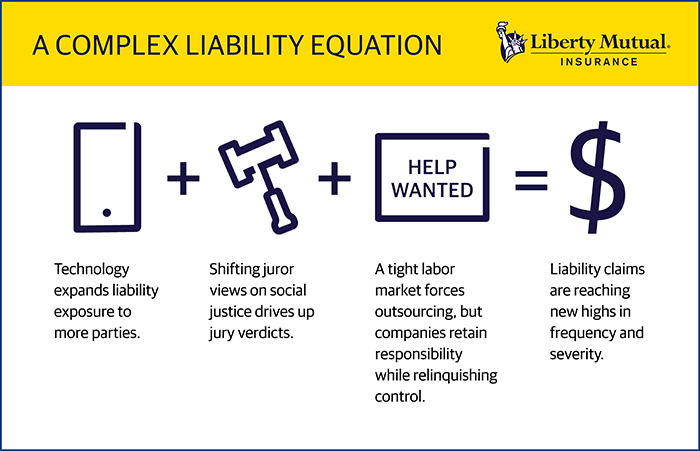

Determining Liability Is No Longer Black and White. These 3 Macro Trends Are Blurring the Line

A distracted driver rear-ends the car stopped in front of him at a red light. Who’s at fault?

Ten years ago, the immediate answer would be, “The distracted driver, of course.” But what if that driver was distracted by a text message from his boss regarding a high-priority project? What if the car was in autonomous mode? What if the driver was drowsy because he’s a delivery worker at the end of a 14-hour shift? Is someone else to blame?

When there are other forces at play beyond the driver and the road, the lines of accident liability get blurry. “Determining culpability is no longer black and white,” said Jon Tellekamp, Chief Underwriting Officer, Excess Casualty, Liberty Mutual Insurance. “Employers, third-party vendors, and even original equipment manufacturers are being drawn into liability battles that can spill out into lengthy, expensive litigation.”

Expanding liability has yielded progressive upticks in both the frequency and severity of liability claims — a trend insurers expect to continue. That will come back to businesses in the form of more expensive risk transfer — unless they can make significant improvements in their risk management programs.

The first step is to better understand how the following macro trends are complicating the liability landscape for businesses across the board:

1. Technology pulls additional parties into the liability equation.

The central role that technology plays in nearly all areas of life has served to alter some historical demarcations of responsibility. Smartphones, for example, and cloud-based communication platforms mean employers and employees can be connected 24 hours a day.

While that makes it easier for people to work remotely, it also may expand an employer’s liability exposure outside of the office walls.

In the above example, “if an individual is driving his or her own car and is off work hours, but then gets distracted by a work-related text and causes an accident, that introduces a new complication. Plaintiff attorneys are making the argument that the employer that sent the message is a responsible party for any damages that occur,” Tellekamp said.

The rise of semi-autonomous vehicles may similarly impact auto manufacturers. When the car is in charge, accident liability is called into question. Is the owner of the car responsible? The original equipment manufacturer? The company that built and installed the car’s software? A component manufacturer?

Tellekamp said technology introduces new variables to the liability equation by potentially broadening the “foreseeability” of an incident. When technology gives an entity more power or more control, it also introduces an opportunity for plaintiffs to allege that ‘you knew or should have known.’

As an example of that theory, a plaintiff could argue that a manufacturer of an autonomous vehicle that promises it will drive safely, with limited human involvement, should have foreseen the possibility of an accident due to malfunction. Or, an employer that gives its workers smartphones should have foreseen that an employee would answer a call or text while driving.

Often, however, companies fail to foresee such events because there is no precedent for them — another consequence of rapidly advancing technology.

“Technology creates gray area, and more opportunities to connect companies to events that they traditionally wouldn’t have been connected to,” Jessica Rogin, Vice President, U.S. Casualty Claims – Specialty, Liberty Mutual.

2. Jurors’ views on social justice are shifting and driving up jury verdicts against companies.

Complicated liability scenarios are making their way into courtrooms, where juries increasingly favor the claimant. The escalation of jury awards may be attributed to a broader notion of social justice espoused by younger jurors.

“There’s a different sense of social responsibility among jurors in their mid-twenties and thirties,” Rogin said. “You see a shift in what’s viewed as personal responsibility versus corporate responsibility.”

These younger jurors expect companies to be good corporate citizens, to go above and beyond to protect their employees, and use their resources to benefit society. That includes stepping up to pay for physical damages and atone for the non-physical damage done to the injured party.

As a result, jury awards for non-economic components like punitive and pain-and-suffering damages are steadily rising.

“We are definitely seeing an increase in the ratio of non-economic to economic damages for claims that do go to verdict. That’s driving up valuations across the board,” Rogin said. “Claims are more frequently piercing higher layers of coverage, for larger amounts than they have in the past.”

3. A tightening labor market forces reliance on outsourcing, but you can’t outsource exposure.

While the strong economy is good for business, it comes with a tightening labor market. The U.S. unemployment rate currently sits around 4 percent – down to pre-recession levels. But the need for workers — especially drivers — has never been higher.

A growing e-commerce industry and consumer demand for fast turnaround have driven up the volume and speed of deliveries, putting the pressure on manufacturers and distributors to move product quickly. To meet increased demand, companies often outsource delivery to third parties — including individuals using their personal vehicles.

“That introduces a whole new element,” Tellekamp said. “Often, companies will outsource thinking they’ve eliminated their auto exposure. But they may still be responsible for ensuring that a qualified driver is behind the wheel, even if it’s not your vehicle or your employee.”

The tightening market has made it more difficult to find those qualified drivers. If filling open positions comes at the expense of safety, it leads to increased accident frequency.

Staying Informed is Key to Staying Ahead of Evolving Risks

All of these elements together should drive companies to reassess their exposures and their risk mitigation strategies. In today’s environment of rapid change, insurance solutions that worked five years ago may not work today.

The first step is education — something insurance carriers are well-positioned to provide as they see how these trends interact in their own claims experience. “We have an obligation to make our clients aware of what we’re seeing in the current environment, especially as exposures and losses evolve,” Tellekamp said.

On the table for review should be a company’s safety policies, including those on distracted driving and use of personal vehicles. Regularly check to verify that staff are complying, follow through on consequences for those who do not, and updates policies as needed so that employees— and even potential jurors— take them seriously.

In addition, work with your legal department to evaluate contracts with third parties to ensure they adhere to specified service standards and hiring and safety practices.

At the same time, increasing frequency and severity likely mean that risk transfer solutions will become more expensive. Companies should revisit and consider raising their limits on core as well as umbrella and excess liability coverages. Carriers can help companies understand what’s needed to improve both their risk mitigation and risk transfer programs.

“We can help on the risk control side, we can help on the claims management side, and then certainly our underwriters are discussing this changing landscape with brokers so we can develop programs that best fit the needs of our customers,” Rogin said.

To learn more, visit https://business.libertymutualgroup.com/business-insurance/coverages/general-liability-insurance-policy.

![]()

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.