Retail Risks

Complications With Compliance

Wage-and-hour lawsuits are the bane of employers, and few industry sectors are as challenged by the Fair Labor Standards Act as retailers, with their multitude of part-time, minimum-wage workers and the potential for misclassifying employees who might be due overtime pay.

The difficulties will only increase as demands for a higher minimum wage grow at the federal level and in various states and cities throughout the country.

But retail risk managers have more on their plates than complying with the FLSA — or struggling to model how potential wage hikes will impact the organization. An even more cumbersome and complicated entree is new Affordable Care Act reporting rules, which are kicking in this year.

These two items are not only adding to retailer regulatory risks, but they also have the potential to increase costs for workers’ compensation and general liability policies. Not to mention the possible multimillion-dollar wage-and-hour lawsuit settlements, which are not uncommon for large employers.

New Reporting Regulations

“The [ACA] reporting is a challenge, partially because it’s new but also because of the timing in the way it was rolled out — the expectations and overall complexity of what employers have to do,” said Jay M. Kirschbaum, practice leader, national legal and research group, Willis Human Capital Practice.

“We might call it the spiked tail on the beast they have been grappling with for a number of years,” said Edward Fensholt, senior vice president, director of compliance services, Lockton.

According to a 2015 PricewaterhouseCoopers survey, only 10 percent of employers have an ACA reporting solution in place, and 16 percent have not even considered a solution yet.

Nearly two-thirds (65 percent) said the quality of the data they will use to determine health care eligibility is a concern.

Beginning in January 2016, employers subject to the ACA reporting requirement must file with the IRS a Form 1094-C and, for at least each full-time employee, a Form 1095-C detailing data on employees and, in some cases, their dependents related to health care eligibility and affordability in 2015 under the ACA’s employer mandate. Employees also must be notified.

“We might call [ACA reporting rules] the spiked tail on the beast they have been grappling with for a number of years.” — Edward Fensholt, senior vice president, director of compliance services, Lockton

Employers face a $250 fine for each form that is not filed, up to a $3 million maximum, said Fensholt, although he noted the IRS has indicated a willingness to allow slight filing extensions and to excuse some errors or failures if the employer made a good faith effort to comply.

For retailers, the issue is made more problematic by high turnover in the industry; the preponderance of hourly employees, many of whom may fluctuate between full-time and part-time employment; multiple locations; new coding requirements; monthly reporting rules; and for large employers, mandatory electronic filing.

Jay M. Kirschbaum, practice leader, national legal and research group, Willis Human Capital Practice

“They are all scrambling to figure out what they are going to do,” Kirschbaum said. “The payroll industry has not covered itself in glory in getting packages together, but in their defense, I don’t think they had much advance warning.”

And for those employers that did not proactively begin planning and lining up key partners — and many employers postponed action until after the Supreme Court ruled on the constitutionality of health care subsidies in June — some are now finding themselves left to their own devices.

“The demand for that service is so high,” Fensholt said, “that many of these payroll and other vendors said this summer that they are not taking any new customers. They are at maximum capacity.”

In addition, because many employees in the retail industry have variable hours or are part-timers, some companies may be challenged to respond to notices from health care exchanges about subsidized insurance. When employees apply for subsidies, employers must validate or challenge the subsidy. Failure to respond on a timely basis could trigger penalties, according to PwC.

“Particularly for multi-state employers with many worksites, responding to the exchange notices on a timely basis could be very challenging since state exchanges may vary in their notices and response procedures,” according to PwC.

Wage-and-Hour Concerns

With ACA compliance added atop the possible flux in the minimum wage, it’s clear why regulatory concerns are considered a top risk for retailers, according to the 2015 “BDO Retail RiskFactor Report.”

“Federal, state and/or local regulations” tied as the No. 1 risk with “general economic conditions” and “competition and consolidation” in BDO’s most recent report. It was No. 2 in both 2014 and 2013, and No. 4 in 2012.

Many of the employee recordkeeping challenges retailers face in complying with ACA regulations are also challenges for wage and hour issues, but the growing demand for a $15 an hour minimum wage (already adopted in Seattle, San Francisco and Los Angeles and for fast-food workers in New York), plus a proposed minimum wage hike at the federal level — from $7.25 an hour to $10.10 an hour — add more complexity.

When Walmart recently hiked its minimum wage for new workers to $9 an hour — to increase employee engagement and customer service — grumbles arose among longer-term employees who received no raise and felt their experience and commitment were being undervalued.

Part of the modeling some companies are doing looks at not only the increase to minimum wage but also increases in wages for others in the organization, said Brandi Boles, vice president, Lockton.

“It’s a true domino effect,” she said.

