Sponsored: Rising Medical Solutions

A Place for Concierge Medicine in Workers’ Comp?

Everyone seems to be talking about big data, analytics and how to leverage them toward better claims performance, including medical outcomes. But does better information alone drive optimal outcomes?

Most likely, the answer is no.

Experienced claims professionals understand that the complexity and cost of managing a portfolio of medical cases preclude a simple solution. There are just too many challenges — case volume, workers’ comp regulations, the health care system, medical expenses, patient personalities, disjointed service providers, and managed care fees to name just a few.

At the individual case level, ensuring that the right doctor, treatment and care are provided at the ideal time can greatly improve the outcome. In group health, various providers and medical management firms utilize this approach under the name “concierge medicine.” For a significant fee, patients gain access to top doctors, highly attentive service, customized medical research, etc.

“Many of the industry’s technology advances to date have created ways to make us better at old, ineffective approaches. But we must start with a better approach and then pair it with technology and talent to really move the needle.”

— Anne Kirby, Chief Compliance Officer, VP Medical Review Services, Rising Medical Solutions

The effectiveness of concierge medicine is gaining widespread acceptance, but the feasibility and affordability of this model in workers’ comp has been doubtful.

That’s where data and analytics come in. “Technology is helping the industry elevate the level of care management it can provide to injured employees,” explained Anne Kirby, Chief Compliance Officer and VP of Medical Review Services at Rising Medical Solutions. “We are now able to continually monitor all cases, identify when a case is high-risk and then employ a wide variety of medical concierge style services to ensure the best possible outcome.”

What does “concierge medicine” look like in workers’ comp?

In addition to technology, patient advocacy is key to the medical concierge approach. By aligning with the injured employee and providing proactive and preventive clinical care, costs are incurred upfront and unnecessary medical, indemnity and legal costs are avoided throughout the claim lifecycle.

“Historically, there’s been a lot of friction in the work comp system that often results in employees seeking legal counsel. Doing a better job of incorporating patient advocacy into managed care makes sense. Employees know that their employer cares about them, so they don’t need to get an attorney and they get healthier and back to work in less time,” said Robert Evans, who leads Rising’s “high-touch” surgical care program.

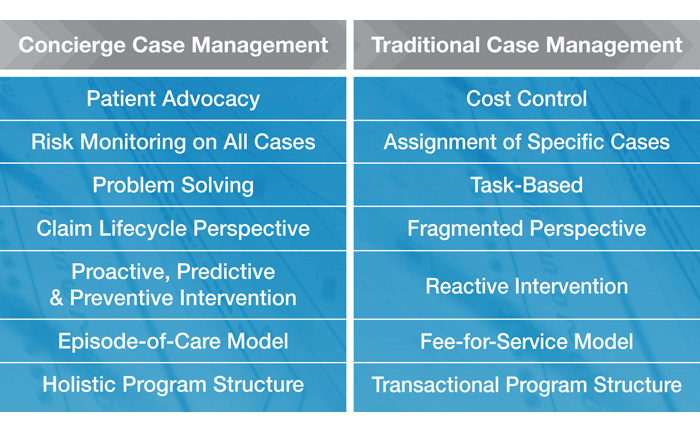

Using concierge attributes in case management stands in stark contrast to the industry’s standard approach of retrospective, task-based efforts that try to keep service fees low but lose focus on the big picture as a result. Kirby put the contrast in perspective this way, “Concierge medicine in workers’ comp starts with a new slant on case management. In the ’90s, payers became focused on service costs and began delegating only very specific cases and micro-tasks to case managers. This can control service costs, but often the referral is happening too late in the game when cases have already become problematic.”

How technology makes concierge case management more cost effective than traditional approaches

Experts and specialists working closely to manage the most challenging medical cases ensure that the right doctor, treatment and care are utilized to help an injured worker get healthier faster and thereby save payers money. What’s not to love?

Some would say the cost. But, with appropriate data and analytic tools, a medical concierge approach can be applied only to the higher-risk cases.

“Many of the industry’s technology advances to date have created ways to make us better at old, ineffective approaches,” said Kirby. “But we must start with a better approach and then pair it with technology and talent to really move the needle.”

“Using the selective application of medical concierge services is how to drive better outcomes without incurring higher costs. By targeting the higher-risk cases, concierge service fees can be spread across an entire claim portfolio.”

— Robert Evans, National Director of Network Solutions, Rising Medical Solutions

First, employing risk “scoring” analytics at the onset of an injury can identify cases that require immediate early intervention. Scoring algorithms use risk predictors such as BMI, previous traumatic event and geographic location to tag high-risk cases that then become the focus of a medical concierge approach.

Second, continuous analytical monitoring of the low or medium-risk cases ensures alerts are in place when a case shows signs of evolving into the high-risk group. At this point, case managers can intervene with the appropriate response and resources.

“Using the selective application of medical concierge services is how to drive better outcomes without incurring higher costs. By targeting the higher-risk cases, concierge service fees can be spread across an entire claim portfolio,” said Evans.

The proof is in the outcomes

In 2013, a national workers’ compensation insurer who writes $255 million in premiums partnered with Rising to implement a range of services that leverage a medical concierge approach. The impact of the change was significant after just one year of implementation.

- 33 percent reduction in average claim duration, producing a decrease in short-term disability timeframes, an acceleration in return-to-work timeframes, and a decrease in indemnity costs

- 40 percent reduction in average medical spend per claim

- 32 percent reduction in addictive prescription fills (e.g. opioids, hypnotics, muscle relaxants)

- 56 percent reduction in total pharmacy costs

- A low service cost of less than 0.5 percent of total claim costs

Finally, there is a clear way to utilize big data and analytics to drive better outcomes in workers’ comp. Through the selective application of medical concierge type services, injured workers are getting better faster, benefiting their companies and their insurers.

Contact Rising Medical Solutions: [email protected] | www.risingms.com

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Rising Medical Solutions. The editorial staff of Risk & Insurance had no role in its preparation.