Risk Management Education

Butler’s Risk Business

Butler University’s bomb-sniffing dog Marcus is being insured by a student-run captive.

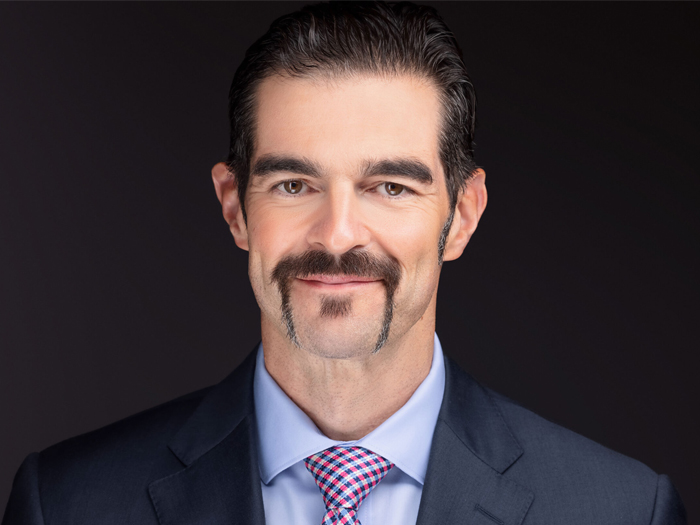

Butler University’s Zach Finn possesses such a passion for risk management that steam practically emanates from the top of his head when he talks about it.

So when the former J.M. Smucker Co. risk manager got the chance to work with a university risk management program, he jumped at the chance to begin teaching and innovating.

And one of his dreams was to guide his students in developing a student-run captive.

“One of the reasons I wanted to set up a student-run captive at Butler was to show not only students what they could do with a risk management degree but show the industry what students could do with a risk management degree,” said Finn, the director of the Davey Risk Management & Insurance Program at Butler.

The program was launched with funding from 1947 Butler graduate William Davey, who enjoyed a long career with the Indiana Department of Insurance, including being appointed Insurance Commissioner in 1955.

The captive, which underwrites risks for Butler University’s liberal arts college, came into being in April, is licensed in Bermuda, and will become operational this month.

But the direct roots of the program date back to 2015, when Finn sat down with Michael M. Bill, the founder of MJ Insurance, to begin planning.

“I spent a lot of time in my career sitting down with people saying, ‘This is what this means, this is how this could be a benefit to the organization,’ ” Finn said.

Finn built a class within Butler’s risk management curriculum charged with putting together a feasibility study on the captive formation. He then hand-selected students from the risk management program to work on the study.

One recruit was Kentucky native Brad Weber, who was brought to Butler to play football and is now a risk professional, having landed a job as a risk analyst with the Moog Corporation after graduating from Butler’s risk management program in May.

“Butler University as a whole is all about experiential learning and it sounded like a great way to learn about insurance and not just from a textbook,” Weber said.

“Plus there was the opportunity to take a trip to whatever domicile was selected,” Weber said.

“That ended up being Bermuda, which was a really cool trip.”

After the class wrote its feasibility study and vetted it with the captive program’s professional advisory board, Finn and his students sent out inquiries to 10 domiciles.

“To their credit, Vermont and Bermuda were the only domiciles that responded,” Finn said.

Akilah Wilson, an assistant director of the Bermuda Monetary Authority, recalls her department being contacted by Butler University in September.

“Their original e-mail provided an Insurance Captive Brochure which outlined their initial proposal and demonstrated their commitment to establishing a captive. It was very well constructed from the outset,” she said.

“From what I gathered during the initial conversation, the students were very independent in producing their feasibility study on domiciles,” she said.

“They also led the first question and answer session. This demonstrated that they were leading the charge, with the help of their professors, of course.”

“One of the reasons I wanted to set up a student-run captive at Butler was to show not only students what they could do with a risk management degree but show the industry what students could do with a risk management degree.” — Zach Finn, director, Davey Risk Management & Insurance Program, Butler University

Don Ortegel, Aon Chicago managing director and a member of the school’s advisory board, also recalls being impressed with the Butler students when his team presented their RFP in the effort to win the job of captive manager.

“It was very clear from the process that the students were very engaged, very thoughtful,” he said.

“They not only reviewed the RFP we had to present to them, they made the recommendation for the final decision,” Ortegel said.

What is now known as the MJ Student-Run Insurance Company Ltd. was established with a cross-class aggregate limit of $265,000 and will insure science equipment, books and fine arts collections in Butler University’s College of Liberal Arts and Sciences.

“We are insuring the first $150,000 of all of the scheduled fine arts and inland marine. Travelers will sit in excess,” Finn said.

Part of the students’ risk management work is performing loss control tours of the college’s library and its observatory.

As part of their analysis they determined that the college’s 38-inch Cassegrain reflector telescope was underinsured, by about $1 million. They also found out that they could automate closure of the observatory’s dome to close it remotely in the event of inclement weather.

Butler University’s student-run captive is insuring the university’s telescope; and conducting observatory safety evaluations.

“If the power goes out [in a storm] and somebody has to go over and manually shut the dome and it doesn’t happen, we’re out $2 million,” Finn said.

“That’s a $2,000 fix,” he said.

The captive is also insuring the university’s bomb-sniffing dog, Marcus. In an era when the alarming threat of terror attacks is on almost everyone’s minds, Finn thinks he has hit on a way to not only teach students about terrorism, but use risk management to fight it.

Finn and his Butler student team are developing a line of duty endorsement to the policy covering Marcus. The endorsement will allow for two dogs to rise up and take Marcus’ place should he ever be lost in the line of duty.

“Once we have developed this endorsement, we are going to float it out to the entire insurance industry. We’re going to ask that any carrier that insures a police dog or a bomb-sniffing dog include this line of duty endorsement.”

Butler grad Brad Weber said the experience he picked up in establishing a student-run captive in Bermuda proved invaluable in the job interview process.

“I would say what was really valuable about the class, more than what we learned which was specific to the captive industry, were project management skills,” Weber said.

“I think my education did a lot for me,” he said.

The position Weber is in at Moog required two to three years’ experience.

“Which I didn’t have coming right out of school,” Weber said.

“I was able to write a cover letter talking about how I would be able to handle all of the other requirements,” he said.

“And why my education gave me the experience required for a job like this,” he said.

Aon’s Ortegel said the Butler University accomplishment of establishing a student-run captive is a game changer.

“This isn’t necessarily about education,” he said.

“This is about the way we bring students or talent to the industry.”

As a result of the experience of helping to develop a captive at Butler, Ortegel said he and his teammates at Aon have been approached by other university risk management programs.

“We have had multiple inquiries and multiple conversations as a result of this,” he said.

Given that only the domiciles of Vermont and Bermuda responded to the initial inquiries from the Butler team — although other domiciles later entered discussions — one might surmise that many didn’t take the Butler students seriously.

One who had no problem taking the Butler risk management students seriously was Bermuda’s Akilah Wilson, who holds a risk management degree from Philadelphia’s Temple University.

“Being a graduate of Temple and a member of the Fox School of Business & Management’s Gamma Iota Sigma Chapter, I understood that there is a level of real world experience that you are exposed to during one of these programs,” she said.

“It actually did give me a greater appreciation for their initiative. I thought it was a great, practical hands-on experience for students to embark on.” &