Brokers

Can Brokers Keep Pace?

Technology and globalization offer opportunities for innovation, expansion, increased efficiency and improved customer service. But they also involve a rapid pace of change — and evolving risks — that keep every company on its toes.

“Changing global landscape, economy, regulatory environments, technology … this is changing the way companies manage both their financial and human resources,” said Tim DeSett, executive vice president of risk practices, Lockton.

“For brokers, this is really a transformational opportunity.”

The traditional role of the broker is transactional. A company hires a broker to buy insurance. But that model has been changing for years, with brokers becoming consultants and risk advisers in addition to procurers of policies.

“The traditional ways are shattered,” said Mary Ann Cook, senior vice president, risk and insurance knowledge group at The Institutes, a leading education provider for the industry.

“Those brokers that come to terms with that more quickly will be the ones out in front.”

But if brokers are to be effective risk consultants, they have to be a half-step ahead of the pace of change, anticipating the challenges their clients will face and understanding what mitigation strategies best fit their long-term goals and capabilities.

That takes a mix of forming key relationships and expertise within a client’s industry, and gaining a deep understanding of data.

Broker as Expert Consultant

“The best brokers are businesspeople,” said Brian Elowe, managing director, global risk management, Marsh.

“In a fast-paced world, I don’t see how you can be an effective adviser to a client without specializing in their industry. Client organizations have higher expectations that they won’t have to train their broker, but that the broker will bring insights to the table.”

To best understand a client’s risk, it is incumbent upon brokers to familiarize themselves with every aspect of the client’s business, from macro industry trends, to the regulatory environment, to the strength of its competitors in the market, and down to the nuts and bolts of their operations and financial standing.

Today, brokers also have to take into consideration a broad range of issues like the impact of increasingly unpredictable weather, migration patterns and political climate, impending local regulatory changes, and the now eternal question of data security. Conversations with experts are often the easiest and most reliable way to stay updated on broad trends.

The Institutes, in the course of assembling its seminars and educational materials, seeks input from policymakers and legislators, regulatory bodies, the NAIC, various conference attendees, social media platforms and multiple advisory groups.

Additionally, “belonging to industry associations is a great way to ensure you’re around the conversation of what those businesses are facing, and what strategies they’re developing in response,” Elowe said. “Our account executives are really experts in health care, technology, real estate or whatever sector they’re serving.”

Marsh works with several organizations to put together its annual global risk report, which is presented at the World Economic Forum each year.

Elowe described the process of consulting with leading economists, often working with the world’s top universities, as “an opportunity to challenge our thinking and get a better idea of the conversations we should be having with our clients.”

That in-depth understanding is critical if brokers want to get the attention of the C-suite.

“To have a conversation at that level, we need to translate our risk management initiatives into language that relates to the company’s goals and objectives, and what global resources are available,” DeSett said.

“To do that, we have to know what they’re saying to Wall Street and to their shareholders.”

The broker’s role as a consultant also involves adjusting to greater demand for alternative risk transfer strategies that don’t involve insurance. Emerging exposures like cyber, climate, political and reputational risks are often difficult to insure in the traditional market, pushing more risk managers to look for creative ways to retain it themselves.

“As a broker, it’s about ensuring capital efficiency and helping clients set up internal finance mechanisms to prepare for risks that may not be insurable,” Elowe said.

“Pooled risks and captives are situations where a broker wouldn’t be involved in a transaction, but would fill a role providing guidance to clients on how to utilize those models,” said Cook of The Institutes.

Leveraging Analytics

Big Data and predictive analytics also are useful tools in identifying emerging risks and vulnerabilities, but could also be a stumbling point for brokers as technology continues to evolve.

“Big Data is an incredible asset and opportunity to leverage, but takes a lot of energy to manage and can also be a distractor,” DeSett of Lockton said.

“Predictive analytics is a tool that should be a part of a broader strategy of measuring potential outcomes of potential risks.”

