COVID-19 and Workers’ Compensation. It’s the Indemnity Costs, Really

Over a year into the COVID-19 pandemic and many employers are finally starting to feel hope for a return to normalcy.

As vaccine rollouts continue, many are looking back at 2020 to see how the pandemic affected the workers’ compensation industry.

A recent study of workers’ compensation claims data from Mitchell examined COVID-19’s effects on the industry. The report is a follow-up from a July study which took stock of how the industry was doing midway through 2020.

The data showed that the majority of COVID-19 claims did not have medical costs, just indemnity costs, and it revealed that the health care sector was hit the hardest by pandemic-related illnesses and exposures. Its findings were consistent with other surveys conducted in the workers’ compensation industry.

The Report By the Numbers

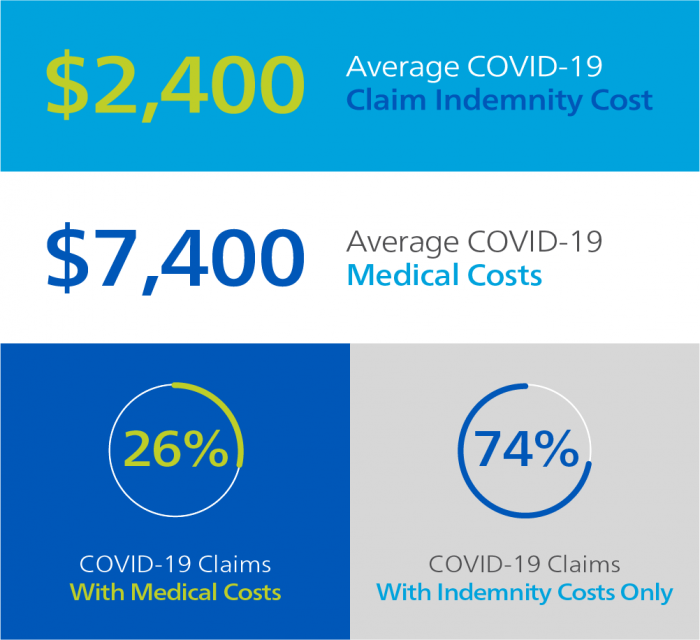

- The report held several insights about how COVID-19 claims have affected the industry. In 2020, 25% of workers’ compensation claims incurred medical costs, while the other 75% only had indemnity costs.

- Medical and indemnity costs for COVID-19 claims were on the low end, with the average total cost of a COVID-19 claim totaling $4,320. Average medical costs for COVID-19 claims came in at $2,400, while indemnity costs averaged $7,400.

- As expected, the brunt of COVID-19 claims came from health care workers. Health care had six times more COVID-19 claims than any other sector.

- Overall, most industries saw a decrease in claims, but the health care and the transportation and warehouse sector saw a 24% increase in total claims reported.

Key Takeaways

Tina Queen, senior manager, product management for Mitchell’s Casualty Solutions Group, and the report’s author, said the data contains few surprises.

“I don’t think there were any surprises in the data; it just kind of confirmed what everybody has been experiencing,” she said.

Mitchell’s findings are consistent with what others in the industry have reported seeing in COVID-19 claims reviews. In a June survey from Health Strategy Associates respondents reported that 96% of claims cost less than $3,500.

The discrepancy between medical and indemnity costs found in Mitchell’s data could mean that most people who are exposed to the virus while at work don’t come down with a serious illness. Instead, after being notified of an exposure, they may just need time off to quarantine.

“The majority of the cases were either an exposure or not a strong illness, because they didn’t have medical costs,” Queen said.

Though most COVID claims are low cost, payers should still be prepared for the rare catastrophic claim. Only about 5% of COVID-19 patients become critically ill, but the death rate among these patients remains high at about 30.9%. People with catastrophic cases of the disease could experience high-cost symptoms like neurological complications and organ failure, NCCI writes.

As more people get vaccinated and the worst days of the pandemic are behind us, payers could expect trends like a decrease in workers’ comp claims to fade away.

Like Mitchell, Health Strategy Associate’s survey also found that most sectors experienced a decrease in workers’ comp claims in 2020, with most respondents experiencing a 25-50% drop in claims since March of 2020. But when people return to the office, injury rates may see an uptick.

Additionally, some workers’ comp care may have been delayed as a result of the pandemic.

“It’ll be really interesting to watch and see what happens with medical costs as a result of the pandemic,” Queen said. “Will the costs continue to overall stay low or are we going to see that creeping up?” &