In addition, the U.S. Department of Labor has proposed raising the salary threshold used to determine whether employees are eligible for overtime pay from $455 per week to $970 per week.

That may require employers to reclassify part-time managers or administrative employees who are on a salary basis, as hourly, nonexempt employees.

“That could create some challenges for companies,” said Adeola Adele, executive vice president and EPL product leader, Willis FINEX practice. “It’s not just about adjusting the salary, it’s about the actual responsibilities the employee has.

“Ultimately, the challenge is one of classification [of workers as exempt or nonexempt],” she said. “Retailers have to stay even more vigilant in the way in which they attempt to comply.”

A final rule is expected to take effect in 2016. If so, it “would impact 5-10 million workers, many of whom are concentrated in the retail and hospitality industries,” according to Alex Passantino, leader of the wage and hour litigation practice group at Seyfarth Shaw. “Some other estimates believe the number of impacted employees is more likely to be in the range of 15 million.”

The National Retail Federation puts the number of affected retail and restaurant workers at 2.2 million, and estimated it would cost $745 million to comply with new federal regulations.

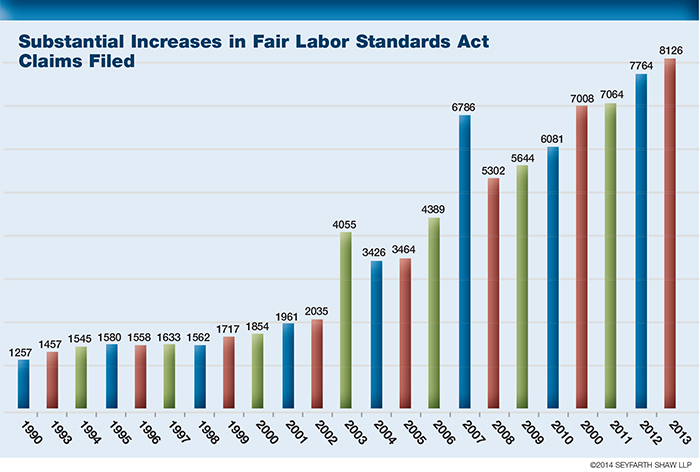

The cost of federal wage-and-hour lawsuits is already astronomical. The number of FLSA lawsuits filed against employers has increased by more than 300 percent since 2000, from 1,854 claims in 2000 to 8,126 cases in 2014, according to Seyfarth Shaw, which tracks such litigation.

The proposed FLSA rules are “definitely going to create challenges,” Boles said. “It’s already creating challenges.

“There’s a lot of time and effort running a lot of modeling, looking at different angles. What has to happen, what needs to happen if these changes were to occur,” she said.

If labor costs increase due to a wage hike, retailers, already battling thin margins, may be forced to increase product prices. And that could impact insurance premiums.

Insurance Implications

Because workers’ compensation insurance is based on employer payroll, companies would undoubtedly see carriers asking for increased premium costs should the minimum wage be hiked, according to Lockton.

“I am looking at ways to be able to offset and/or credit policy audits as a result of the pure minimum wage impact,” Boles said. “We are working with individual carriers to create strategies to acknowledge the fact that individual company exposure has not changed, and it’s just due to a minimum wage increase.”

Thus far, carriers have been receptive, she said.

But because retailers may opt to increase product prices to offset the potential labor costs, they also would likely see their general liability policy premiums increase, since they are based on revenue.

“I am looking at ways to be able to offset and/or credit [workers’ comp] policy audits as a result of the pure minimum wage impact.” — Brandi Boles, vice president, Lockton

Wage-and-hour lawsuits generally fall within the scope of employment practices liability insurance, but most policies exclude coverage for violations of the FLSA or similar state or local laws, according to attorneys at Dickstein Shapiro.

The attorneys noted, however, that even if indemnity coverage is ultimately excluded, the carrier may have a duty to defend the employer if the complaint includes the possibility that one of the claims is potentially covered by the policy.

Adele noted that the Bermuda market within the last two years has developed a stand-alone wage-and-hour insurance policy to respond to such allegations, covering defense and indemnity costs.

Contrary to some brokers’ expectations, though, the coverage has not seen significant take-up, she said, partly because the premium is still relatively high and the minimum retention is $1 million.

“Not every company is willing to take that kind of retention,” Adele said. “I think over time, as more competition is introduced, there will be more interest in wage-and-hour insurance and the policies will probably become broader to address some of the emerging wage-and-hour risks.”

However, she said, with the current volatility, “I think insurance carriers are treading very carefully to make sure they are insuring a loss that would still be profitable for them.”

Profitability, of course, will also continue to be the major factor underlying the struggle of retailers as they attempt to meet these complex regulatory demands.