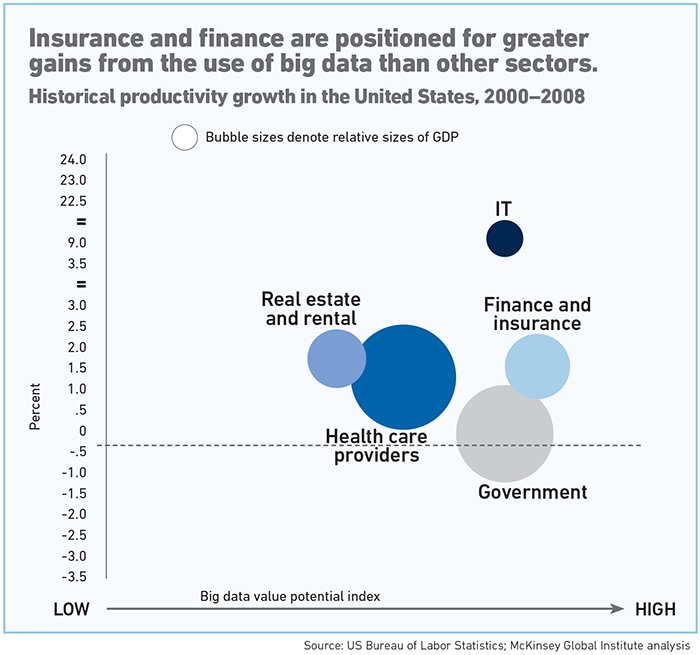

To paint a picture of just how rapidly data has grown as an asset for businesses, the McKinsey Global Institute (MGI) estimated that U.S. retailer Wal-Mart’s data warehouse in 1999 held about 100 terabytes of stored data; by 2009, nearly every sector in the U.S. economy was gathering and storing at least twice that amount.

Fifteen of 17 U.S. sectors have more data stored per company than the U.S. Library of Congress, it said.

McKinsey also projected 40 percent growth in global data per year, although with only 5 percent global growth in IT spending, according to its 2011 report, “Big Data: The Next Frontier for Innovation, Competition and Productivity.”

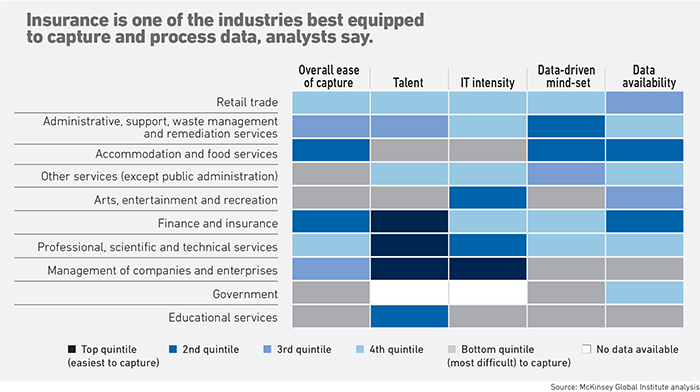

The insurance industry in particular not only has access to large amounts of data gathered from policyholders, but also the analytical talent to process it in its field of actuaries.

The study by MGI analyzed nine occupations that require the skills needed to execute big data analytics and in what industries they could be found, based on reporting by the U.S. Bureau of Labor Statistics.

Insurance carriers employed more of these individuals than any other segment included in the study, which also included telecommunications and internet service providers. In 2009, insurance carriers employed about 18,400 people considered to have “deep analytical talent;” the runner-up, scientific research and development, employed 13,000.

The report concluded that the financial services and insurance industry is “positioned to benefit very strongly from big data as long as barriers to its use can be overcome.”

Brokers have the opportunity — the obligation, even — to tap into carriers’ wealth of data and analytical talent.

“It will be critical to partner with a carrier willing to work with brokers on the analytics side,” Cook said.

“The data wars are coming. Brokers have to be able to capture it and work with it better; don’t defer an obligation to help clients build out an insurance program today that is comprehensive, flexible and integrated with data analytics.”

DeSett said, however, that barriers to effective use of data analytics are significant. The ability to store large amounts of data and run analytical software requires heavy investment in technology updates and training.

Aggregating large amounts of data is a useful tool for spotting trends, Elowe said, but it remains difficult to “get out in front” of emerging issues. Even those organizations with access to data and the talent to utilize it will struggle to keep up with new analytical tools and techniques.

For now, brokers’ predictive capabilities may be behind the pace. But this may be an even stronger reason for brokers to, as Elowe advocated, “Get a higher level of understanding of the business first, risks second.” &